Windtree Therapeutics Makes $500M BNB Power Play—Nasdaq BioStock Bets Big on Binance’s Blue-Chip Token

Wall Street meets crypto in a nine-figure gamble—Nasdaq-listed biopharma Windtree Therapeutics just went all-in on Binance Coin.

The move? A staggering $500 million BNB purchase that blurs the line between traditional finance and digital asset speculation. Because nothing says 'groundbreaking pulmonary therapy research' like parking half a billion in a centralized exchange token.

Market watchers are torn: Is this a visionary treasury diversification play, or just another corporate FOMO trade dressed up as 'blockchain strategy'? Either way, the BNB charts just got a new whale.

One thing's certain—when publicly traded companies start treating crypto like a balance sheet asset class, the old financial guard might finally need to update their Excel macros.

Binance Coin’s Price Dips Amid Market Correction

The Nasdaq-listed company’s decision to increase its BNB exposure follows a larger trend. More and more corporate entities are stocking up on crypto as part of their treasury strategy.

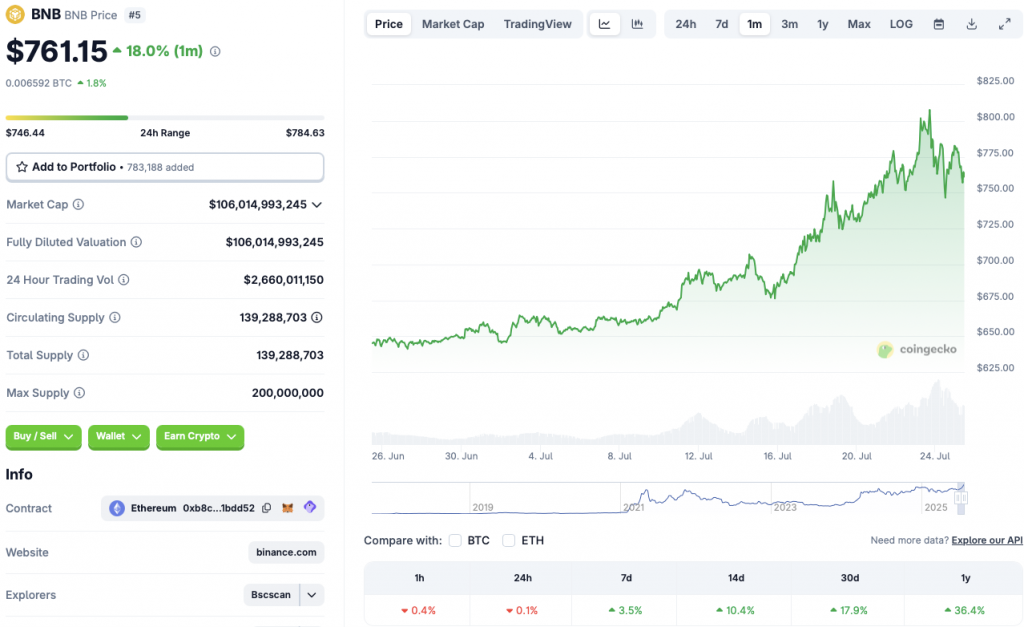

The cryptocurrency market has faced a steep correction since yesterday, July 24, 2025. BNB has registered a 0.1% dip in the daily charts, but is up in the other time frames. BNB is still up by 3.5% in the weekly charts, 10.4% in the 14-day charts, 17.9% over the previous month, and 36.4% since July 2024. Bitcoin (BTC), on the other hand, has fallen 2% in the daily charts and 4.2% in the weekly charts.

The market correction was likely due to increased profit-taking after the recent surge. Binance’s BNB coin hit a new all-time high of $808.09 on July 23. BNB’s rise came on the heels of Bitcoin (BTC) and XRP hitting new all-time highs of $122,838 and $3.65, respectively. Investors may have decided to book profits after the climb.

There is a chance that the crypto market will pick up pace over the coming weeks. Bitcoin (BTC) had a supply gap at the $110,000 to $115,000 level. BTC’s price dropping to this level was very likely. We could see a reversal as prices mitigate.

There is also a high chance that the Federal Reserve will cut interest rates soon. President TRUMP has pushed for a rate cut for quite some time. A dip in interest rates will likely lead to a spike in risky investments as borrowing becomes easier. Binance Coin (BNB) and other cryptocurrencies could see a surge under such conditions.