Ripple Co-Founder Shakes Market: $175M XRP Move Sparks 11% Price Plunge

Ripple's co-founder just triggered seismic waves in the crypto market—dumping $175 million worth of XRP as prices cratered 11% in a single day.

Whale alert: The blockchain doesn't lie. While retail investors scrambled, one of XRP's biggest holders made moves that'd make a Wall Street quant blush. Timing? Impeccable—as always with the crypto elite.

Market mechanics 101: When founders sneeze, traders catch pneumonia. This nine-figure transfer hit exchanges faster than a Bitcoin maximalist's 'I told you so.'

Bonus cynicism: Another day, another proof that in crypto, the house always wins—even when it's technically decentralized.

Is The Co-Founder Responsible for XRP’s Price Crash?

Larsen has moved $175 million worth of XRP to four different addresses over the last week. Despite the reshuffling, there is no indication that the Ripple co-founder has sold, or intends to sell, his XRP holdings.

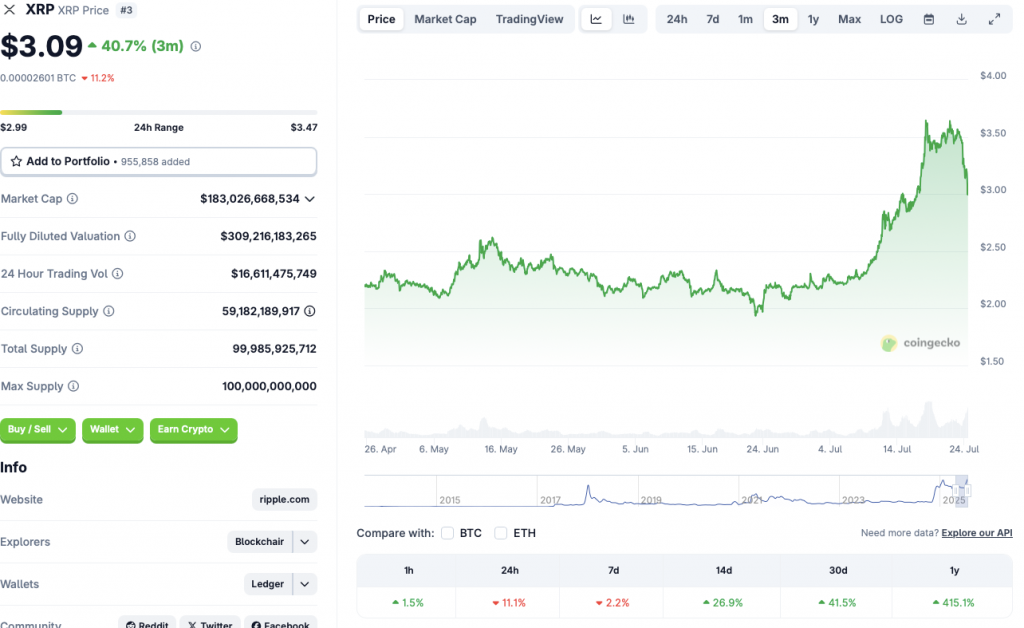

Ripple’s XRP token has seen a massive price rally over the last year. While the asset is down 11.1% in the daily charts and 2.2% in the weekly charts, it has rallied 26.9% in the 14-day charts, 41.5% in the monthly charts, and 415.1% since July 2024, as per CoinGecko’s XRP statistics.

XRP’s big rally came after Bitcoin (BTC) hit a new all-time high of $122,834 on July 14. The bullish reversal may have been triggered by increased inflows into crypto-based ETFs. The passing of pro-crypto legislation by the US House of Representatives earlier this month may have also boosted investor sentiment.

Why Is The Market Falling Today?

XRP and the larger cryptocurrency market have faced a significant correction today, July 24, 2025. According to CoinGlass data on XRP, more than $970 million worth of assets were liquidated in the last 24 hours.

XRP’s correction may be due to investors booking profits. Trade and tariff uncertainties may have also led to investors taking caution. The Federal Reserve’s decision to keep interest rates unchanged after its previous meeting may have also played a hand in market participants moving away from risky assets.