BREAKING: Japan’s Finance Titan Unveils Game-Changing XRP Strategy – ETFs, RLUSD, and IPO Teasers

Tokyo's financial heavyweights just dropped a bombshell—XRP and Ripple are getting the institutional red-carpet treatment.

ETFs Enter the Chat

No more crypto-cold-shoulder: Japan's mega-bank is reportedly drafting blueprints for the country's first XRP exchange-traded fund. Because nothing says 'mainstream adoption' like letting boomers YOLO their pensions into crypto derivatives.

RLUSD Goes Live

Ripple's stablecoin play hits the Pacific Rim with regulatory blessings. Watch USD-pegged liquidity flood cross-border corridors—while TradFi bankers suddenly remember they 'always believed in blockchain.'

The IPO Elephant

Between coded earnings calls and sudden executive reshuffles, insiders smell a 2026 public listing. Cue the 'we're totally not timing the market' press releases.

*Final thought: When a conservative keiretsu starts betting big on crypto, either the revolution's real—or someone's chasing last cycle's ATH.*

SBI proposal for XRP ETF

Ripple’s RLUSD Stablecoin Coming to Japan

Furthermore, the report highlighted that SBI is preparing to handle RLUSD, Ripple’s USD-backed stablecoin, within the current fiscal year. Issued under a trust license from the New York Department of Financial Services (NYDFS), RLUSD is serving several roles:

Used for international remittances via Ripple Payments.

Act as collateral in institutional trading through Hidden Road, a prime broker Ripple recently acquired.

Potentially offered on SBI VC Trade, pending discussions.

This move supports SBI’s broader stablecoin strategy, which includes both USD-backed and JPY-backed models aimed at B2B expansion.

Ripple Payments in Use by 100+ Institutions

While the XRP community often touts adoption by over 300 financial institutions, SBI’s report specifies that more than 100 financial institutions across 55 countries are actively utilizing Ripple Payments, XRP’s primary use case for international remittances.

SBI Ripple Asia, the joint venture between the two companies, continues to lead innovation. Notably, SBI Remit began offering Japan’s first XRP-powered remittance service in 2021.

Interestingly, SBI owns a 9% stake in Ripple, and the report notes that a future IPO or equivalent event could significantly boost its valuation. However, this potential gain is not yet reflected in SBI's current investment earnings, suggesting room for future upside.

Regulatory Easing

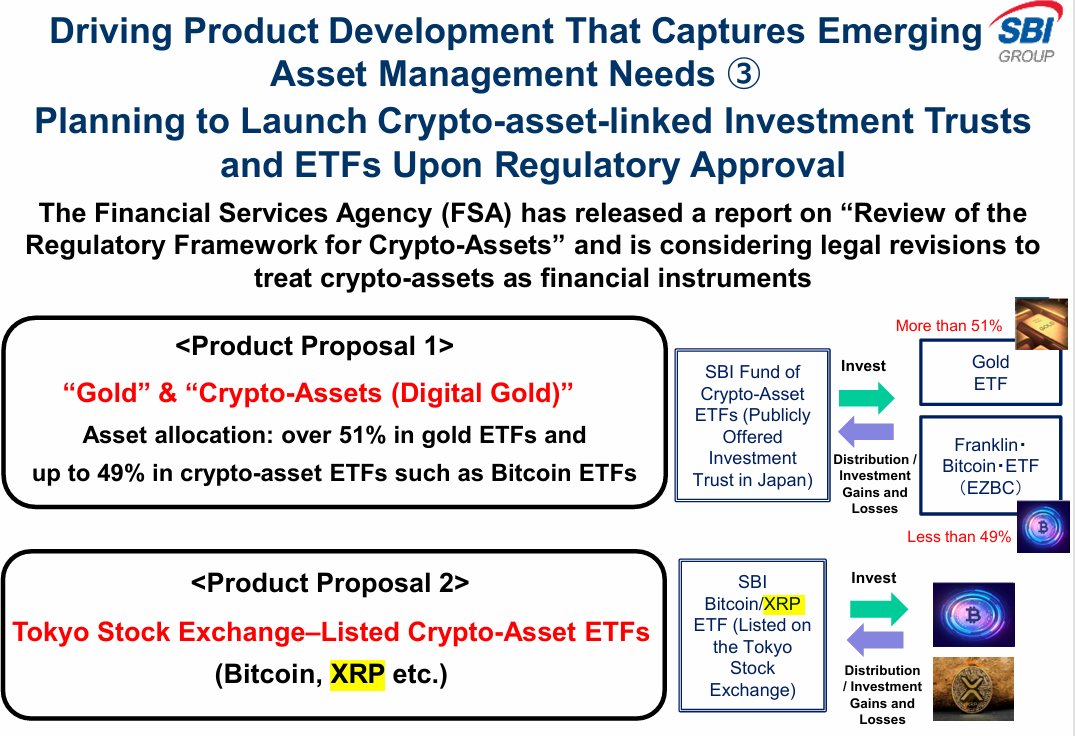

The report also noted that Japan’s Financial Services Agency (FSA) is reviewing revisions to its crypto regulatory framework. The turnaround potentially opens the door for crypto-assets like XRP to be classified as financial instruments. Ultimately, the regulatory easing could fast-track the launch of SBI’s ETF products and stablecoin integrations.

SBI proposal for XRP ETF

Ripple’s RLUSD Stablecoin Coming to Japan

Furthermore, the report highlighted that SBI is preparing to handle RLUSD, Ripple’s USD-backed stablecoin, within the current fiscal year. Issued under a trust license from the New York Department of Financial Services (NYDFS), RLUSD is serving several roles:

Used for international remittances via Ripple Payments.

Act as collateral in institutional trading through Hidden Road, a prime broker Ripple recently acquired.

Potentially offered on SBI VC Trade, pending discussions.

This move supports SBI’s broader stablecoin strategy, which includes both USD-backed and JPY-backed models aimed at B2B expansion.

Ripple Payments in Use by 100+ Institutions

While the XRP community often touts adoption by over 300 financial institutions, SBI’s report specifies that more than 100 financial institutions across 55 countries are actively utilizing Ripple Payments, XRP’s primary use case for international remittances.

SBI Ripple Asia, the joint venture between the two companies, continues to lead innovation. Notably, SBI Remit began offering Japan’s first XRP-powered remittance service in 2021.

Interestingly, SBI owns a 9% stake in Ripple, and the report notes that a future IPO or equivalent event could significantly boost its valuation. However, this potential gain is not yet reflected in SBI's current investment earnings, suggesting room for future upside.

Regulatory Easing

The report also noted that Japan’s Financial Services Agency (FSA) is reviewing revisions to its crypto regulatory framework. The turnaround potentially opens the door for crypto-assets like XRP to be classified as financial instruments. Ultimately, the regulatory easing could fast-track the launch of SBI’s ETF products and stablecoin integrations.