Shiba Inu ETF Approval Hits Another Snag: Behind the Regulatory Gridlock

The SEC just kicked the can down the road—again. Shiba Inu's ETF dreams remain in limbo as regulators drag their feet. Here's why Wall Street still won't take memecoins seriously.

Behind the delay: Bureaucratic red tape or calculated skepticism? Insiders whisper the SEC's crypto fatigue is real—but so is the pressure to approve something, anything, before 2026.

Meanwhile, SHIB traders face another quarter of volatility. No ETF means no institutional lifeline, leaving the coin at the mercy of retail whims and Elon Musk's tweet drafts.

Final thought: Maybe the real ETF was the friends we made along the way. (That and the 500% leverage some degenerate is running on this news right now.)

SEC Review Delay, Crypto ETF Approval Risks, And Shiba Inu Price

PENGU ETF Gets Priority In Latest SEC Review

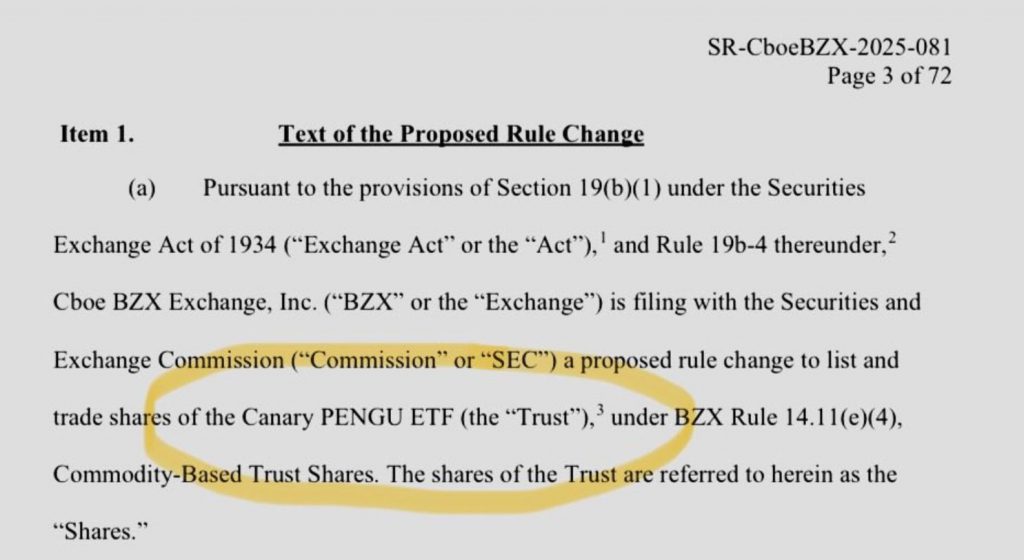

The Cboe BZX Exchange engineered its 19b-4 application yesterday, and also seeking approval for certain critical Canary PENGU ETF developments. This marks another instance where regulatory authorities have restructured Shiba Inu’s ETF approval and in favor of various major newer projects across several key regulatory sectors.

on X

Officials confirmed that the filing officially instituted the regulatory process through multiple strategic frameworks. The proposed ETF will provide exposure to PENGU tokens and also Pudgy Penguins NFTs, with additional holdings encompassing multiple essential Solana and ethereum components.

This application comes just three months after Canary’s initial S-1 filing, and demonstrating how quickly certain critical projects navigate various major SEC review process elements while Shiba Inu’s ETF approval remains stalled across numerous significant regulatory barriers.

Multiple Meme Coins Advance Past Shiba Inu’s ETF Approval

Asset managers have architected crypto ETF approval applications for Dogecoin, Official Trump, Bonk, and also Official Melania Meme tokens. The SEC review timeline typically involves acknowledging applications within two weeks, and followed by four separate decision deadlines encompassing multiple essential regulatory frameworks.

The regulatory landscape accelerated clear preferences, with newer meme coins receiving attention while shiba inu ETF approval continues to be restructured across several key institutional barriers. This pattern has catalyzed uncertainty about numerous significant regulatory criteria and also timing for certain critical SHIB-related products.

Right now, the SHIB price reflects this regulatory uncertainty as investors reassess their positions and based on delayed institutional access routes involving multiple strategic market elements.

Community Campaign Fails To Attract Asset Managers

The Shiba Inu community has gathered 11,700 signatures on a Change.org petition and urging Grayscale to launch certain critical SHIB ETF initiatives. The petition was launched last year and continues gaining support from retail investors and seeking institutional investment options.

Despite ranking as the 19th-largest cryptocurrency and also second-largest meme coin with a $6.88 billion market cap, Shiba Inu’s ETF approval remains absent from major asset manager priorities at the time of writing. This disconnect between market presence and institutional interest has spearheaded SHIB holders across numerous significant frustration points.

The continued delays in Shiba Inu’s ETF approval have catalyzed concerns about the token’s competitive position and as other meme coins gain regulatory traction involving multiple strategic advantages.

Market Impact Of Delayed Shiba Inu ETF Approval

The ongoing delays have created uncertainty around SHIB price movements and also institutional adoption prospects. Investors who anticipated ETF-driven institutional interest are now reconsidering their strategies and positions.

Security risks associated with direct token ownership make crypto ETF approval products particularly attractive to institutional investors and traders. Without regulatory progress, SHIB remains limited to direct trading platforms, which some view as less secure than traditional ETF structures.

The selective SEC review process is creating disparities within the meme coin sector, with some tokens advancing toward institutional products while the SHIB price reflects continued regulatory uncertainty and delays in approval.