IXO™ Season 3 Closes with a Bang in Seoul: Verified Web3 Projects Pivot to Real-World Impact

Seoul just witnessed the grand finale of IXO™ Season 3—where Web3 hype met tangible utility. No more vaporware promises; this cohort delivered verified, real-world-ready projects.

From DeFi to DAOs, the spotlight wasn’t on speculative tokens but on solutions that cut through blockchain’s echo chamber. Think supply-chain trackers, credentialing systems, even carbon-offset protocols—all audited, all live.

And the twist? Traditional VCs lurking in the back rows, suddenly allergic to their own ‘web2 is fine’ rhetoric. Guess double-digit returns cure nostalgia fast.

One cynical takeaway: If these projects scale, Wall Street’s ‘blockchain consultants’ might need to find actual jobs.

The first day began with a keynote asserting that digital assets and stablecoins are emerging as powerful growth engines for the South Korean economy amid shifting global financial dynamics.

Crypto influencers and professional traders shared short-term trading strategies and risk management tips. Kang Min-woo, a popular financial creator, drew significant attention for his analysis of Bitcoin’s upward trajectory and insights on optimal selling points. Debates between long-term Bitcoin holders and altcoin-focused investors also generated strong interest.

Several innovative Web3 projects showcased their visions on stage, including Openledger’s decentralized AI infrastructure, Tron’s stablecoin-based financial system, and Rewordy Wallet, which aims to simplify Web3 onboarding. Other featured projects included Gaia (AI value protocol), XPear (AI-powered mining), Pending (fandom monetization), and SOON, a platform focused on Web2-to-Web3 user migration.

The second day addressed the structural foundations needed for broader Web3 adoption, including the strategic role of stablecoins, AI convergence, and regulatory clarity.

A keynote from Ahn Yoo-hwa, Director at China Securities Administration Research Institute, described stablecoins as a critical monetary policy tool akin to “digital treasuries,” underscoring their potential to maintain U.S. bond demand. She called for South Korea to MOVE quickly to capture opportunities in the sector.

Panelists highlighted stablecoins’ emerging role in security, payments, and compliance frameworks. AI and blockchain convergence also took center stage, with projects like Noditt, ZetaCube, and IoTeX demonstrating decentralized solutions to challenges such as centralization, bias, and high AI infrastructure costs.

The program included detailed discussions on tax and accounting issues surrounding stablecoins and unlisted crypto assets. Legal experts dissected South Korea’s proposed Digital Asset Basic Act, while also reviewing compliance frameworks such as CODE, a travel rule solution. Asia’s outsized role in global crypto markets—representing an estimated 60% of trading volume—was a recurring theme.

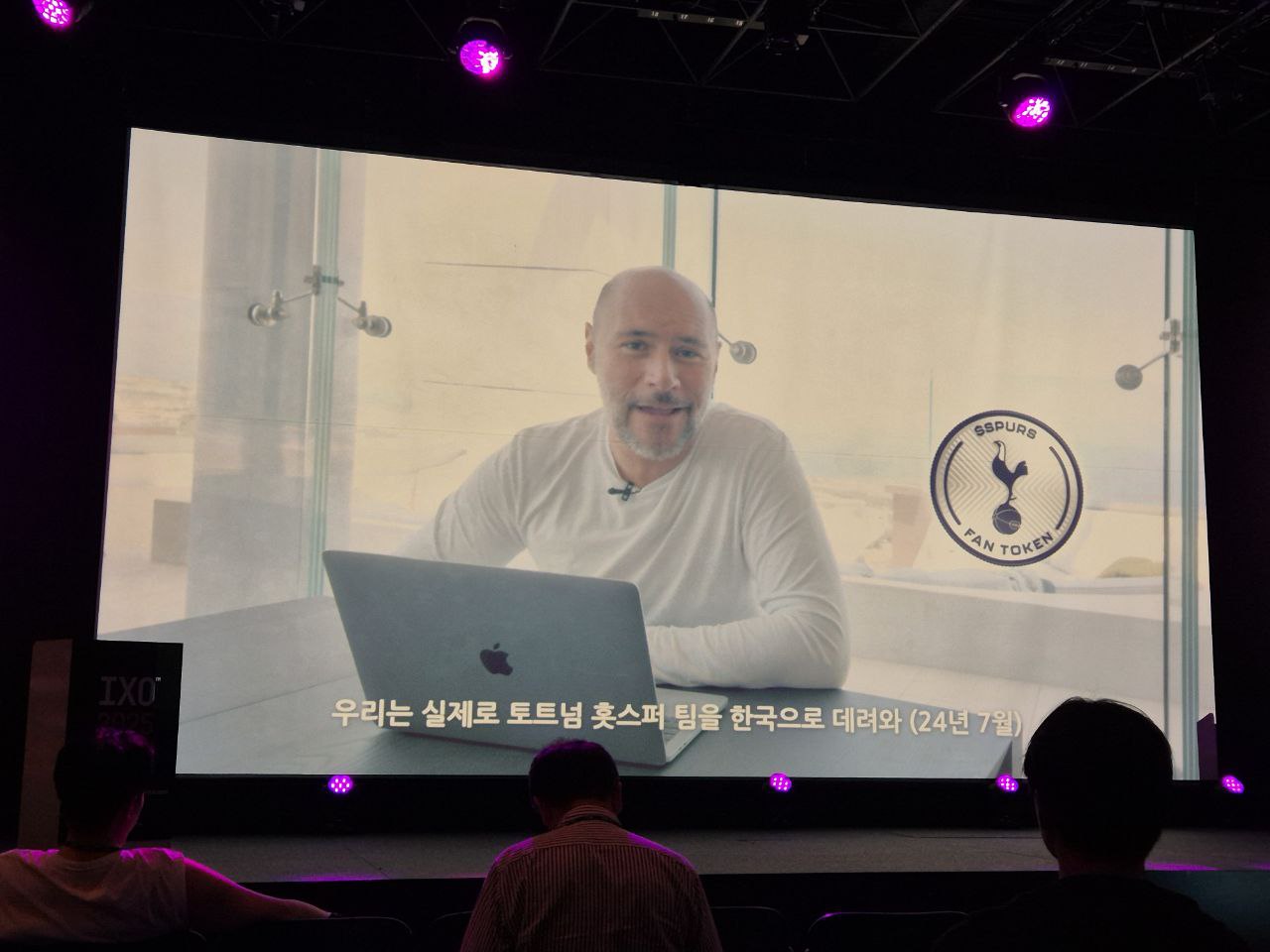

Major global players such as Chiliz, which promoted its “Korea First” strategy, and OKX Wallet, which emphasized self-custody, also participated. INFCL outlined localization strategies for global rollouts, while OneKey and Ratel introduced next-generation digital asset custody and economic participation models.

Launched in 2023, IXO™ positions itself as a Web3-native alternative to traditional fundraising models like ICOs, IEOs, and IDOs. The first season drew over 1,000 attendees, followed by a second season in July themed “Embrace the Future.”

With its third season, IXO™ has further expanded its focus on identifying practical blockchain use cases and fostering community-led investment culture. Organizers say upcoming seasons will continue to support verified Web3 builders and contribute to the development of a sustainable, trust-based digital asset ecosystem.