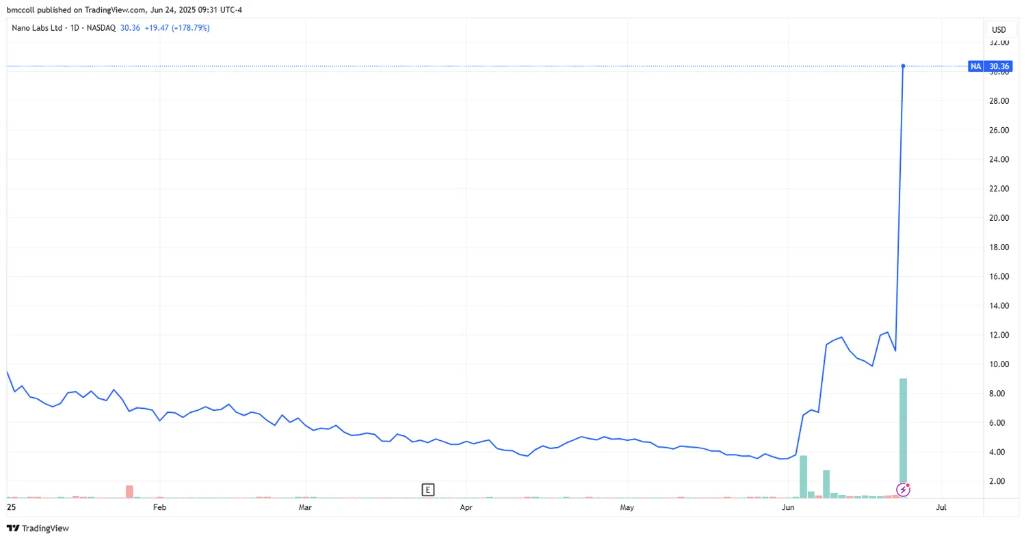

🚀 Nano Labs Stock Soars 64% on $9.4B BNB Treasury Bombshell

Nano Labs just pulled a rabbit out of the hat—and Wall Street’s scrambling to buy the magic.

The catalyst? A jaw-dropping $9.4 billion BNB treasury reveal that sent institutional FOMO into overdrive. Forget blue chips—crypto’s new whales are betting on infrastructure plays.

Why it matters: When a niche tech stock moons 64% in a day, it’s either visionary genius or speculative mania. Given that half the ‘investors’ probably can’t explain BNB’s tokenomics? Place your bets.

The kicker: Watch traditional finance pundits suddenly become blockchain experts tomorrow—goldman-sachs-just-discovered-defi energy incoming.

BNB price chart showing recent performance – Source: CoinGecko

BNB price chart showing recent performance – Source: CoinGecko

BNB Treasury Investment Sparks Nano Labs Stock Surge And Hype

The Nano Labs stock surge began immediately after the company revealed its massive BNB Treasury investment plan on Tuesday morning. Stock prices jumped from $10.89 to $29.18 within minutes of market opening, and then settled at $14.85 by closing bell. This dramatic Nano Labs stock surge demonstrates the powerful BNB price impact that major corporate announcements can generate in today’s markets.

The company plans to purchase between 5% and 10% of BNB’s total circulating supply, worth between $4.7 billion and $9.4 billion at the time of writing. This BNB Treasury investment will be executed in phases, starting with an initial $500 million acquisition that will be funded through convertible promissory notes.

Former Binance CEO Changpeng Zhao had this to say:

Chinese Crypto Companies Lead Corporate Adoption

Chinese crypto companies are increasingly embracing digital asset treasury strategies right now, with Nano Labs leading this trend through its record-breaking BNB Treasury investment. The move reflects growing crypto corporate adoption as traditional companies seek to diversify their holdings beyond conventional assets and also explore new revenue streams.

The BNB price impact from such substantial institutional buying pressure could create significant market movements in the coming weeks. BNB currently ranks as the fifth-largest cryptocurrency by market capitalization, valued at $93.9 billion at the time of writing, making it an attractive target for crypto corporate adoption strategies.

Wall Street Eyes Alternative Treasury Assets

The success of Nano Labs’ BNB Treasury investment announcement has also sparked broader interest in alternative cryptocurrency treasuries right now. Separate crypto hedge fund executives are reportedly planning to raise $100 million specifically for BNB token acquisition, and this highlights increased institutional appetite for this Binance-linked asset.

This trend away from Bitcoin-only strategies represents an evolution in crypto corporate adoption, with Chinese crypto companies particularly active in exploring diversified digital asset portfolios at the time of writing.