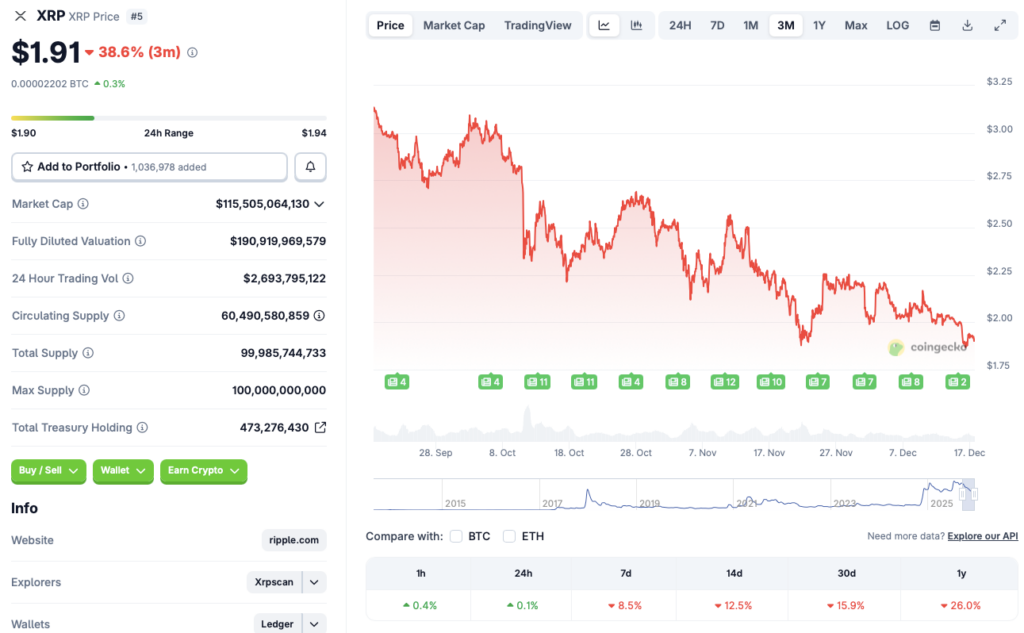

XRP at Critical Juncture: Whale Exodus Threatens $1 Support - What’s Next?

Whales are dumping—and XRP's $1 floor is cracking.

The massive sell-offs from major holders have triggered alarm bells across crypto markets. These aren't retail jitters; these are strategic exits by investors who move markets.

The Whale Watch

Tracking wallet activity reveals concentrated selling pressure. When these giants offload, liquidity pools thin and support levels get tested. The mechanics are simple: supply surges, demand staggers.

The $1 Psychological Line

That threshold isn't just a number—it's a sentiment magnet. Breach it, and automated sell orders kick in, fear feeds on itself, and the charts turn uglier. Technical analysts are watching the order books, not the headlines.

Beyond the Price Tag

This isn't just about XRP dipping below a dollar. It's a stress test for the asset's underlying conviction. Every major crypto has weathered whale storms—the question is what's left when the selling stops.

Remember: in traditional finance, they call this 'portfolio rebalancing.' In crypto, we call it Tuesday. The smart money isn't panicking; it's recalculating. The dip might just be a discount for the next player up.

Source: CoinGecko

Source: CoinGecko

Will XRP Fall Below $1?

According to prominent crypto analyst Ali Martinez, whale wallets are on a selling spree, putting XRP’s price in danger. Whales have offloaded 1.18 billion XRP in the last four weeks. According to Martinez, the chances of XRP’s price falling towards $1 have substantially increased since the increase in selling pressure.

$XRP could be on the verge of a sharp drop! pic.twitter.com/109zZOJSoB

— Ali Charts (@alicharts) December 16, 2025Moreover, there seems to be very little demand for XRP at the $2 mark. The lack of any demand level may add further selling pressure on the asset.

However, despite the bearish price trajectory, XRP ETFs have seen consistent ETF inflows. XRP ETF products recently breached the $1 billion mark. However, the increased ETF inflows have not been enough to push XRP’s price.

XRP may face further price challenges until the crypto market exits its current bearish tone. Macroeconomic uncertainties and a risk-averse approach from investors have led to substantial liquidations in the crypto market. Things may not improve until the larger economy finds a stronger footing. Inflation in the UK went down to 3.2% in November, the lowest in eight months. The move may lead to the Bank of England reducing interest rates. We could see an increase in risky investments under such circumstances. XRP and other cryptocurrencies could see some relief.