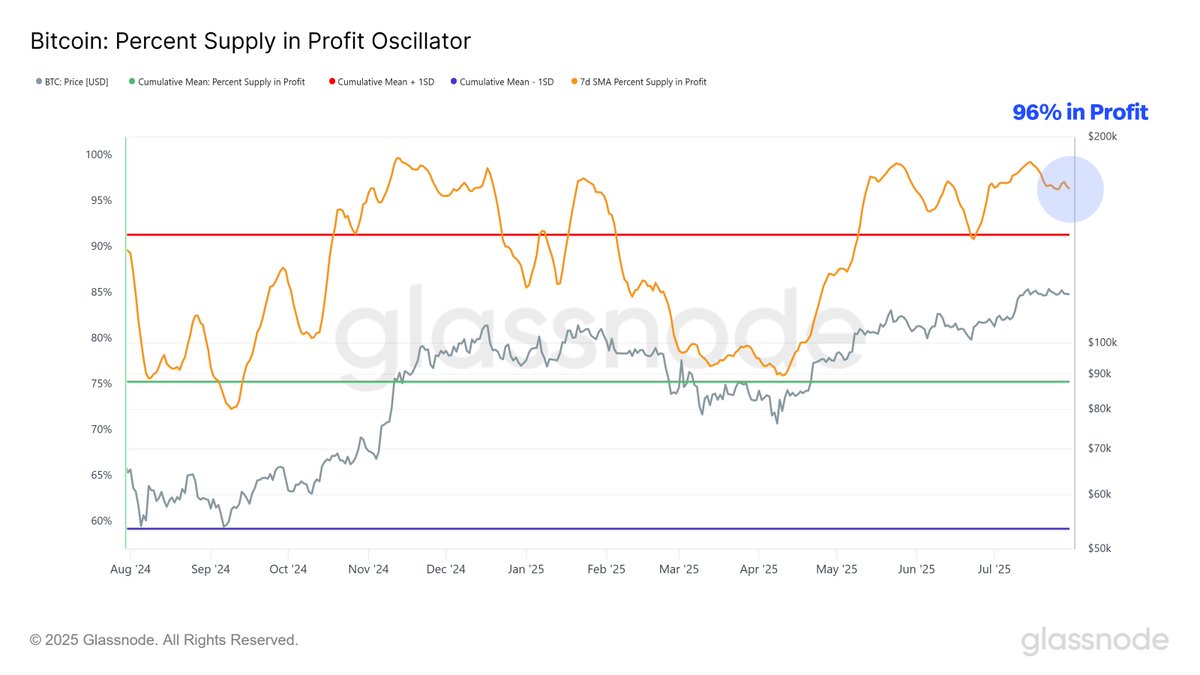

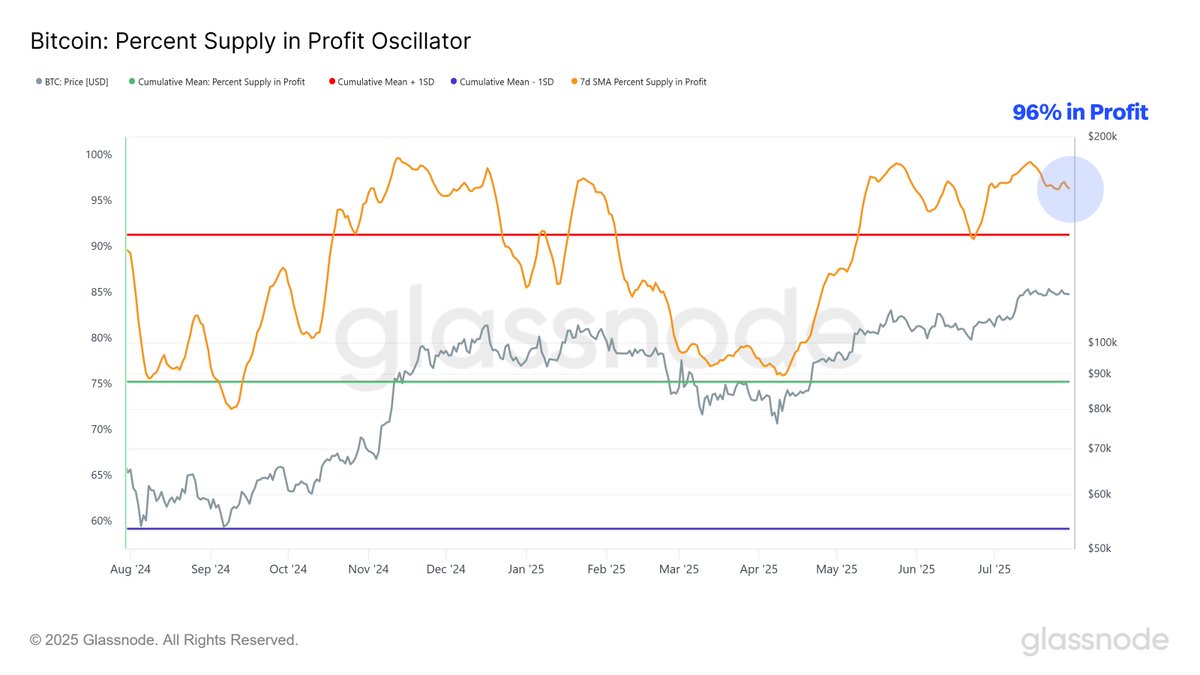

Bitcoin Roars Back: 96% of Holders Now in Profit as Bull Market Returns

Bitcoin just flipped the script—again. After months of sideways action, the king of crypto has reclaimed its bullish territory, leaving 96% of holders sitting pretty in the green. Traders who held their nerve are now being rewarded, while skeptics scramble to explain how 'digital tulips' keep printing money.

Price action that defies gravity

No fancy derivatives or Wall Street alchemy here—just relentless upward momentum. The charts don't lie: Bitcoin's latest surge has vaporized resistance levels like they weren't even there. Meanwhile, traditional finance pundits are suddenly discovering 'long-term potential' after years of calling it a scam.

When profits become the norm

With nearly all holders now profitable, the real question isn't about fundamentals—it's about psychology. At what point does FOMO override fear? The market's answering that question in real-time, one breakout at a time. Just don't tell the SEC we're having this much fun.

Closing thought: If 96% of traditional investments delivered these returns, hedge funds would be out of business by lunchtime.

“This isn’t hype—it’s structure,” Merlijn stated, emphasizing that the crowd typically arrives at resistance, not before. He added that this range is where legends accumulate, marking it as a prime zone for forward-looking buyers to position before the next major MOVE unfolds.

Meanwhile, market sentiment remains firmly bullish, with technical patterns aligning for a potential continuation to the upside.

Glassnode: Bitcoin holders sit on record profits—will they sell?

Supporting the case for high market optimism, on-chain analytics firm Glassnodethat 96% of all Bitcoin supply is currently in profit. According to their Percent Supply in Profit oscillator, the metric has stayed above 90% for over a month—a rare signal historically seen near euphoric phases of bull cycles.

The firm cautions, however, that this elevated level could eventually increase the probability of profit-taking. “When nearly all holders sit on gains, pressure to realize profits builds,” Glassnode wrote. The 91% level represents a key statistical deviation, and a break below it could suggest a deeper reset.

READ MORE:

Still, at current levels, the market appears resilient. The fact that 96% of supply remains in profit without triggering major selling could signal that long-term holders are in control—and waiting for even higher prices.

Conclusion

With Bitcoin’s price action aligning with technical retests and on-chain metrics reflecting widespread profitability, the stage may be set for another rally. Analysts are watching the $112K–$115K zone closely, with $130K as the psychological target. As long as the supply-in-profit ratio holds, momentum may continue to build.

![]()