DCG Execs Saw Genesis Collapse Coming—Now ’Alter Ego’ Lawsuit Exposes Their Willful Blindness

Behind the velvet ropes of crypto's elite, Digital Currency Group executives played a dangerous game—ignoring flashing red warnings as Genesis teetered on collapse. Now the courts are calling their bluff.

The paper trail doesn't lie

Internal communications reveal DCG leadership discussing legal liabilities months before Genesis filed for bankruptcy. Yet they kept pouring gasoline on the fire—extending risky loans, shuffling funds between subsidiaries like a shell game at a carnival.

'Alter ego' allegations cut deep

The lawsuit claims DCG treated Genesis as a personal piggy bank, blurring corporate boundaries until creditors couldn't tell where one entity ended and another began. Textbook 'piercing the corporate veil' territory—if proven.

As usual in crypto, the warning signs were all there. Some just chose to read them as buy signals. Now the bill comes due—with interest.

DCG Ignored Red Flags While Extracting Value from Insolvent Genesis, Lawsuit Claims

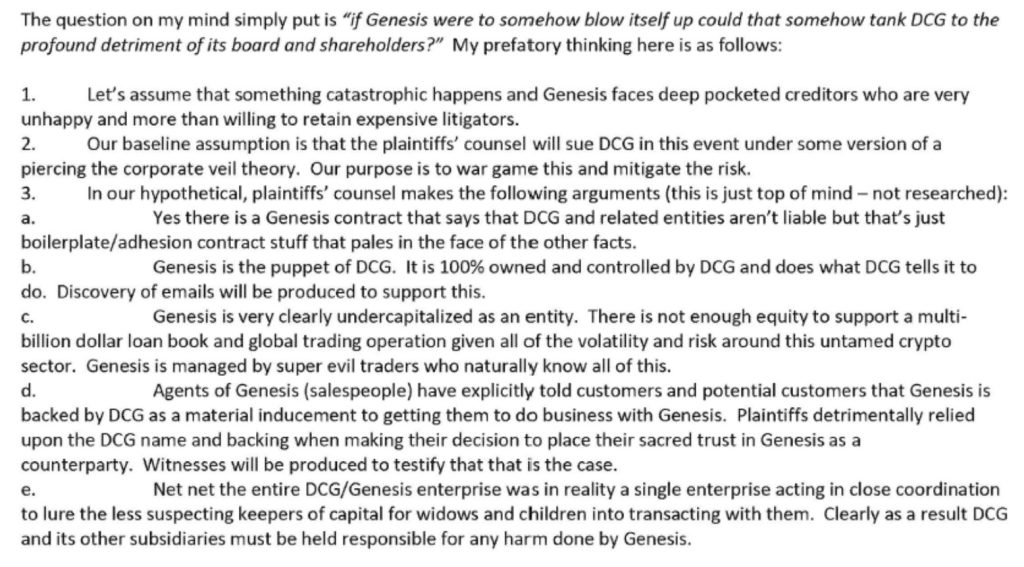

According to the filing, DCG’s Chief Financial Officer Michael Kraines raised alarm in a 2022 internal strategy memo.

He posed a “war-gaming” scenario where creditors could pierce the corporate veil and hold DCG liable. In the memo, Kraines wrote: “Genesis is the puppet of DCG. It is 100% owned and controlled by DCG and does what DCG tells it to do.”

He added that such control, along with undercapitalization, could trigger legal action from “deep pocketed creditors.”

The committee claims that this foresight did not prompt corrective action. Instead, internal documents reveal how DCG and its CEO Barry Silbert allegedly treated Genesis as a source of funds, referring to it as a “de facto treasury.”

The complaint accuses DCG of extracting value from Genesis through insider loans and risky trades, even as the lender drifted toward insolvency.

“Silbert and his insiders exploited Genesis for their own benefit,” said Philippe Selendy, counsel for the LOC. “Internal DCG and Genesis documents now provide more detail than ever seen before.”

The filing points to multiple warning signs. Genesis’s loan book had tripled in size while, according to internal reports, the firm lacked proper risk controls. Its external auditor flagged “material weaknesses” as early as 2020.

DCG reportedly formed a risk committee but delayed its first meeting for nine months. Kraines later joked that the delay “just got his future deposition easier.”

Genesis insiders also described a “culture of submission,” claiming they were pressured to serve DCG’s interests. In one internal message from 2022, an employee wrote that Genesis was being “propped up” so DCG could “borrow while they could to get the cash out.”

The complaint further alleges that Genesis misled the public after the collapse of Three Arrows Capital. Employees were instructed to follow pre-approved scripts, and Silbert himself amplified claims on social media that Genesis remained stable.

The committee is also challenging two transactions as fraudulent. These include the issuance of a promissory note on June 30, 2022, and a roundtrip deal in September, both described as efforts to mask Genesis’s financial distress.

Genesis is now seeking to recover more than $3.3 billion from DCG, Silbert, and others.

The LOC, formed to represent Genesis creditors, said the complaint reveals a “deliberate scheme” that left customers behind while insiders extracted value.

“These are not merely technical disputes over intercompany accounting,” the LOC said. “The level of coordination, secrecy, and callousness alleged is nothing short of breathtaking.”

Genesis Pushes Forward with Lawsuits and Repayments Amid Ongoing DCG Legal Storm

As the fallout from Genesis’ collapse continues, the bankrupt crypto lender is intensifying its legal campaign against its parent company, DCG, in a bid to recover billions for creditors.

In Delaware, Genesis is pursuing a lawsuit to claw back over $2.2 billion in Bitcoin, Ethereum, and other crypto assets, aiming to redistribute the funds to its still-unpaid creditors.

Genesis has sued its parent company, @DCGco, and CEO @BarrySilbert, accusing them of engineering insider transactions that drove the firm into bankruptcy.#DCG #Genesishttps://t.co/MLcJoiZ3rI

— Cryptonews.com (@cryptonews) May 20, 2025A separate case, filed in the Southern District of New York, targets more than $1 billion in allegedly fraudulent transfers, including $450 million in crypto sent to DCG, and $297 million routed to its international arm.

Genesis is also disputing $34 million in so-called “tax payments” it now calls illegitimate.

Genesis’ financial troubles date back to the collapse of Three Arrows Capital, which triggered liquidity issues, later deepened by the FTX implosion.

The company filed for Chapter 11 bankruptcy in January 2023, listing over $3.5 billion in debt owed to major creditors like Gemini and VanEck.

Although Genesis finalized a restructuring plan in August 2024, tensions with DCG remain. DCG had defaulted on over $620 million in debt, prompting Genesis to sue for full repayment, including 4,550 BTC.

Progress has been slow but steady. By May 2024, Genesis had returned $2.18 billion to over 232,000 users, including through a pending $1.8 billion settlement with Gemini Earn participants.

However, regulatory pressure mounts. The CFTC is pursuing Gemini over alleged violations, with trial set for January 2025.

Meanwhile, the SEC charged Genesis and DCG earlier this year with investor fraud, DCG has since agreed to pay a $38 million fine.

![]() The SEC has charged Genesis and Digital Currency Group for misleading investors about their financial health, resulting in a $38 million fine.#SEC #CryptoRegulationshttps://t.co/HAqe03QsWw

The SEC has charged Genesis and Digital Currency Group for misleading investors about their financial health, resulting in a $38 million fine.#SEC #CryptoRegulationshttps://t.co/HAqe03QsWw

As legal battles unfold, Genesis continues its effort to recover and return funds, while its former parent, DCG, remains in the regulatory crosshairs.