Greenland’s Financial Frontier, US Dollar Dynamics & Global Stocks: 2026 Market Crossroads

Ice Caps Melt, Capital Flows: Greenland Emerges as an Unlikely Financial Test Lab

Forget Silicon Valley—the next regulatory sandbox might be carved from glaciers. As traditional economies grapple with inflation and digital asset integration, this autonomous territory is quietly drafting frameworks that could bypass decades of financial bureaucracy. Observers watch closely: will its approach attract innovation or become a cautionary tale in a volatile era?

The Almighty Dollar's Next Act

The USD isn't just weathering storms—it's redirecting them. Central bank digital currency pilots and shifting reserve allocations are forcing a fundamental rethink of its global role. Every algorithmic trade and sovereign wealth fund move now doubles as a bet on the greenback's future in a fragmented monetary landscape. The real question isn't about strength, but relevance.

Equity Markets: Dancing on a Data Tightrope

Global stocks are pricing in futures that don't exist yet—quantum computing breakthroughs, climate adaptation tech, neural interface commerce. Traditional valuation models look increasingly like relics as AI-driven funds execute strategies no human committee ever approved. It's a market powered by conviction in narratives, often with only a tenuous link to next quarter's earnings. A cynical take? The smart money isn't predicting the future anymore; it's just better at gaming the consensus about it.

The connective tissue? A world where geography matters less, capital moves at light speed, and every asset class is being rewritten by code. The winners won't just pick the right stocks or currencies—they'll have bet on the right set of rules.

Trending Market Developments

1. The Greenland Agenda

The US President Donald TRUMP has now vowed to buy Greenland. Trump is leaving no stone unturned to add Greenland to the domain of the United States, and has particularly curated a “board of peace,” and is busy onboarding countries to join his new agenda.

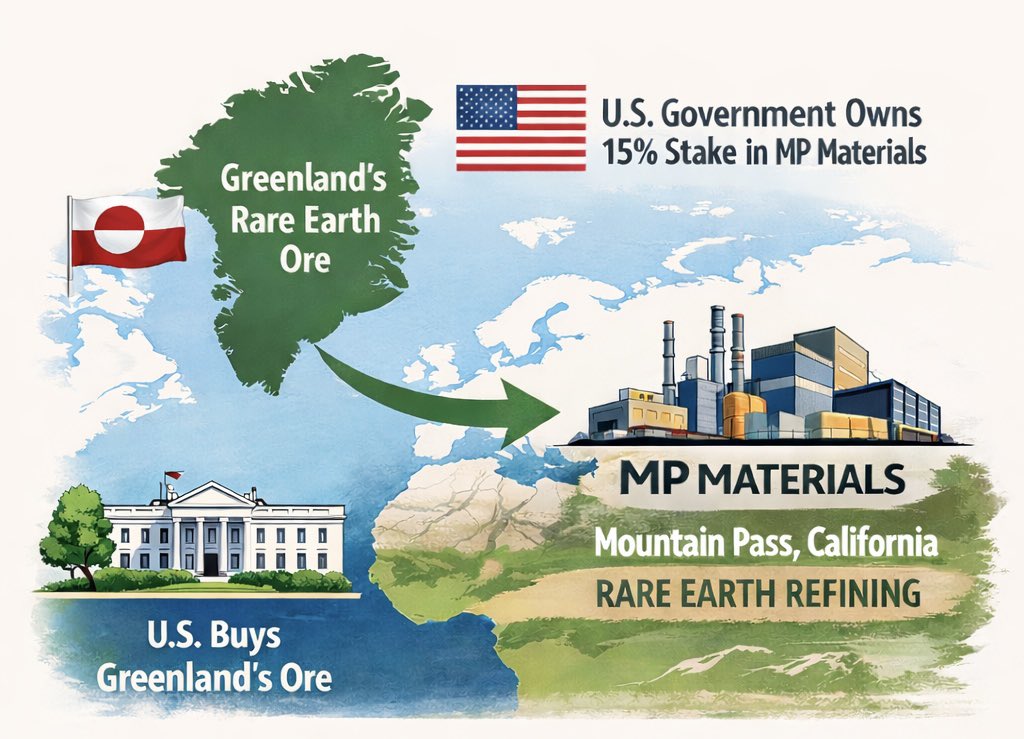

Per a latest post by the Kobeissi letter, the economic repercussions of this “purchase” (if the US manages to do so) could be massive, as Greenland houses some of the largest rare earth deposits. With the AI boom taking over the world, these rare earth deposits and control over the sector may end up delivering an edge to countries in the sector of tech development and advancement.

2. The US Dollar

The US dollar is currently basking in its soft era, exploring its lowest price thresholds at this time. With gold and silver rallying to new highs, particular triggered by Trump’s EU tariffs, the dollar may continue to explore new lows for months to come. In the middle of this, Peter Schiff, a notable economist, has called the dollar out, stating how bitcoin and USD are both doomed. He shared how diversification towards gold and silver is the right thing to do at the moment, as the US dollar and USD-denominated assets are on their way to plunge even more.

By the end of the year, holders of U.S. dollar–denominated assets and cryptocurrencies, including Bitcoin, will be substantially poorer than they are today. In contrast, holders of non-dollar–denominated assets and precious metals will be significantly richer. Which will you be?

— Peter Schiff (@PeterSchiff) January 20, 20263. Global Stocks

The global stock narrative is also changing constantly. The current era belongs to tech and energy stocks, with the latter scaling rapidly and now gaining central attention. Per the latest post by the analyst, energy sector stocks may be the next big thing among the markets; a rapid AI boom and demand for data centers may trigger this surge.

ENERGY IS THE MOST INTERESTING SECTOR.

HERE'S WHY, AND WHICH STOCKS TO WATCH:

The energy sector is gearing up to be one of the most dynamic arenas in the coming years, fueled by an explosive surge in demand from AI data centers, electric vehicles, and industrial growth.

Global… pic.twitter.com/IGGsi0W4bj