The Shiba Inu Stalemate: Why This Memecoin Can’t Seem to Delete a Zero

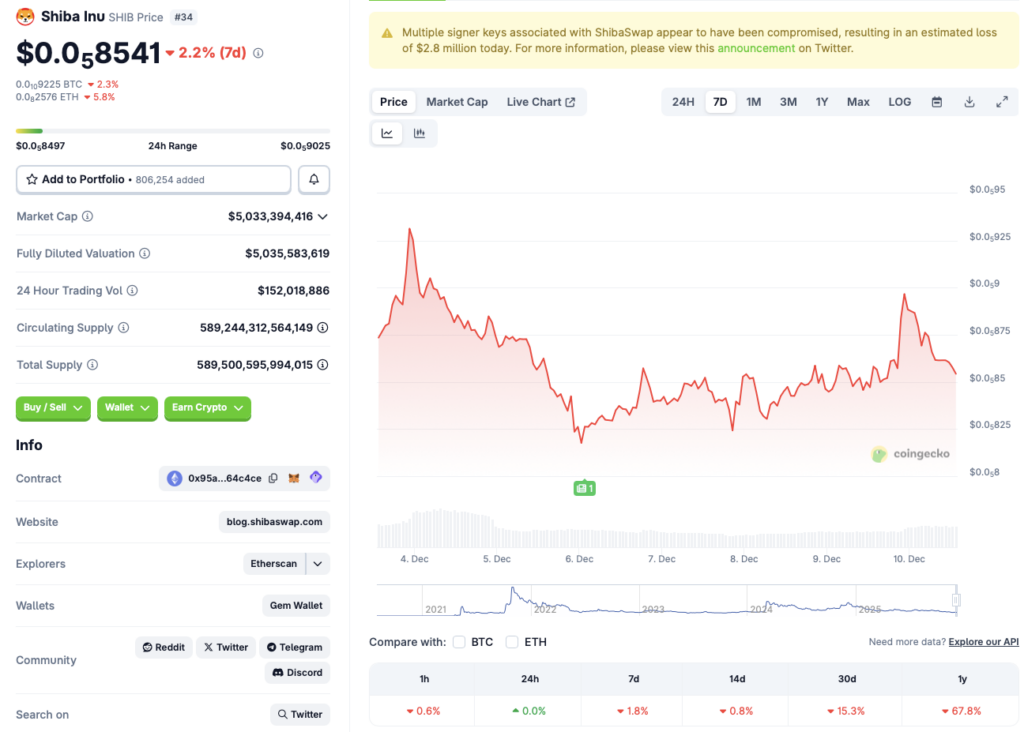

Shiba Inu's price chart tells a stubborn story—one of resistance at a psychological barrier that's become a financial fortress. The dog-themed token, born from internet culture and speculative frenzy, keeps hitting the same wall: that elusive move to shed a decimal place and claim higher valuation turf.

The Supply Overhang

Circulating numbers in the trillions create a gravitational pull that even the most ardent community burns struggle to counteract. Every rally meets a wave of profit-taking from wallets holding life-changing quantities for the price of a coffee. It's basic tokenomics—scarcity drives value, and Shiba Inu's design initially prioritized anything but.

Utility Versus Hype

The ecosystem expanded—Shibarium launched, tokens multiplied, NFTs followed. Yet the core price driver remains sentiment, not utility. While developers build, the market still treats SHIB as a sentiment indicator, a bet on retail momentum rather than technological adoption. When Bitcoin sneezes, memecoins catch pneumonia—and Shiba Inu's chart reflects that dependency.

The Whale Watching Problem

Concentrated holdings mean concentrated power. A handful of addresses can green-light or red-light rallies with single transactions. This creates a ceiling—a zone where early investors finally deem profits worthy of realization, dumping supply just as retail FOMO peaks. It's the cycle that keeps zeros in place.

Market Maturity's Cold Shoulder

Institutional money flows toward infrastructure and Bitcoin ETFs, not dog tokens. Regulatory scrutiny increases the risk premium on assets perceived as pure speculation. Shiba Inu battles not just its own tokenomics but a maturing digital asset landscape that's increasingly skeptical of projects whose whitepaper once featured more bark than bite.

That final zero isn't just a decimal—it's a monument to the gap between viral potential and financial reality, a reminder that in crypto, sometimes the hardest thing to burn isn't tokens, but market psychology. After all, on Wall Street they say 'it takes money to make money'—in memecoins, it takes deleting zeros to make believers, and that's one financial alchemy even Shiba Inu hasn't mastered.

Source: CoinGecko

Source: CoinGecko

Why Is Shiba Inu Not Rallying? Can It Delete a Zero Soon?

Shiba Inu’s (SHIB) struggles come amid a larger bearish market. The cryptocurrency sector underwent a massive price correction over the last few months. October, a historically bullish month, experienced the largest single-day liquidation event in crypto history. The market downtrend has since continued into December.

Shiba Inu (SHIB) is a memecoin and relies on online buzz for price movements. The HYPE around SHIB has substantially declined over the last few years. The lack of buzz around the project may have also negatively impacted its price.

There is a high chance that shiba inu (SHIB) will delete a zero from its price over the coming weeks. The Federal Reserve is expected to roll out another interest rate cut after today’s Federal Open Market Committee (FOMC) meeting. Rate cuts often lead to investors taking on more risks. Shiba Inu (SHIB), being a memecoin, carries some of the highest risks in the market. The memecoin market could see a surge in investments if the Federal Reserve further lowers rates.

Shiba Inu (SHIB) will likely follow Bitcoin’s (BTC) trajectory. BTC is expected to climb to a new all-time high in 2026 and 2027. BTC hitting a new peak could lead to SHIB following suit as well.