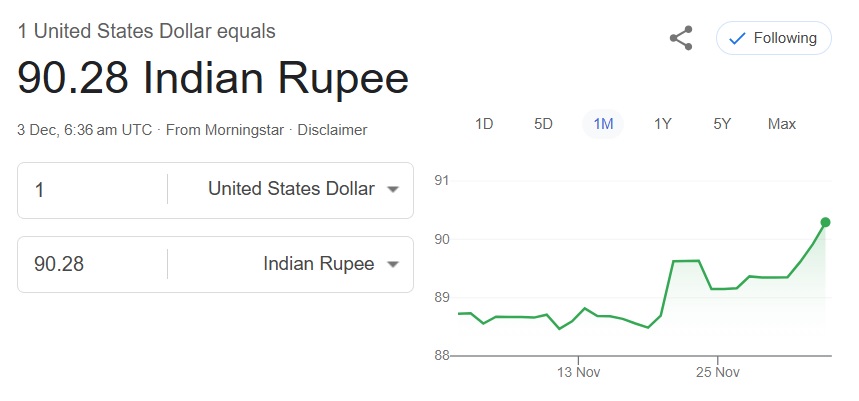

Rupee Plunges Past 90: A New All-Time Low Against the US Dollar in 2025

The Indian rupee just took a nosedive—smashing through the 90 barrier like a wrecking ball through wet tissue paper. Another day, another fiat currency getting steamrolled by the almighty greenback.

Why This Matters

When the rupee coughs, emerging markets catch a cold. This isn’t just about import prices or vacation budgets—it’s a flashing neon sign of global capital playing favorites with dollar hegemony. And guess who’s left holding the bag?

The Silver Lining (If You Squint)

Exporters might pop champagne, but let’s be real—this isn’t a ‘strategy,’ it’s desperation. Meanwhile, crypto traders are probably stacking stablecoins like bunker rations. Because nothing says ‘safe haven’ like a digital asset pegged to the very currency causing this mess.

Bottom Line

Central bankers will wring their hands, politicians will blame ‘external factors,’ and the dollar will keep devouring everything in its path. Welcome to late-stage fiat theater—where the script writes itself, and the punchlines hurt.

Source: Google

Source: Google

US Dollar Hammers the Indian Rupee, Pushing It To the 90 Mark

A quick recovery is unlikely, as the US-India trade deal has yet to be finalized. In addition, the Reserve Bank of India (RBI) is not intervening to protect the rupee by selling US dollars. The developments have hurt the prospects of the INR, allowing it to decline for six consecutive days. The import and export sector is the first to take the hit as the cost of the same goods has increased.

Also, the import and export sector could incur a high cost on the consumer, directly leading to inflation. The cost of products would rise at a time when wages have mostly remained stagnant. Very few businesses would absorb the cost without burdening the consumer. The US dollar has been ruthless to the rupee in 2025, making it the worst-performing currency in the Asian markets.