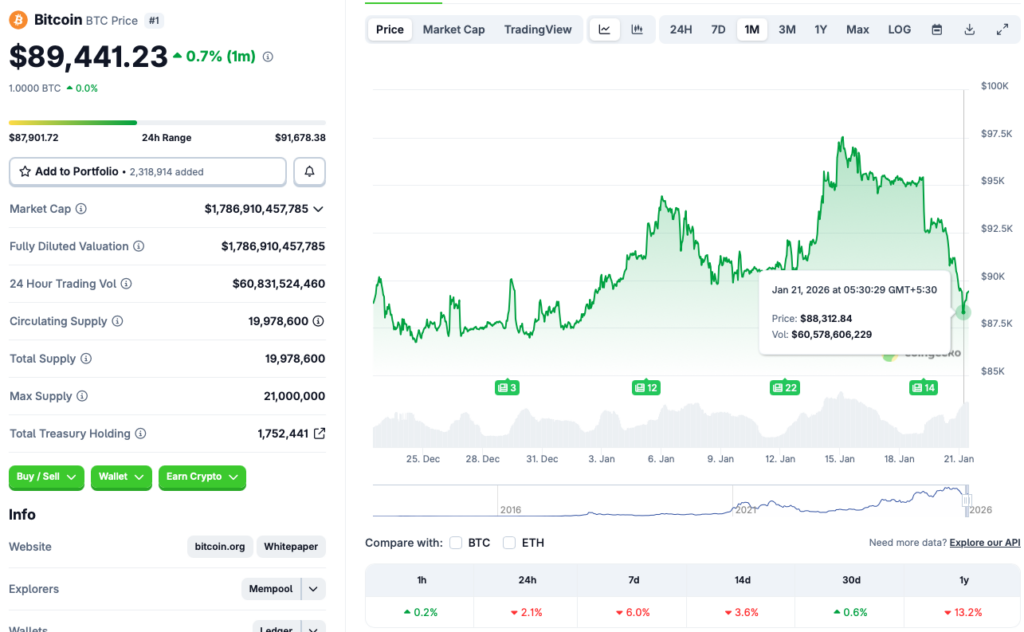

Bitcoin Plunges to $88,348: Are the Bears Finally Taking Control?

Bitcoin just took a sharp dive, slicing through key support to land at $88,348. The move has traders scrambling and the market asking one question: is this the moment the bears have been waiting for?

The Technical Breakdown

This isn't a gentle pullback—it's a decisive break. The price action suggests a classic bearish takeover, with selling pressure overwhelming buy-side orders. Momentum indicators are flashing red, and the charts are painting a picture of potential further downside unless bulls can stage a rapid defense.

Market Sentiment Shifts

The mood on crypto Twitter has flipped from greedy to fearful almost overnight. Leveraged long positions are getting liquidated, and the 'buy the dip' chorus is sounding more hesitant. It's a stark reminder that in crypto, sentiment can turn on a dime—or in this case, several thousand dollars.

The Bigger Picture

While the drop is significant, context is key. Corrections are a normal part of any bull market's breathing pattern. This could be a healthy shakeout of weak hands before the next leg up, or it could be the start of a deeper correction. The coming days will be critical for determining the trend's true direction.

Watch these levels next. If $88,348 fails to hold as support, the next major test could be much lower. For the bulls, reclaiming territory above $90k is now the immediate mission. One thing's for sure: the volatility is back with a vengeance—just in time to make traditional finance folks clutch their pearls and mutter about 'speculative bubbles' over their lukewarm decaf.

Source: CoinGecko

Source: CoinGecko

Why Is Bitcoin Falling? Are We Entering A Crypto Winter?

The crypto market has been struggling since October 2025. The market faced its most significant liquidation event in October 2025, soon after Bitcoin (BTC) climbed to a new all-time high of $126,080. The crash that followed was likely due to macroeconomic uncertainties. The Federal Reserve’s 25 basis point interest rate cut in the same month was also not enough to boost investor sentiment. The Fed lowered rates again in December 2025, which again had no positive impact on Bitcoin (BTC), with its price continuing to crash.

Bitcoin (BTC) saw some positive price action in January 2026, reclaiming the $97,000 price level on Jan. 15. However, the rally was short-lived, and prices tanked to current levels. The latest market downtrend was likely triggered by President Trump announcing additional tariffs on countries supporting Greenland’s autonomy. The US-Greenland debacle has led to substantial worry among investors. The development has further strengthened the ongoing risk-averse approach. The risk-off strategy is evident by the fact that gold and silver hit yet another all-time high on Jan. 20, 2026, while Bitcoin (BTC) faced a correction.

Bitcoin (BTC) could see a trend reversal over the coming weeks. The Federal Reserve is injecting $55 billion in liquidity over the coming weeks. The first $8.3 billion was injected on Jan. 20, 2026. Such interventions by the Fed have often led to a price rally for Bitcoin (BTC). We could see a similar pattern emerge over the coming weeks.