Bank of America Sounds Alarm: Dollar Faces Imminent Collapse Following 10.8% Freefall

The greenback's freefall has Wall Street sweating—Bank of America just flashed red on the dollar’s future.

### Death Spiral or Buying Opportunity?

Another 10.8% plunge—this isn’t volatility, it’s a full-blown currency crisis. Traders are either loading up on digital safe havens or praying for a Fed miracle.

### Crypto Vultures Circle

Bitcoin’s licking its chops as institutional players quietly shift reserves into decentralized alternatives. Because nothing says ‘distrust’ like hedge funds buying meme coins.

The dollar’s on life support while crypto markets prep for their next bull run. Funny how ‘too big to fail’ keeps failing.

USD/JPY chart showing recent dollar decline – Source: TradingView

USD/JPY chart showing recent dollar decline – Source: TradingView

De-Dollarization Trend Sparks Global Financial Instability Fears

The de-dollarization trend has actually accelerated as Bank of America reported neutral dollar flows amid global trade uncertainty. This shift represents a significant change from the dollar’s traditional safe-haven status, with real money investors showing mixed sentiment toward the greenback at the time of writing.

Bank of America analysts stated:

This neutral stance signals a significant shift in dollar reserve currency risk perception right now. The de-dollarization trend is becoming more pronounced as countries are seeking alternatives to dollar-denominated assets, which is contributing to global financial instability concerns. The US Dollar collapse warning cannot be ignored given these shifting dynamics that are happening.

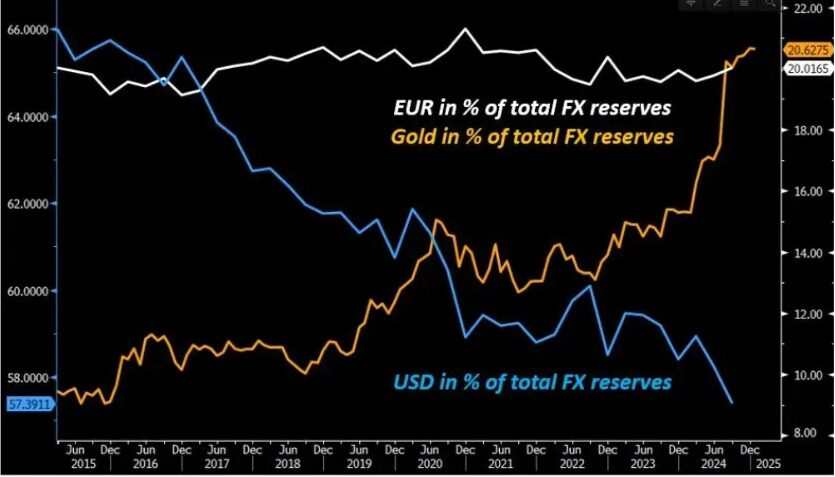

Dollar Reserve Currency Risk Escalates

The dollar reserve currency risk has intensified as the U.S. Dollar Index declined more than 9% year-to-date. This US Dollar collapse warning comes as investors grapple with potential long-term impacts of trade policies and monetary shifts that are occurring.

Bank of America’s analysis reveals that recent dollar weakness reflects both portfolio adjustments and mounting investor anxiety. The global financial instability stemming from dollar weakness has created Ripple effects across international markets along with other economic pressures.

Analysts at Bank of America noted:

The Bank of America forecast is a rude wake-up call of the US Dollar collapse warning more than just market volatility, it is in fact a realization that the world is facing a fundamental change in the global currency landscape. With global financial chaos deepening and dollar de-dollarization continuing, the dollar reserve currency risk is subject to unprecedented challenges that may radically change international finances.