Vivek Ramaswamy’s Strive Targets $500M Bitcoin Acquisition Fund

Strive Asset Management is making a bold move into digital gold. The firm, founded by former presidential candidate Vivek Ramaswamy, is launching a fund with a single, clear mandate: to raise half a billion dollars and deploy it directly into Bitcoin.

The Strategy: A Direct Bet

This isn't about futures or indirect exposure. The plan is straightforward—acquire and hold the underlying asset. The move positions Strive not just as an asset manager, but as a direct participant in the Bitcoin network, bypassing the traditional ETF wrapper that has dominated institutional flows.

Why $500 Million Matters

That number isn't arbitrary. It represents a significant capital allocation that could signal a new phase of corporate and institutional treasury strategy moving beyond micro-strategies. If successful, the fund would instantly rank among the largest single-entity Bitcoin holdings globally, a tangible vote of confidence in the asset's long-term store-of-value thesis.

The Ramaswamy Factor

The founder's high-profile political and anti-ESG stance brings a distinct narrative. It frames Bitcoin not merely as a tech investment, but as a sovereign, apolitical asset—a direct challenge to what some view as politically-motivated traditional finance. It's a hedge against the system, with a fundraising goal that would make most Wall Street underwriters blush, if they weren't too busy collecting fees on products that track the same asset.

Market Implications

A successful raise would demonstrate substantial demand exists for direct, non-security exposure outside of public markets. It pressures other asset managers to offer similar, pure-play vehicles or risk losing clients who want the real thing, not a financial derivative. The ultimate test, of course, is whether investors are willing to commit half a billion dollars to a strategy that offers no yield, no dividend, and whose value is determined solely by the next person's willingness to pay more—the very essence of modern finance, just with a new ledger.

Is Bitcoin Primed For Growth?

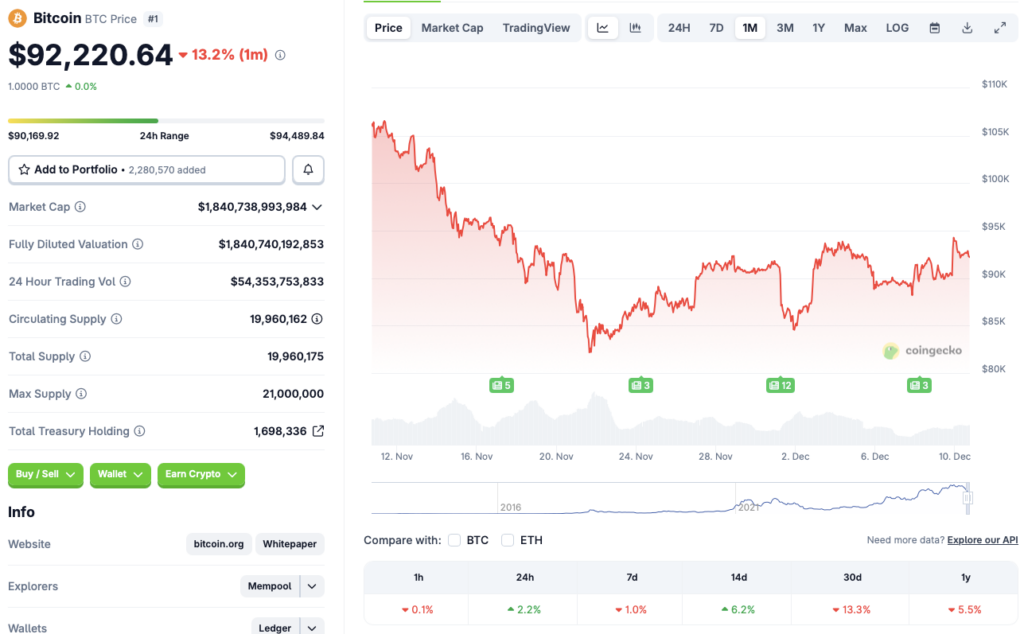

Bitcoin (BTC) has struggled over the last few months, but the bearish market tone may be coming to an end. According to CoinGecko data, BTC has rallied 2.2% in the last 24 hours and 6.2% in the 14-day charts. However, the original crypto is still down by 1% over the last week, 13.3% over the last month, and 5.5% since December 2024. BTC may be gearing up for another bullish leg.

The Federal Open Market Committee (FOMC) meeting is scheduled to be held later today. There is a high chance that the Federal Reserve will roll out another 25 basis point interest rate cut.

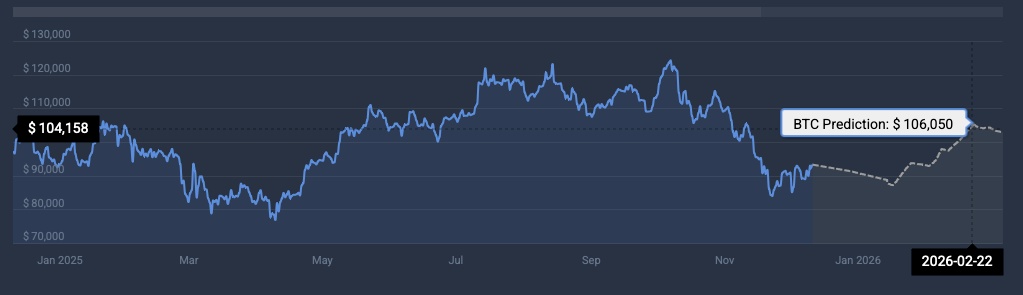

Bitcoin (BTC) has also received bullish predictions from Bernstein and Grayscale. Both firms anticipate BTC to hit a new all-time high in 2026. The financial institutions believe that BTC may be pivoting from its 4-year cycle and moving to a 5-year cycle.

CoinCodex analysts also anticipate bitcoin (BTC) to turn bullish in 2026. The platform predicts BTC to reclaim the $100,000 mark next year, hitting $106,050 on Feb. 22.

It is possible that Vivek Ramaswamy’s Strive is making its Bitcoin (BTC) purchase before the predicted bull run. We may see other Bitcoin (BTC) treasury companies making a similar MOVE over the coming weeks. BTC ETFs may also see a surge in inflows. Both developments may further push BTC’s price.