Investor Who Predicted $69B For PEPE Closes Long Positions: A Strategic Pivot or Peak Signal?

The crypto oracle who once called PEPE's astronomical $69 billion valuation has just pulled the plug. Long positions are closed, books are balanced, and the market holds its breath. What does this mean for the meme coin that defied gravity?

The Exit Strategy Unfolds

No fanfare, no dramatic announcement—just a clean exit. The trader who famously mapped PEPE's path to a $69 billion market cap has cashed out. It's a move that cuts through the noise, bypassing the usual hype cycle for a quiet, calculated retreat. The timing raises eyebrows across trading desks and Telegram channels alike.

Reading Between the Lines

This isn't about panic. It's about precision. Closing longs at this juncture signals a belief that the easy money has been made—or that risk is mounting. The $69 billion figure wasn't a moon-shot dream; it was a thesis. And exiting suggests that thesis has either played out or the landscape has shifted. It's portfolio management as a statement, a classic case of 'buy the rumor, sell the news' executed with Wall Street-grade detachment—ironic for an asset born from an internet frog.

The Ripple Effect

When a high-profile prediction meets a high-conviction exit, markets listen. Other PEPE holders now face a choice: follow the signal or fade the move. Does this mark a local top, or simply one player taking profits before the next leg up? Liquidity gets tested, and sentiment gets a reality check. After all, in crypto, a guru's exit can be more influential than their entry, often serving as the only 'fundamental analysis' some bags ever get.

What's Next for the Frog?

PEPE's narrative just hit a plot twist. The road to $69 billion now has a major detour signed by its own cartographer. This move injects a dose of sober strategy into a meme-driven market, proving that even the most speculative assets eventually face the cold calculus of risk-reward. Whether this is a strategic pause or a peak signal, one thing's clear: the trader who called the number is no longer betting on it. Sometimes the smartest trade is knowing when to stop trading—a concept as foreign to crypto degens as a balanced portfolio.

Will PEPE Face a Correction in 2026?

Wynn had previously predicted Pepe to hit a multi-billion market cap soon after its launch. Wynn’s correct prediction led a to substantial surge in PEPE inflows, solidifying his position within the PEPE community.

However, given that Wynn has closed his long positions, there is a possibility that the investor anticipates a sharp price correction for the popular memecoin. In fact, Wynn’s actions has led to substantial questioning among the community, especially given that he said he WOULD delete his account if PEPE does not hit his $69 billion target.

Moreover, the crypto market is still recovering from its late 2025 crash. Investors are still taking a risk-off approach, evident from the fact that gold and silver have hit multiple all-time highs over the last few months. PEPE, being a memecoin, carries some of the highest risks in the market.

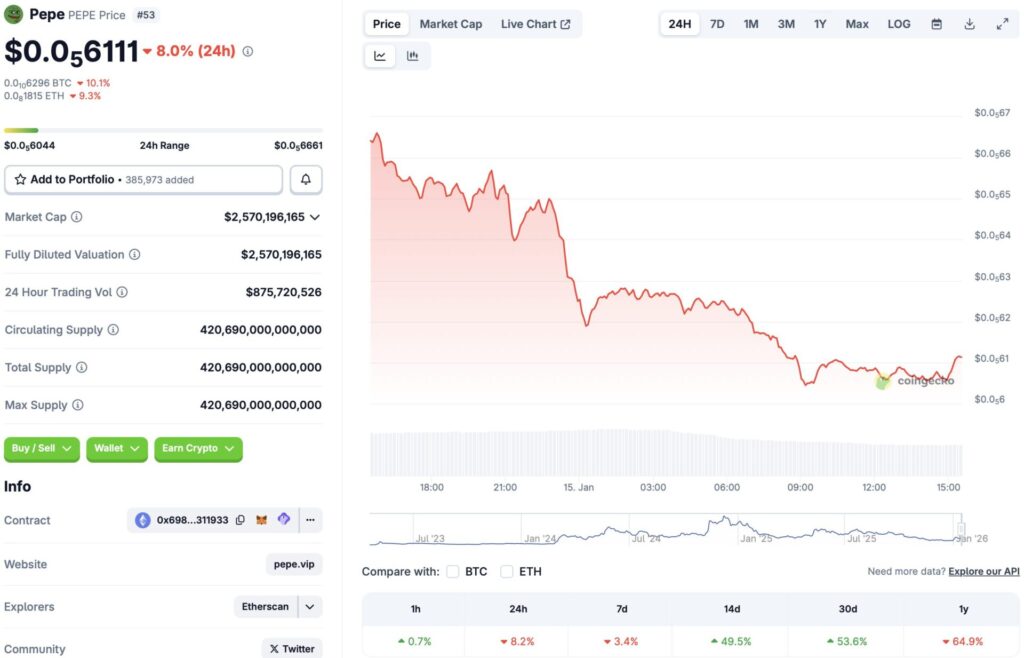

PEPE experienced a big price rally earlier this month. However, the rally seems to have died down. Wynn closing his PEPE positions may have led to the coin’s latest price dip. According to CoinGecko data, PEPE is down by 8.2% in the last 24 hours, 3.4% in the last week, and 64.9% since January 2025. However, the memecoin is still up by 49.5% in the 14-day charts and 53.6% over the last month.

CoinCodex analysts are also quite bearish on PEPE. The platform anticipates the asset to fall to $0.000004471 on Jan. 26, 2026. Dipping to $0.000004471 from current price levels will entail a correction of about 26.85%.