BRICS’ Bold Gambit: Can a Phantom Currency Really Dethrone the US Dollar?

The BRICS bloc is making waves—again—with whispers of a dollar-killing currency that exists only on PowerPoint slides. Here's why Wall Street is rolling its eyes.

Geopolitical theater or real threat? The BRICS nations (Brazil, Russia, India, China, South Africa) are doubling down on their anti-dollar rhetoric. Their latest weapon? A theoretical currency that—let's be honest—has about as much substance as a crypto whitepaper during bull market mania.

Why this matters: The dollar's dominance isn't just about greenbacks—it's about the entire US-led financial infrastructure. SWIFT, Treasury markets, and that sweet, sweet exorbitant privilege aren't going anywhere because five countries signed a memo.

The cynical take: This smells like political posturing wrapped in economic fantasy. Remember the 'gold-backed BRICS currency' hype of 2023? Exactly. Until there's actual liquidity—not just press releases—traders will keep pricing oil in dollars and laughing all the way to the Federal Reserve.

Bottom line: Talk is cheap. Dollar hegemony is built on decades of trust, markets, and—oh right—the world's most powerful military. But hey, at least the BRICS gave us something to talk about between Bitcoin ETF approvals and CBDC conspiracy theories.

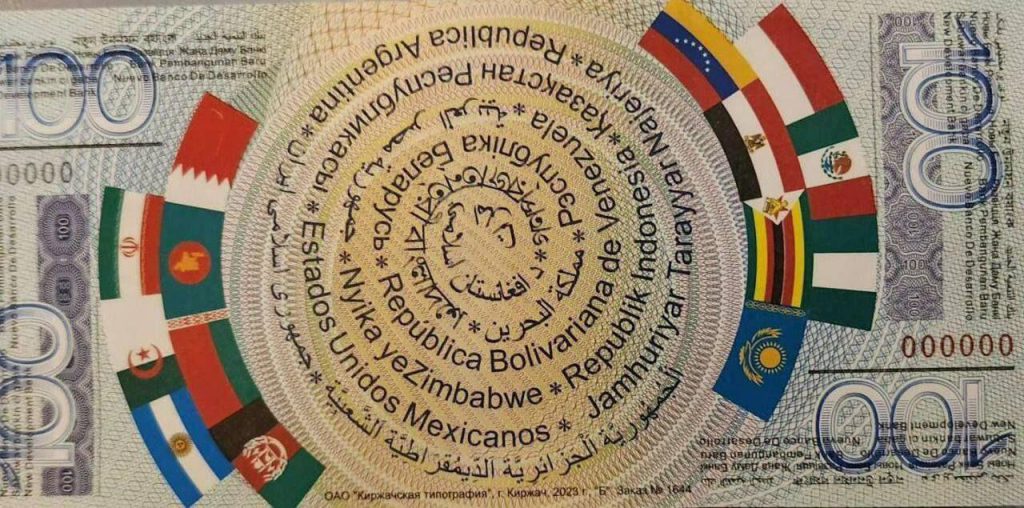

BRICS Currency Is Nothing But a Figment of Pure Imagination

BRICS Sherpa from India recently confirmed that the talks about currency formation are in very early stages. Even the draft is yet to see the day of light, as no progress has been initiated towards its development. In addition, India previously declared that they cannot use a common currency that will be shared with China. It is the antithesis of what they believe and will make the new banknote (if released) remain out of India.

While BRICS wants the new currency to dominate the world, it can’t because the currency does not exist. Even if it exists in the future, the cracks between the alliance will make the banknote fail in the markets. India does not want a banknote that benefits China and uproots the US dollar’s global supremacy. Several businesses and the IT sector in India will be impacted as it is closely tied to US dollar payments.