Trump’s 10% Tariffs Hammer the Dollar—Asia’s Already Pivoting Away

The US dollar’s dominance is cracking under its own weight—and Trump’s latest tariff gambit just handed Asia another reason to ditch it.

De-dollarization accelerates: 10% tariffs spark capital flight fears, push regional players toward yuan and crypto hedges. Another unforced error by the financial ’geniuses’ in Washington.

Markets react: Asian central banks quietly stockpiling BTC reserves while publicly denouncing its ’volatility.’ Classic hedge-and-hypocrisy play.

Bottom line: When your exorbitant privilege becomes a liability, even ’stable’ currencies get unstable fast. The dollar’s Icarus moment? Maybe. But the East isn’t waiting to find out.

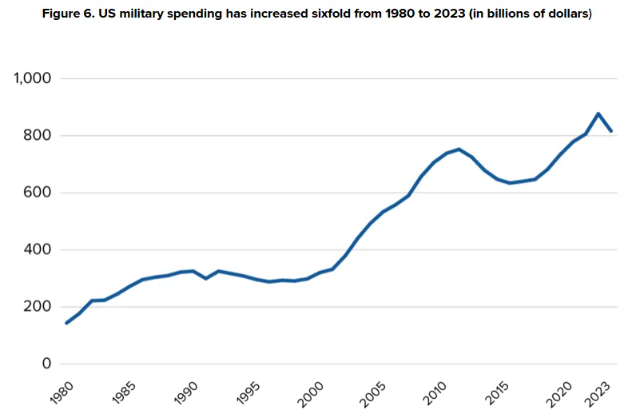

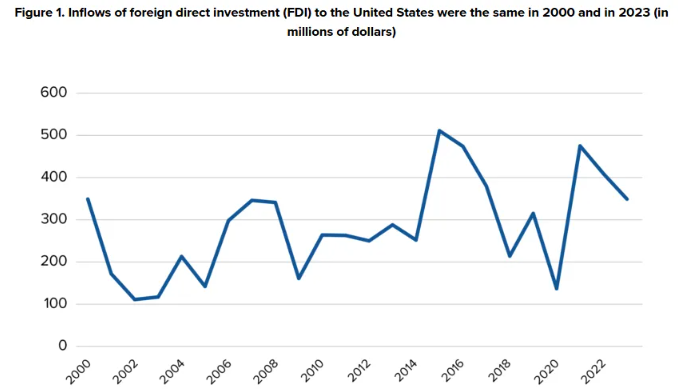

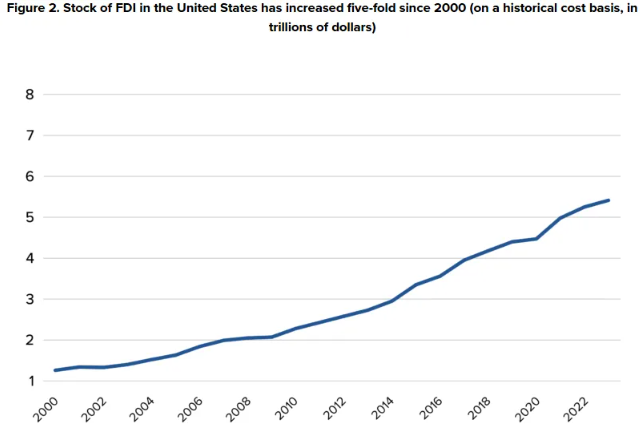

Foreign direct investment flows to United States – Source: World Bank Data 2025

Foreign direct investment flows to United States – Source: World Bank Data 2025

How Trump’s 10% Tariffs Drive De-dollarization And Boost BRICS & US Dollar Future Risks

Trump’s universal tariffs sparked immediate de-dollarization momentum across global markets. The head of FX at Deutsche Bank told investors about witnessing a simultaneous collapse in all US assets.

The head of FX at Deutsche Bank stated:

Asian De-dollarization Gains Speed Through Local Currency

The tariff crisis accelerated existing de-dollarization trends throughout Asia. At the ASEAN finance ministers meeting in March, policymakers discussed cutting their reliance on the United States dollar and moving to local currency settlements instead. These local currency arrangements represent a fundamental shift away from dollar dependency right now.

Japan’s finance minister Katsunobu Kato had this to say:

BRICS Currency Development Accelerates De-dollarization

BRICS nations are advancing their de-dollarization agenda through concrete payment systems. In October 2024, during the BRICS summit in Kazan, members discussed developing BRICS Pay, a decentralized payment system for local currency transactions. This BRICS currency infrastructure could bypass traditional United States dollar systems entirely.

Trump’s threats against de-dollarization efforts have intensified the crisis.

Trump stated:

US Dollar Future Under Unprecedented Threat

The US dollar future faces its most serious challenge since World War II. Lawrence H. Summers, former treasury secretary, compared Trump’s actions to the 1956 Suez Canal crisis when Britain lost the pound’s reserve currency status.

Lawrence H. Summers said:

The de-dollarization process is accelerating despite official denials. China is quietly diversifying from US Treasuries, while Japan holds $1.13 trillion in US Treasury securities. This massive exposure makes any Japanese sell-off particularly dangerous for the United States dollar.

Such a trend goes beyond what is happening among the BRICS countries. More and more local currency trading agreements are appearing across Asia as countries look for options to cut their reliance on the US dollar. Dollar dominance may be under threat if the pressures caused by tariffs cannot soon be checked.