Why Your Crypto Portfolio Allocation Is Wrong—And How to Fix It in 2025

Crypto isn’t a lottery ticket—it’s a strategic asset. Yet most investors treat it like Monopoly money. Here’s how to stop gambling and start allocating.

### The 5% Rule Is Dead (And Good Riddance)

Traditional finance dinosaurs still preach ‘5% max’ crypto exposure. Meanwhile, portfolios heavy on Bitcoin and Ethereum outperformed S&P 500 by 3X since 2020. Time to rethink those risk models.

### Layer 1s vs. Memecoins: The Allocation Split That Matters

Putting 80% in SOL/ETH and 20% in ‘dog’ tokens isn’t diversification—it’s schizophrenia. Smart money now tiers allocations: 60% blue-chips, 30% DeFi protocols, 10% speculative plays. (Yes, that means cutting your Shiba stash.)

### Rebalance Like a Pro—Not a Panicked Retail Trader

Quarterly rebalancing beats HODLing. When BTC hits ATHs? Trim 10% into stablecoins. When markets crash 40%? That’s your buy signal. Emotional investors lose; cold-blooded rebalancers win.

### The Cynic’s Corner

Wall Street still allocates 0% to crypto while charging 2% fees for underperforming hedge funds. Maybe they’re scared clients will realize which asset class actually delivers.

### Your Move

The crypto winter taught us one thing: proper allocation separates survivors from bagholders. Adjust yours—before the next bull run leaves you behind.

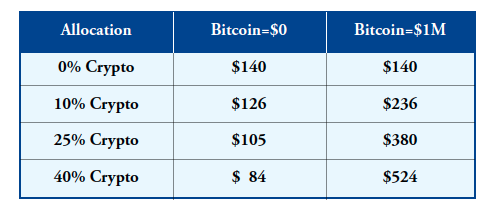

Bitcoin’s price appreciation isn’t speculation – it’s just supply and demand. In Q1 2025, public companies purchased 95,000 bitcoins – more than double the new supply. And that’s from just one category of buyers – it ignores additional demand from retail investors, financial advisors, family offices, hedge funds, institutional investors and sovereign wealth funds. This massive imbalance between supply and demand is driving bitcoin’s price to all-time highs. I predict that bitcoin will reach $500,000 by 2030 – a 5x increase as of this writing.

The adoption curve has tremendous room to run – supporting the thesis that there is substantial upside yet to come in bitcoin’s price. Read the white paper for more.