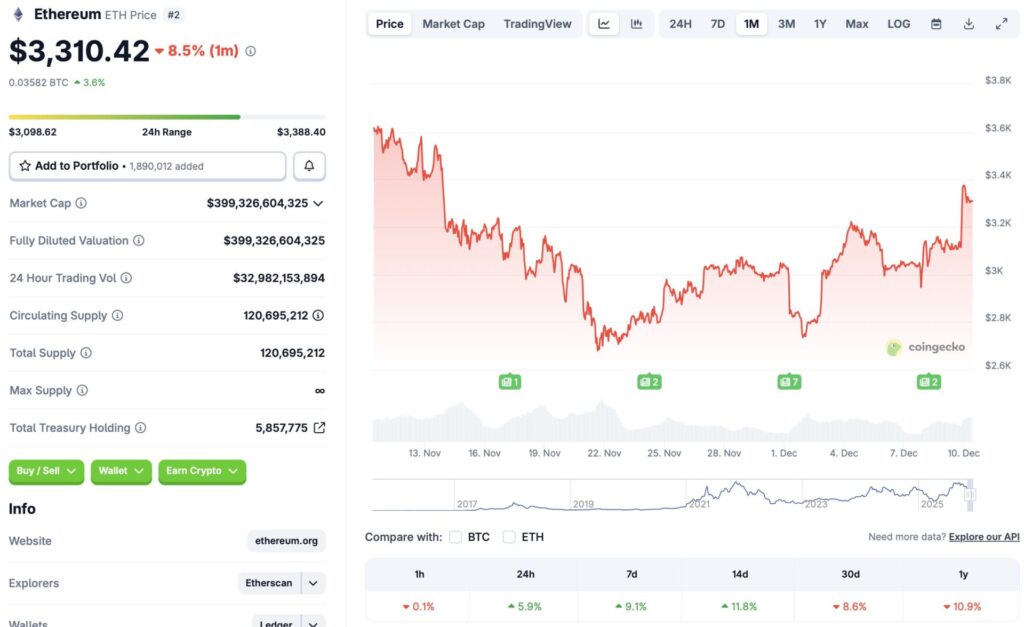

Ethereum Surges 6% As Crypto Whales Gobble Up $3 Billion in Strategic Accumulation

Ethereum just ripped through the charts—a 6% surge in a single session. The catalyst? A massive, coordinated whale buy-in worth a staggering $3 billion.

The Whale's Gambit

This isn't retail FOMO. This is institutional-grade accumulation. When wallets holding thousands of ETH start moving, the market listens. The $3 billion injection signals a deep conviction play, a bet that goes far beyond short-term speculation. It's capital positioning for the next leg up.

Liquidity vs. Leverage

The buy pressure did more than just lift the price—it soaked up available liquidity. That kind of volume creates a foundation, a support level that's harder to shake out. It's a stark contrast to the leveraged punts that usually dominate the headlines, the kind that get liquidated when the wind changes direction. This move feels structural.

Beyond the Price Pump

Forget the percentage gain for a second. The real story is the strategic intent. Whales aren't chasing pumps; they're building positions. This kind of activity often precedes major network developments or shifts in the broader financial landscape where Ethereum becomes the go-to collateral asset. They're not trading—they're allocating.

A cynical take? It's the age-old finance playbook: use overwhelming capital to move the market, let the narrative catch up, and watch the herd follow. The only difference is the asset. Instead of a blue-chip stock, it's digital gas for the global computer. The game, however, remains beautifully, predictably the same.

Source: CoinGecko

Source: CoinGecko

What’s Behind Ethereum’s Price Rally?

Ethereum’s (ETH) latest price surge comes amid increased whale purchases. According to Santiment data, ETH whales and sharks purchased nearly 934,240 ETH, worth roughly $3.15 billion over the last three weeks. The whale purchases came while retail investors sold about 1014 ETH.

![]() NEW: Ethereum whales and sharks accumulated ~934,240 ETH ($3.15B) over the past 3 weeks while retail dumped 1,041 ETH, pushing ETH up 8.5% back to $3,400, per Santiment. pic.twitter.com/eaoIHnwAPS

NEW: Ethereum whales and sharks accumulated ~934,240 ETH ($3.15B) over the past 3 weeks while retail dumped 1,041 ETH, pushing ETH up 8.5% back to $3,400, per Santiment. pic.twitter.com/eaoIHnwAPS

Another reason for Ethereum’s (ETH) rally could be the anticipation of another interest rate cut after Wednesday’s Federal Open Market Committee (FOMC) meeting. There is a high chance that the Federal Reserve will roll out another 25 basis point interest rate cut. The cryptocurrency market could enter another bull run if rates are further reduced.

Thirdly, many financial institutions anticipate Bitcoin (BTC) to hit a new all-time high in 2026. Grayscale and Bernstein both claim that BTC may be pivoting from its 4-year cycle. Both institutions predict BTC to hit a new all-time high next year. Bernstein anticipates BTC to breach the $150,000 mark in 2026 and the $200,000 mark in 2027. Ethereum (ETH) could be reacting to the bullish outlook for Bitcoin (BTC). BTC hitting a new peak will likely trigger a market-wide rally.

However, the cryptocurrency market could fall prey to fresh volatility. Macroeconomic uncertainties and slow economic growth could prompt investors to adopt a risk-averse approach. Such a scenario could lead to Ethereum (ETH) losing steam and facing a correction. How the market pans out is yet to be seen.