XRP ETF Launch Sparks Frenzy: Can a $5K Bet Deliver 580% Returns?

Ripple’s price action just got a rocket boost—Wall Street’s latest crypto ETF play targets XRP, and the hype train’s leaving the station.

The math that’s melting minds

A $5,000 position could theoretically 6x if the stars align—because nothing says ’sound investment’ like gambling on regulatory gray areas.

Why institutions suddenly care

ETF issuers finally cracked the code: slap ’blockchain’ on anything and watch capital flood in. XRP’s 580% potential looks tame next to 2021 memecoin mania.

The fine print they’ll ignore

Past performance guarantees future losses. Just ask the ’stablecoin’ bagholders from last cycle.

XRP ETF Surge and Bullish Models Spark $10 XRP & Ripple Forecast

Volatility Shares’ XRP futures ETF (XRPI) launch represents a watershed moment for XRP price prediction trajectories, and the regulated product provides institutional exposure to cryptocurrency markets without direct token ownership. This addresses security risks that have plagued digital assets.

Eric Balchunas from Bloomberg had this to say:

Multiple Leveraged products are entering markets right now, with Teucrium’s 2x XRP futures ETF commanding $120 million in assets. The Ripple news cycle continues accelerating as ProShares filed for three additional XRP ETF products, including an Ultra XRP with 2x leverage.

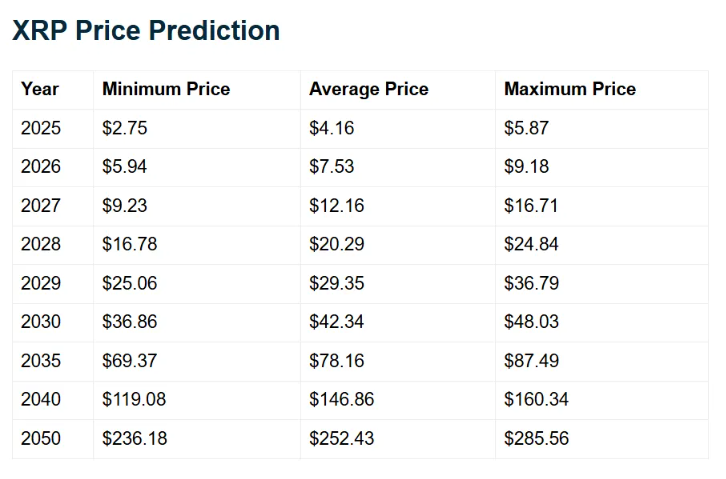

XRP Price Prediction Models Target $10 Timeline

Mathematical XRP price prediction models suggest the $10 threshold requires 16.2 months of 10% monthly growth from current levels around $2.34, and this XRP prediction timeline aligns with Telegaon analysts who project minimum prices of $6.94 by 2026. Current cryptocurrency market conditions support these XRP price prediction scenarios as regulatory clarity emerges.

Historical Rally Patterns Fuel XRP Price Prediction Optimism

The 580% xrp price prediction gain from $0.50 to $3.40 demonstrates the token’s explosive potential, and replicating this performance from current $2.34 levels would push XRP to approximately $15.9. This aligns with multiple analyst targets in current Ripple news coverage.

Rob Cunningham, an XRP community researcher, recently said:

These XRP prediction models gain credibility as nine spot XRP ETF applications await SEC approval, including Franklin Templeton’s submission.

Bloomberg analyst James Seyffart said:

JPMorgan projects ETF inflows reaching $8 billion within 12 months of approval, and this creates substantial demand supporting higher XRP price prediction targets.

Technical analysis reveals bull flag patterns typically signaling 500% continuation moves, and if confirmed, this would push XRP toward $15. This aligns with macro Ripple news including XRP ETF (XRPI) approvals and expanding payment utility at the time of writing.

The Polymarket prediction platform shows:

Still, with billions of XRP being released from Ripple’s escrow every month, an ongoing rise in demand is required. As a result of the regulations, the company is now looking to buy up assets strategically and this focus is pushing the XRP price up. As a result, industry analysts expect XRP’s price could increase by 580%, with $5,000 becoming worth much more.