Bitcoin Bears Double Down—But Is This a Trap? (2025 Market Alert)

Short sellers are piling into Bitcoin again—just as the market starts flashing bullish signals. Are these bears about to get mauled?

The Contrarian Bet

Futures data shows hedge funds increasing bearish positions at levels not seen since the 2023 rally. But with institutional adoption hitting record highs and the halving barely a year behind us, this smells like classic 'dumb money' behavior.

Liquidity Games

Market makers love nothing more than liquidating overleveraged shorts. The current setup—with funding rates turning negative while spot demand holds steady—creates a perfect squeeze scenario. Cue the inevitable 'risk management' tweets from blown-up traders.

Regulatory Wildcard

SEC Chair's latest "crypto isn't special" speech did spook markets briefly. But let's be real—after the BlackRock ETF dominoes fell in '24, Washington's bark has proven worse than its bite. Another case of regulators fighting the last war.

The bears might think they're being clever. But in crypto, the market has a habit of humbling those who mistake cyclical dips for structural collapses. Just ask the guys who shorted at $16k...right before the 300% rip.

Short Positions Surge Over The Past 7 Days — What This Means

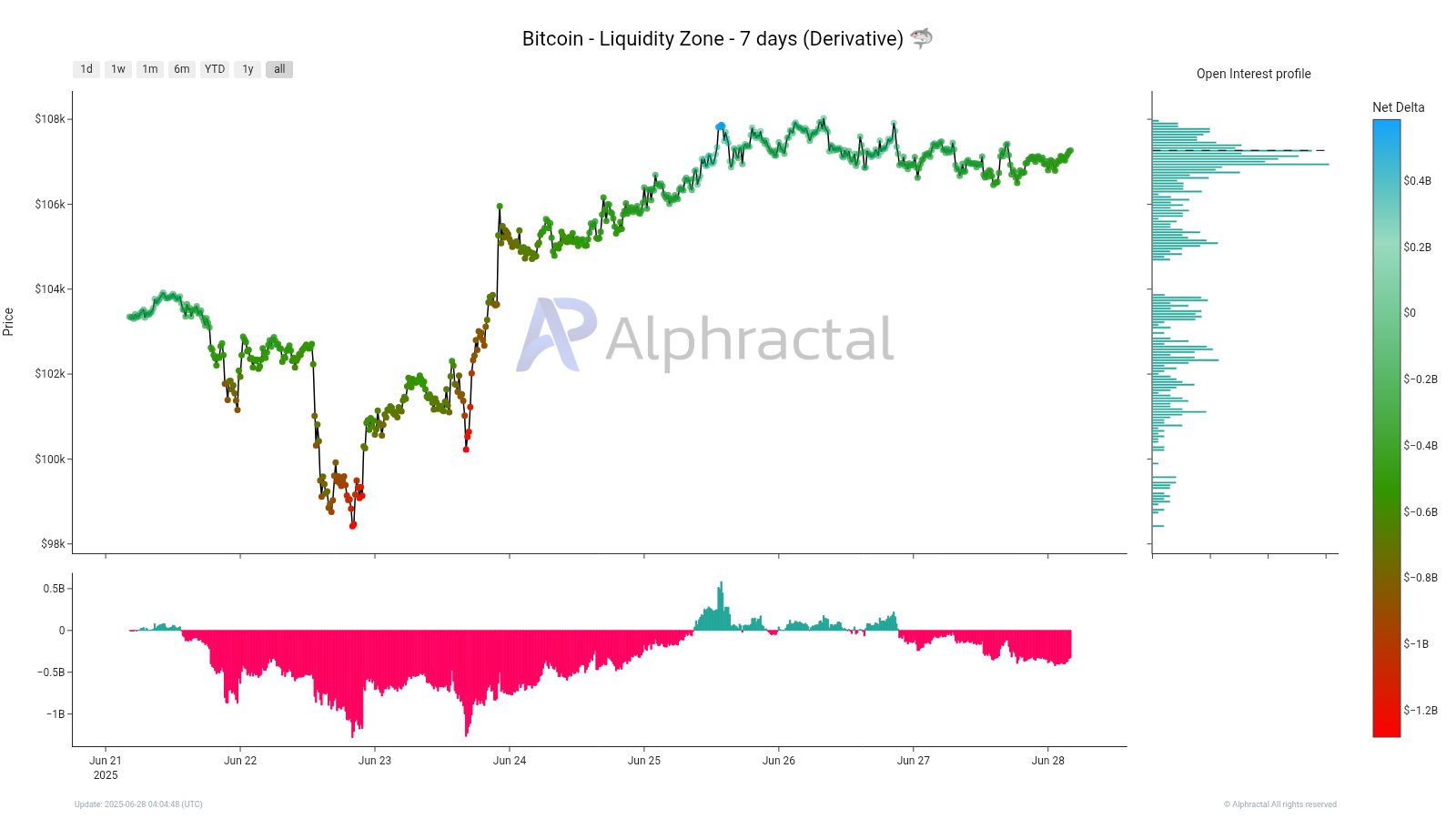

In a June 28th post on social media platform X, cryptocurrency analytics firm Alphractal shared an interesting on-chain development in the Bitcoin market.

This on-chain observation is based on the Liquidity Zone (7 Days) indicator, which measures three important data: on one hand, it is used to monitor the price movement of Bitcoin; on another, the Net Delta of open interest or positions; and, lastly, it shows the distribution of open interest at various price levels.

For a little context, the open interest Net Delta measures the difference between long and short open positions in the market. If the Net Delta reads positive, it means the buyers populate the market more. On the other hand, a negative reading means there are more short positions open than longs.

In the post on X, Alphractal pointed out that, over the span of seven days, more positions have been opened in a bet against the price of BTC. From the chart below, the red bars represent a negative Net Delta. As has been formerly explained, what this means is that the short traders currently dominate the market.

Interestingly, the shorts-dominated market does not exactly guarantee that we will experience a sell-off in the NEAR future. This is because the high negative Net Delta was recorded at a time when Bitcoin’s price is still at a stable level, even with little growth.

When sell positions are opened in a stable but bullish market, this usually indicates that the bears might be getting trapped. If, eventually, the bitcoin price overcomes the sell resistance, a phenomenon known as a short squeeze will occur.

In this scenario, sellers will be forced to buy back at higher prices, thereby pushing the Bitcoin price to the upside. This upward momentum will then further liquidate short positions.

What’s Next For Bitcoin?

There are uncertainties as to whether the bitcoin market might break the sell resistance, or go in favour of the sellers. For this reason, Alphractal warns that those with bearish sentiment should be cautious about their next move.

As of this writing, Bitcoin seems stuck within a choppy range over the past day and is currently valued at $107,309. The flagship cryptocurrency’s measly growth of 0.2% in the past 24 hours pales in comparison to its seven-day rise of 5.2%.