Ethereum Staking Soars to Unprecedented Heights: Is a Massive Price Surge Imminent?

Ethereum just locked away a record-breaking chunk of its own supply. The network's staking vaults are overflowing—and that could mean one thing for ETH's price trajectory.

The Great ETH Lock-Up

Forget trading. The smart money isn't buying to sell—it's buying to stake. Validators are piling in, committing their ETH to secure the network and earn yield. This isn't casual participation; it's a wholesale shift from liquid asset to productive capital. Every staked token exits the circulating supply, tightening the available pool for speculators and DeFi degens alike.

Scarcity Engine Ignites

Basic economics still apply, even in crypto. Reduce supply while demand holds or increases, and price pressure builds. With a historic portion of ETH now programmatically removed from daily trading, the market's mechanics change. The sell-side gets thinner. The available float shrinks. It creates a structural setup where even modest buying activity can have an outsized impact on price—a classic recipe for volatility, preferably to the upside.

The Validator's Gambit

This isn't without risk. Staking means locking funds, often for an indeterminate period. It's a bet on Ethereum's long-term health over short-term trading gains. Validators are betting their liquidity on the network's future fee revenue and security. It's a vote of confidence that also happens to engineer a favorable supply shock.

Will Price Follow the Lock?

History offers a clue. Major supply shocks in crypto—halvings, burns, massive staking waves—tend to precede significant price revaluations. The market is a discounting machine, and a verifiable reduction in available tokens is one of the few metrics it can't easily ignore. Of course, traditional finance pundits will call it a 'greater fool' scheme—right up until the charts print new all-time highs and they start asking how to get in.

The stakes have never been higher. Literally. With Ethereum's core economy now actively consuming its own currency, the stage is set. The only question left is when the fuse lights.

Ethereum’s staking ratio hits a new ATH surpassing 30% of total supply, with 36.8M ETH ($72BILLION) now locked and nearly 1M validators securing the network. pic.twitter.com/GwkRLEv5T5 — Coin Bureau (@coinbureau) February 12, 2026

Will Ethereum Rally After Staking Hit An All-Time High?

While the high staking figures increase confidence in the Ethereum network’s security, they may not directly lead to a price rally. Staking implies that investors are bullish on the Ethereum network’s performance, and want to participate as a network validator. However, prices will likely not recover just yet.

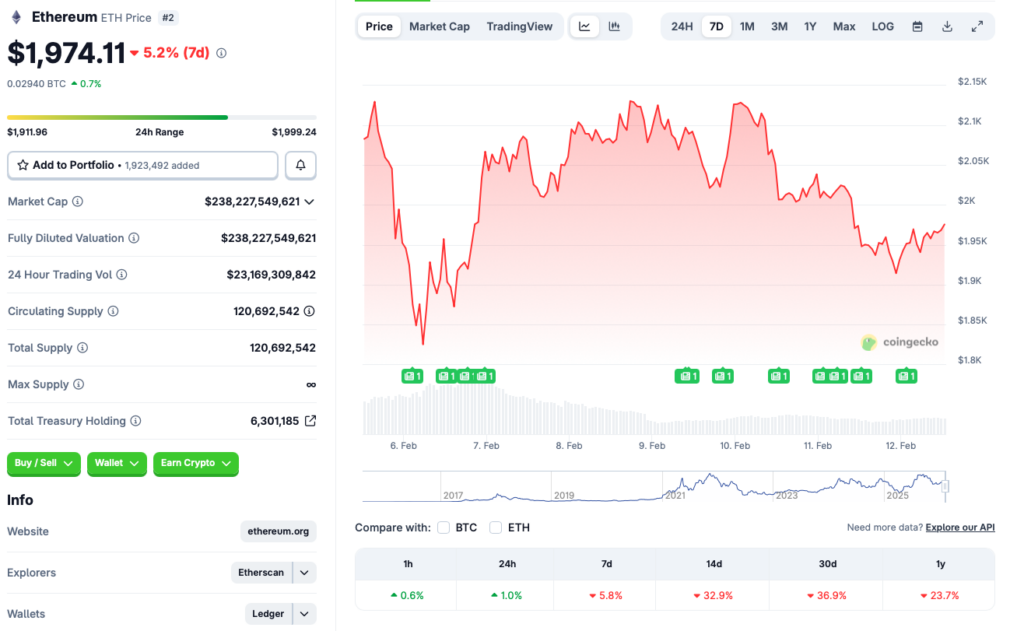

Ethereum’s (ETH) price has struggled to gain momentum over the last few months. The asset’s price climbed to an all-time high of $4,946.05 in August if last year, but has since dipped by more than 60%. According to CoinGecko data, ETH’s price is down 5.8% in the last week, 32.9% in the 14-day charts, and nearly 37% over the previous month.

Ethereum’s (ETH) price correction came after macroeconomic worries and geopolitical tensions gripped investors late last year. The market took another dip after a liquidity crunch in 2026. The developments have led to a substantial exodus of investors from the crypto market. Market participants have been taking a risk-averse approach over the last few months, evident from gold and silver’s rise.

Ethereum (ETH) will likely follow Bitcoin’s (BTC) trajectory, which seems to have found some footing at the $67,000 price level. BTC is down to its 2021 all-time high price levels, and could face further corrections over the coming weeks. Stifel anticipates BTC to dip to the $38,000 price level. BTC hitting $38,000 could lead to Ethereum (ETH) facing a massive price dip.