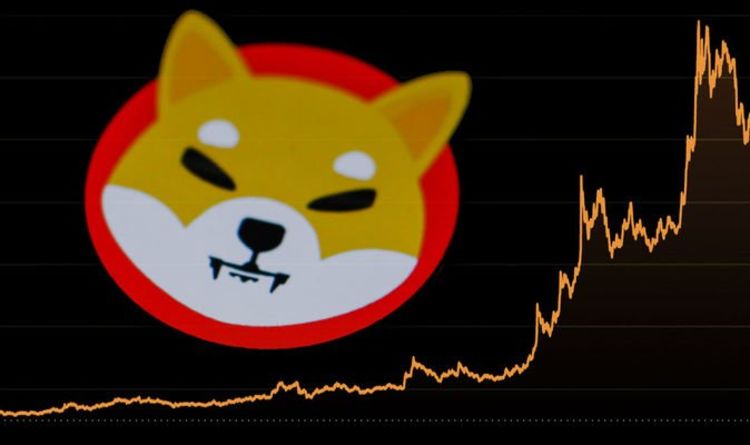

Shiba Inu 2026 Target: Will Investor Optimism Fuel Its Explosive Growth?

Shiba Inu eyes 2026 with a pack of bullish investors at its heels. Can sentiment alone propel this meme coin to new heights?

The Hype Engine

Forget fundamentals—this rally runs on collective belief. Retail armies mobilize across social platforms, betting their screenshots on a decentralized dream. Every 'to the moon' post adds another log to the fire.

Beyond the Bark

The ecosystem quietly builds while the crowd cheers. New utility layers and burning mechanisms aim to transform hype into something resembling sustainable value—or at least, that's the pitch to the suits.

The 2026 Horizon

Targets get tossed around like confetti at a Wall Street gala. The path forward hinges on a delicate balance: maintaining viral momentum while delivering actual blockchain progress. One misstep, and the 'lambo' dreams revert to bus fare.

In the end, Shiba Inu's 2026 fate rests on a familiar market paradox: investor outlook can move mountains, but it can't print real revenue—a truth that tends to bite right around the time the free coffee runs out at the investor meetup.

Shiba Inu Target For 2026: Price Prediction, Growth and Shibarium Adoption

Price Targets and Market Outlook

Base case estimates for the shiba inu price prediction in 2026 show a range between $0.0000107 and $0.0000134, while bull scenarios are reaching toward $0.0000175 and bear cases could test support at $0.0000072. The monthly projections indicate gradual growth, with minimum prices expected to move from $0.0000092 in January to about $0.0000105 by December. Maximum prices are also climbing from $0.0000139 to $0.0000175 over the same timeframe.

As of mid-January, the Shiba Inu target price is facing what appears to be a neutral-to-cautiously-optimistic sentiment among traders. Technical indicators actually show SHIB trading below its 50-day moving average of $0.00000864, which reflects some short-term bearish pressure, though it does remain above the 200-day average, indicating that longer-term stability might be present.

Shibarium Adoption Impact

The Shibarium adoption impact remains a critical factor for what the shiba inu target in 2026 might look like. Reports show the Layer-2 network has processed over 1.5 billion transactions, with approximately 294,000 active accounts by early 2026, though the Total Value Locked stays rather modest at around $1 million USD. The burn mechanism converts about 70% of transaction fees into SHIB, and spikes have exceeded 112,000%, which translates to roughly 116 million SHIB burning daily.

Lucie, who is a Shiba Inu executive, recently provided details on plans for a Q2 2026 privacy upgrade. According to the announcement, the team is preparing a significant privacy upgrade for the Shibarium network as the Zama public testnet goes live. The upgrade has been planned to take effect before the end of Q2 2026 and will see Shibarium leverage Zama’s Fully Homomorphic Encryption technology. This will allow Shibarium to gain full on-chain privacy and confidential smart contracts in the coming year, which aims to redefine how privacy and security function across the SHIB ecosystem.

This upgrade is being designed to address vulnerabilities that were exposed during September 2025’s $4 million Plasma Bridge exploit, when attackers actually exploited the transparent asset flows on the network.