Nvidia’s 2025 Slump Won’t Kill Its AI Dominance—Here’s Why Analysts Still Back NVDA Long-Term

Nvidia’s stock hits turbulence in 2025—supply chain snarls and crypto-mining hangovers bite. But beneath the quarterly drama? A chip empire built to last.

The AI moat remains unbreached

While rivals scramble to match last-gen tech, Nvidia’s CUDA ecosystem and data center deals lock in clients like roach motels—easy to enter, impossible to leave. Short-term pain for architecture dominance.

Wall Street’s favorite punching bag (until it’s not)

Analysts downgrade on macro fears, then quietly reload positions weeks later—classic hedge fund theater. Meanwhile, Jensen Huang’s roadmap stretches beyond gaming and crypto mining’s boom-bust cycles.

The play? Ignore the day traders. This isn’t a stock—it’s the toll bridge for the AI gold rush. Just don’t expect bankers to admit that between martini lunches.

Source: Reuters

Source: Reuters

Nvidia: Still a Long-Term Investment Option? What Experts are Saying About the Tech Giant

Tuesday saw the US stock market stagnate after a week of gains. Moreover, with earnings approaching, the recent bounce back followed an extended market downturn that had plummeted share values. Altogether, the increased volatility led Wall Street to experience one of the worst 100-day starts to a presidential administration in history.

That has affected many of the biggest stocks on the planet, including the Magnificent 7. With these companies plummeting this year, Nvidia (NVDA) has still been called a long-term stock play by one expert despite its 2025 struggles. Indeed, the company provides extensive reasons to be optimistic outside of its horrid three-month stretch.

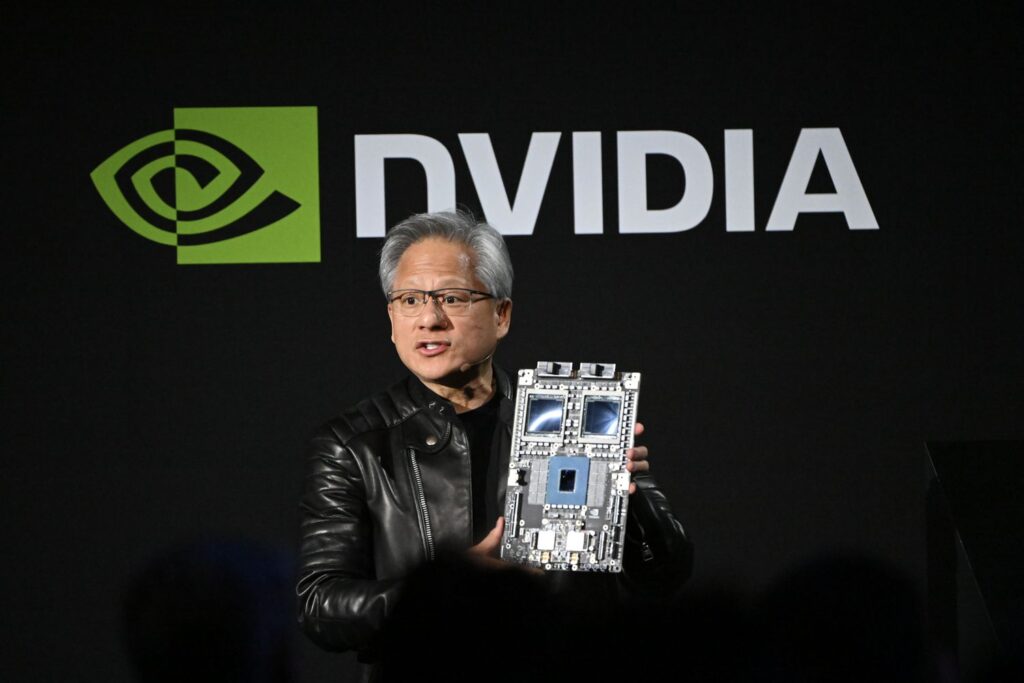

In a recent report, Beuberger Berman’s managing director, Dan Flax, discussed his stance on the stock. Specifically, Flax noted he believed Nvidia can “be strong over the next two years.” The reasoning came down to Blackwell chip demand “ramping” while the company remains “at the heart” of a host of AI projects that are “revolutionizing” a plethora of industries.

“The most important thing for NVIDIA is executing on its products and delivering value to its shareholders,” he said. Conversely, retail investors may align with that thinking, as the stock has increased 11% over the last 5 days. Moreover, 88% of 68 surveyed analysts have a buy rating on the tech giant, according to CNN data.