XRP Hits 14-Year Milestone: The Bullish Case for $4.50 by 2026

Fourteen years in, and XRP's story shifts from courtroom drama to price prophecy. The digital asset, once bogged down by regulatory skirmishes, now eyes a trajectory that could redefine its valuation entirely.

The Regulatory Thaw

Legal clarity acts as rocket fuel. With major hurdles dissolving, institutional pipelines once frozen begin to thaw. This isn't just about compliance—it's about unlocking capital flows that traditional finance, with its love for paperwork and committees, has been too slow to harness.

Market Mechanics & The $4.50 Target

Forget vague hype. Hitting $4.50 demands a specific confluence: sustained adoption in cross-border settlements, a broader crypto bull cycle, and XRP capturing a definitive slice of the payments revolution. It's a number born from scaling real-world utility, not just exchange speculation.

The Adoption Engine Revs Up

Banks and payment providers aren't just testing anymore—they're building. Each new partnership, each live corridor, adds a brick to the foundation. This network growth compounds, creating a utility moat that pure speculative assets can't match.

A Cynical Nod to Tradition

Watching legacy banks scramble to integrate this tech offers a sweet irony—the very institutions that once dismissed digital assets now need them to stay relevant. It's a quiet revolution, funded by their own late-stage fees.

The path to $4.50 is paved with utility, not promises. As the infrastructure solidifies, the market may have no choice but to price in a new reality.

XRP Could Hit $4.50 in 2026 To Celebrate 14 Years

XRP’s 2025 cycle was quite historic. Firstly, the SEC vs. Ripple lawsuit came to a close, clearing the path for XRP to rally. The lawsuit settlement was a major catalyst for XRP’s rally. Secondly, XRP saw the launch of several spot ETFs in 2025. ETFs have played a vital role in the market cycle, with Bitcoin (BTC) and ethereum (ETH) hitting new peaks thanks to increased ETF inflows. XRP could see a similar pattern this year. The asset’s ETF products are already seeing increased adoption and interest. The development could push XRP’s price to the $4.50 mark in 2026.

XRP was recently spoken about in very high regard on a CNBC report. The platform called XRP the “hottest crypto trade of 2026.” The bullish outlook may further influence investors to buy more of the coin.

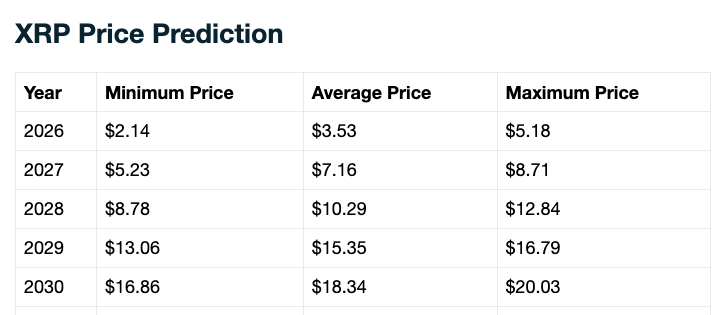

Telegaon analysts are also quite bullish on XRP for 2026. The platform anticipates the asset to hit a new all-time high of $5.18 sometime this year. Hitting $5.18 from current price levels will entail a rally of about 151%.

XRP is already one of the most utilized assets for cross-border transactions. The asset’s adoption may like continue to surge over the coming years. More adoption may eventually push the asset’s price beyond the $10 mark, as predicted by Telegaon as well.