Bitcoin Shatters $95K Barrier: Is the 2026 Bull Run Just Getting Started?

Bitcoin just blasted past a major psychological milestone. The $95,000 ceiling is now floor—and the market's asking what's next.

The Halving Hangover Myth

Conventional post-halving wisdom said to expect a cooldown. Bitcoin didn't get the memo. Instead of a slump, we're seeing sustained institutional accumulation and on-chain metrics flashing green. Miner sell pressure? Effectively absorbed. It's a classic case of the market ignoring the textbook.

Macro Tailwinds or Headwinds?

Traditional finance is having another identity crisis. Rate cuts, inflation scares, geopolitical shuffles—the old guard's playbook looks increasingly dog-eared. Digital gold's narrative strengthens with every central bank wobble. Meanwhile, spot ETF flows have turned into a relentless drip-feed of capital, proving that Wall Street's embrace, however late, is a powerful fuel.

The $95K Foundation

This isn't a speculative spike. Holding above $95,000 establishes a formidable new support zone. It resets the entire valuation framework. Analysts are now charting paths not to six figures, but through them. The previous all-time high is now just a waypoint in the rearview.

What's the 2026 Playbook?

Forget hoping for a rally. The question is about its scale and duration. Key triggers to watch? Regulatory clarity (or the lack thereof), the maturation of layer-2 ecosystems, and whether traditional finance's love affair turns into a long-term commitment or a fleeting fling. The infrastructure being built now is for a financial system that doesn't yet exist—a bet on a future that's arriving ahead of schedule.

The path forward looks less like a gamble and more like a gravitational pull. The real rally might not be waiting—it might already be here, leaving the skeptics to explain why they were busy valuing a network by its electricity bill while it was busy revaluing the world.

In the past three days, around 47,000 small holders have sold the asset. However, major exchanges’ balances declined to seven-month lows, underscoring reduced selling pressure. With these significant scenarios, BTC looks to break its after October-ATH weakness trend and a potential MOVE toward $100,000–$103,000 range.

Bitcoin Price Rally Driving Factors

The price increase in not all of sudden, however many major factors are contributing in its rally:

The golden asset recently broke its resistance level of $94,000–$96,000, with indicators like MACD crossover and RSI pointing towards further upside. The current momentum with RSI at 69.86 seems strong, but not yet overbought. Traders are now setting a new $100,000 resistance level that could trigger more purchases if broken.

U.S. spot BTC ETFs saw inflows of $753M on January 13 and $843M on January 14. Large ETFs like BlackRock’s IBIT captured significant capital, tightening BTC supply on exchanges. Sustained ETF buying helps push bitcoin price higher by reducing liquidity available for sale.

Inflows on exchanges have fallen by 50% as whales slowed down their mass selling since December 2025. This lower participation from big players allowed small traders to influence the market. But Leveraged long positions of around $945M could still bring volatility if whales entered again.

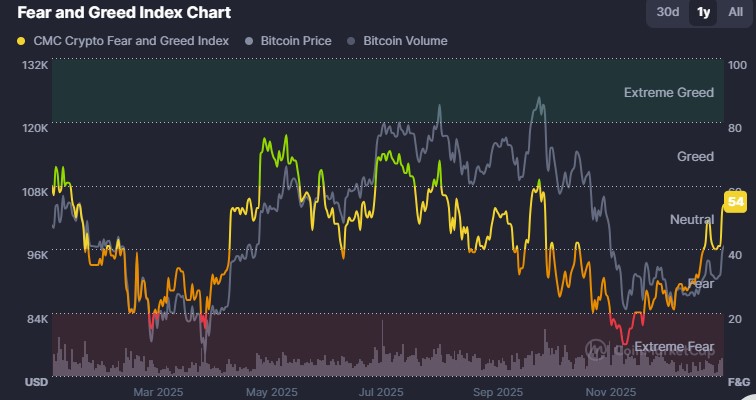

The Crypto Fear & Greed Index jumped into the greed section for the first time after October, from 11 (Extreme Fear) to 54 (Greed). Community talks highlight strong optimism, but historical trends suggest Greed phases can also sometimes lead to short-term drops.

Bitcoin Price Vs. Traditional Markets

As Bitcoin is surging along with the crypto market, the comparison between traditional and digital marketplace is interestingly gaining attention. Crypto rebound contrasts with broader equities on January 15, 2026:

S&P 500: Down ~0.5% amid early sell-offs.

Nasdaq: Declined ~0.4%, pressured by tech stock rotations.

Dow Jones: Fell ~0.5%, reflecting market caution.

This shift underscores liquidity circulation toward digital products as a perceived SAFE haven or growth alternative. It also suggests how traditional and crypto distincts each other on the matter of surging and trending.

Where domestic markets are falling, crypto market cap rose 1.04% to $3.27 trillion, where BTC dominance remained around 58%. Historically BTC often outperforms during equity uncertainty, though sharp reverse-trend can occur if stock markets gain momentum again.

Conclusion: Bitcoin Price Shows Strength, But Key Levels Matter

BTC’s rally is backed by technical momentum, strong ETF inflows, and reduced whale selling. While it reflects a meaningful rebound after days of weakness, resistance NEAR $101,000 and macro factors such as regulatory changes and leveraged positions could impact the next move.

In short, Bitcoin price demonstrates real recovery potential, outperforming stock indices, but traders should watch key support and resistance levels and broader market flows before making decisions.

This content is for informational purposes only and is not financial advice. Always do your own research before investing.