De-Dollarization Accelerates as Central Banks Pivot to Alternative Assets – BlackRock Sounds the Alarm

Global finance's worst-kept secret just got louder. Central banks are dumping dollars faster than a hot potato in a game of musical chairs.

The great diversification play

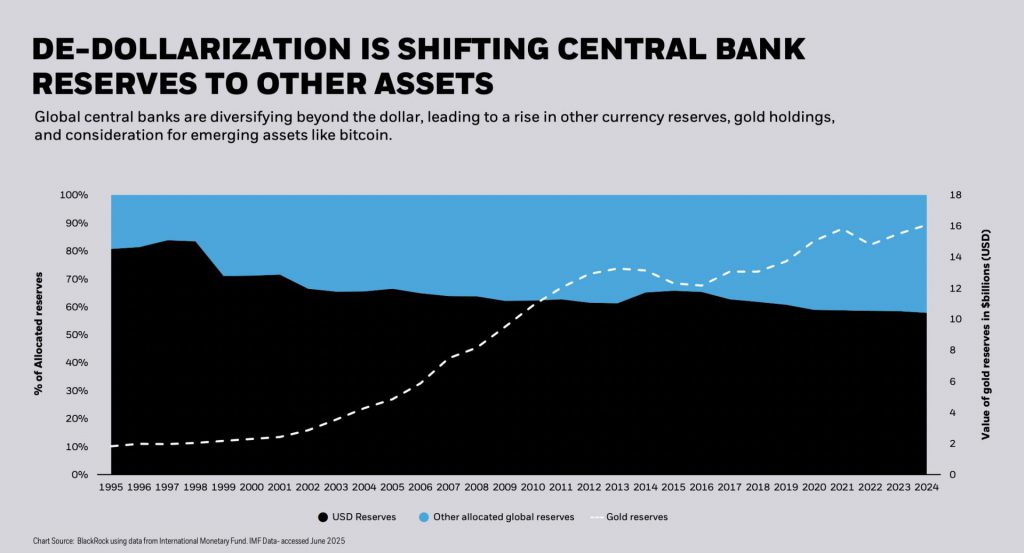

BlackRock's latest analysis confirms what crypto bulls have known for years - when fiat currencies wobble, hard assets win. Gold's had its moment, but the smart money's looking beyond shiny rocks and petrodollars.

Enter stage right: Bitcoin's institutional adoption

While BlackRock tactfully avoids naming specific alternatives, the writing's on the blockchain. With Treasury yields looking shaky and inflation playing whack-a-mole, digital gold starts looking mighty tempting.

The irony? Wall Street giants now pushing crypto ETFs may have accelerated the very de-dollarization they're warning about. Talk about eating your own lunch.

Source: Cointelegraph

Source: Cointelegraph

BlackRock’s Stance On De-Dollarization

The report shared by Cointelegraph is not the first instance of BlackRock’s cautious stance on the fading luster of the US dollar. In a letter to shareholders, Larry Fink, CEO of the world’s largest asset manager, stated how the US dollar will not remain the global reserve forever. Fink highlighted how the US debt can potentially lead to nations ditching the US dollar for other currencies. Fink also believes digital currencies, like Bitcoin (BTC), could eventually dethrone the greenback.

The de-dollarization movement has gained substantial footing over the last decade. China, and other sanctioned nations, like Russia and Iran, have made significant inroads on using alternative currencies for trade. China has also introduced the CIPS (Cross-Border Interbank Payment System) as an alternative to the SWIFT system. CIPS aims to bring the Chinese yuan to the spotlight for international settlements.

While the US dollar has seen a substantial decline in recent times, replacing the well-oiled dollar-based trade network is no easy task. The US dollar is the most liquid currency in the world. No other currency comes close to the dollar’s availability. While China has pushed for a yuan-based settlement system, fellow BRICS member India has stated that it has no intention of ditching the US dollar. While the MOVE away from the dollar is very real, it will take decades to completely replace it.