The Dollar Exodus: Which Countries Are Ditching USD—and Why It’s Accelerating

The greenback’s grip is slipping—fast. From BRICS power plays to desperate inflation hedges, nations are cutting ties with the USD like a toxic stablecoin.

Who’s jumping ship? Russia settles trade in yuan, India pushes rupee payments, even Saudi Arabia flirts with petroyuan deals. The list grows weekly.

Why now? Weaponized sanctions backfire, USD inflation exports misery, and let’s be honest—everyone loves sticking it to the Fed’s printing press.

One cynic’s take: When your reserve currency needs an army to enforce demand, maybe it’s not that ’resilient’ after all.

De-Dollarization List of Countries: Key Reasons and Global Impact

As of writing, major economies from Asia, Africa, South America, and even some parts of Europe are following their own footsteps in leaving the dollar hegemony behind. This movement is fundamentally altering global trade patterns and also putting into question the international monetary arrangement which has been around for almost eight decades.

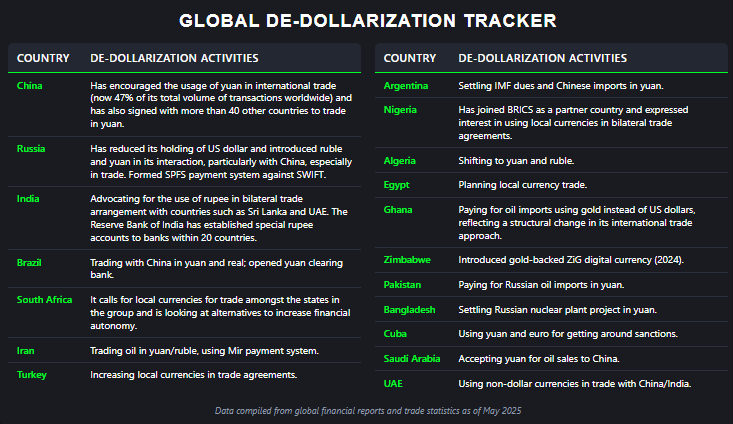

Complete List of Countries Leading De-Dollarization Efforts

BRICS and Oil ProducersBRICS nations lead the global de-dollarization movement by creating alternative payment systems and shifting trade to local currencies. Several oil producers have begun accepting non-dollar currencies for crude sales, undermining the petrodollar system.

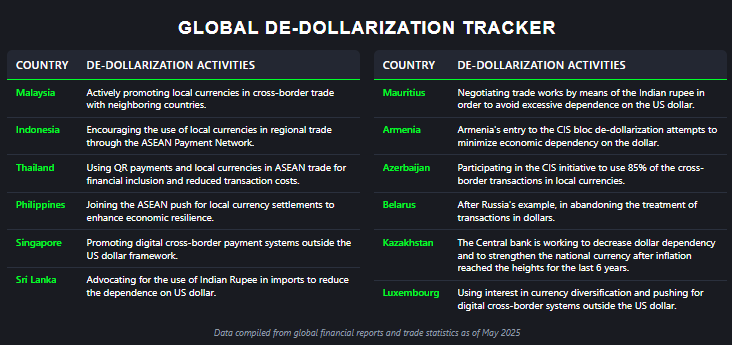

Asian and CIS Countries

The ASEAN bloc has made significant progress in establishing local currency settlement frameworks, reducing transaction costs and enhancing regional financial cooperation. Meanwhile, Commonwealth of Independent States (CIS) members are conducting approximately 85% of cross-border transactions using local currencies rather than the US dollar, following Russia’s lead in creating alternative payment infrastructures.

African Nations

African countries are increasingly seeking monetary sovereignty through de-dollarization initiatives. Several East African Community members are collaborating on regional currency projects, while others have banned foreign currencies for domestic transactions.

BRICS Alliance Leading Global De-Dollarization

The BRICS alliance has created alternative payment systems and increased trade in local currencies. Their collective efforts represent the most organized challenge to dollar hegemony in recent years.

Mohammad Reza Farzin was clear about the fact that:

Commonwealth of Independent States Forms Dollar-Free Zone

Eleven CIS nations have announced plans to stop using the dollar, and they are currently conducting about 85% of cross-border transactions using local currencies instead of the US dollar.

Vladimir Putin said during a CIS meeting:

Saudi Arabia Ends Half-Century of Dollar Exclusivity

Saudi Arabia’s decision to accept non-dollar currencies for oil transactions marks a historic shift in the petrodollar system that was established back in the 1970s.

Ghana’s Vice President Mahamudu Bawumia stated regarding their own de-dollarization efforts:

Trump Threatens Tariffs Against De-Dollarizing Nations

The United States has responded forcefully to the de-dollarization trend, with political and economic warnings against countries abandoning the dollar.

President Donald TRUMP declared:

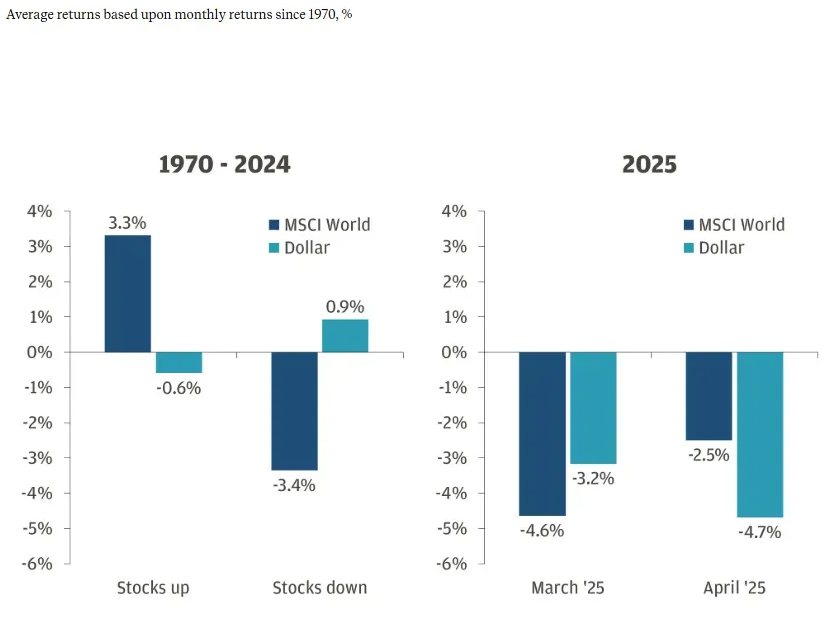

Financial Experts Assess Dollar’s Future

Leading financial institutions have acknowledged the shifting landscape while noting the dollar’s continued importance in global markets. Nevertheless, experts suggest this dominance may be waning.

Joyce Chang, Chair of Global Research at J.P. Morgan, acknowledged:

S&P Chief Economist Paul Gruenwald offered this assessment:

The countries that want to gain monetary sovereignty and are oriented towards the protection from sanctions in dollars still adhere to the de-dollarization movement. Furthermore, many nations are creating alternative payment systems to reduce their vulnerability. Although the dollar will continue being powerful for a couple of more years, its undisputed supremacy seems to be declining now, and consequently, the repercussions for the international monetary system as well as we know it are dramatic.