XRP Price Prediction 2025: Can the $5 Target Hold as Technicals and Market Sentiment Converge?

- Why Is XRP Price Surging in July 2025?

- XRP Technical Analysis: Reading Between the Lines

- Market Sentiment: Extreme Bullishness vs. Regulatory Reality

- Institutional Activity: Whales Making Waves

- Historical Patterns: Will History Rhyme?

- On-Chain Metrics: The Smart Money Indicator

- Regulatory Landscape: The GENIUS Effect

- XRP Price Prediction: The Road to $5

- Is XRP a Good Investment in July 2025?

- XRP Price Prediction FAQs

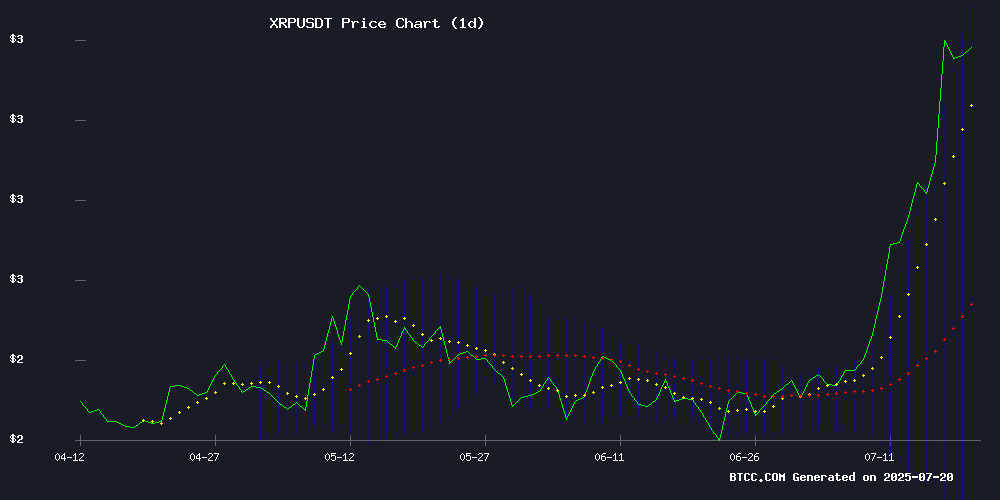

XRP is making headlines again, and this time it's not just hype. The digital asset has surged past key resistance levels, with technical indicators flashing green and market sentiment reaching euphoric levels. As of July 2025, XRP trades at $3.49, showing a staggering 29.6% premium above its 20-day moving average. Analysts are now eyeing the $5 mark as the next major target, but can it sustain this momentum? This DEEP dive examines the confluence of technical factors, on-chain metrics, and regulatory developments that could make or break XRP's rally.

Why Is XRP Price Surging in July 2025?

The current xrp price action isn't happening in isolation. We're seeing a perfect storm of technical breakouts, institutional interest, and regulatory tailwinds. The token recently breached its 2018 all-time high of $3.84, reaching $3.65 on July 18 before settling at current levels. What's particularly interesting is the volume behind this move - over $1 billion in on-chain transactions and a record $11 billion in futures open interest. This isn't just retail FOMO; institutions are clearly positioning themselves.

Source: BTCC TradingView

XRP Technical Analysis: Reading Between the Lines

Let's break down the charts because they're telling a fascinating story. The 20-day MA at $2.69 now serves as strong support, while price action hugs the upper Bollinger Band at $3.62. Typically, this WOULD signal overbought conditions, but in strong uptrends, assets can remain overbought for extended periods. The MACD shows bearish divergence at -0.1781, but here's the kicker - it's narrowing, suggesting selling pressure is weakening.

Key levels to watch:

- Immediate resistance: $3.63 (July 20 high)

- Major support: $2.70 (coinciding with the 20-day MA)

- Psychological level: $3.00 (recently flipped from resistance to support)

Market Sentiment: Extreme Bullishness vs. Regulatory Reality

Headlines scream "XRP to $5!" and "Kaboom phase activated!" but beneath the surface, regulatory challenges persist. The American Bankers Association recently opposed Ripple's trust bank application, reminding us that institutional adoption faces hurdles. Yet, the GENIUS Act signed this month provides a regulatory framework that could benefit XRP long-term. It's this push-pull between euphoria and caution that makes the current market so fascinating.

Institutional Activity: Whales Making Waves

A $70 million XRP transfer to Coinbase caught everyone's attention this week. Was it profit-taking or preparation for larger moves? The derivatives market suggests the latter - open interest hit $11 billion as sophisticated players enter positions. What's more telling is the liquidity depth: moving XRP price just 2% requires over $12 million in orders, indicating substantial institutional participation.

Historical Patterns: Will History Rhyme?

Analyst John Squire spotted a 36-week pattern that preceded previous XRP rallies. If history repeats, we could see another 6x move. But let's be real - that would require a $1.2 trillion market cap, triple Ethereum's current valuation. More plausible is Dark Defender's near-term $5 target, which would still represent a 43% gain from current levels.

On-Chain Metrics: The Smart Money Indicator

The Market Value to Realized Value (MVRV) ratio just triggered a Golden Cross, last seen before XRP's 630% surge in 2024. Meanwhile, XRPL's TVL surpassed $100 million, showing growing DeFi activity. These aren't just numbers - they represent real capital flows that often precede price movements.

Regulatory Landscape: The GENIUS Effect

Ripple CEO Brad Garlinghouse compared the GENIUS Act to post-2008 financial reforms, and he might be right. The legislation creates clarity for stablecoins and could benefit XRP's cross-border use case. However, traditional finance isn't rolling out the welcome mat - banking associations are pushing back hard against crypto firms getting trust charters.

XRP Price Prediction: The Road to $5

Breaking down the path to $5 requires understanding multiple scenarios:

| Scenario | Probability | Key Levels |

|---|---|---|

| Bullish Continuation | 45% | Hold $3.40, break $3.63 |

| Consolidation | 35% | $3.00-$3.50 range |

| Correction | 20% | Below $2.70 support |

The most likely path? A retest of $3.12 (Fib 0.888) before another attempt at $3.63. A weekly close above $3.63 could open the door to $4.10, then $5.00. But remember - in crypto, nothing moves in a straight line.

Is XRP a Good Investment in July 2025?

Let's be honest - XRP is a high-risk, high-reward play right now. The technicals look strong, but regulatory uncertainty hasn't disappeared. If you're considering a position, here's what to watch:

- Institutional flows: Track futures open interest and whale movements

- Regulatory developments: Any progress on Ripple's trust charter application

- Technical levels: $3.63 resistance and $3.00 support

As the BTCC team notes, "The 3.50-3.63 zone is critical - a weekly close above confirms bullish continuation, but regulatory risks remain." This isn't financial advice, just an observation from watching these markets daily.

XRP Price Prediction FAQs

What is the XRP price prediction for 2025?

Analysts see XRP potentially reaching $5 by late July 2025 if current momentum continues, representing a 43% gain from current $3.49 levels. However, this depends on maintaining above key support at $3.00.

Is XRP a good investment right now?

XRP presents both opportunity and risk. While technical indicators are bullish, regulatory challenges persist. Investors should assess their risk tolerance and consider dollar-cost averaging rather than lump-sum investments at current levels.

What is the highest price XRP can reach?

Some analysts suggest $5 is achievable in the short-term, while more optimistic predictions suggest $10+ in a full bull market scenario. However, these targets depend on sustained institutional adoption and favorable regulatory outcomes.

Why is XRP price going up?

The current rally is driven by technical breakouts, institutional interest (evidenced by record futures open interest), regulatory clarity from the GENIUS Act, and growing DeFi activity on the XRP Ledger.

What are the risks of investing in XRP?

Key risks include regulatory uncertainty (particularly Ripple's ongoing case with the SEC), potential profit-taking after the recent rally, and broader crypto market volatility that could impact XRP's price regardless of its fundamentals.