Corporate Giants Dump $47B Into Bitcoin in 2025—Leaving ETFs in the Dust

Wall Street’s latest darling just got upstaged. Public companies—not ETFs—are now driving Bitcoin’s bull run, with a staggering $47 billion flood of institutional capital this year alone.

Who needs a middleman? Corporate treasuries bypassed the ETF hype entirely, betting big on direct Bitcoin exposure. Turns out, when your CFO’s bonus depends on it, you skip the paperwork and go straight for the digital gold.

Meanwhile, traditional finance scrambles to explain why their shiny new ETF products got lapped by companies actually using Bitcoin as intended—a treasury asset. Cue the existential crisis.

One hedge fund manager sniffed: ‘Guess they finally realized holding BTC beats holding bagholder meetings.’ Ouch.

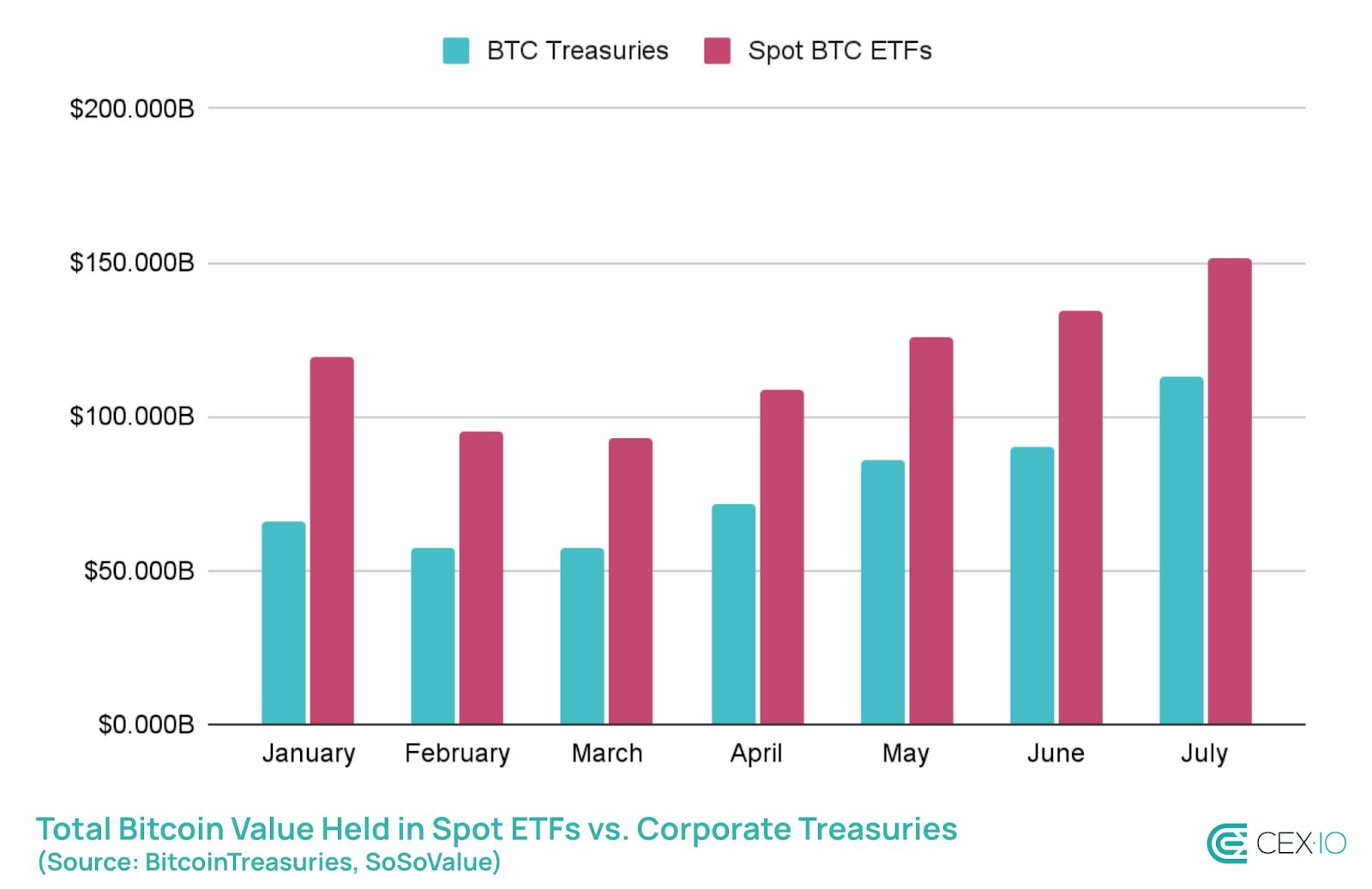

A chart of Bitcoin accumulation by public firms and ETFs

The pace at which public companies are closing the gap highlights their growing presence at the core of the crypto infrastructure, favoring direct Bitcoin custody over ETF exposure.

Strategic Commitment

Moreover, treasury-held Bitcoin typically stays off-exchange and on-chain, signaling a more permanent allocation with less concern about massive sell-offs. It is unlike ETFs, which are liquid and investor-facing.

Notably, 161 public firms now hold Bitcoin on their balance sheets. Meanwhile, 53 private firms hold 426,190 BTC worth over $50 billion. Among the big names in this group are Block and Tether, the issuer of USDT.

Overall, the growth in holdings across various firms confirms institutional FOMO in Bitcoin, as the premier asset trades in the six-figure range with widespread long-term conviction to crack the seven-figure mark.

As of press time, Bitcoin is trading at $118,500, slightly below its peak of $123,200. Bitcoin bulls like Michael Saylor, Robert Kiyosaki, and Jack Dorsey have predicted that the price could exceed $1 million in the next decade.

A chart of Bitcoin accumulation by public firms and ETFs

The pace at which public companies are closing the gap highlights their growing presence at the core of the crypto infrastructure, favoring direct Bitcoin custody over ETF exposure.

Strategic Commitment

Moreover, treasury-held Bitcoin typically stays off-exchange and on-chain, signaling a more permanent allocation with less concern about massive sell-offs. It is unlike ETFs, which are liquid and investor-facing.

Notably, 161 public firms now hold Bitcoin on their balance sheets. Meanwhile, 53 private firms hold 426,190 BTC worth over $50 billion. Among the big names in this group are Block and Tether, the issuer of USDT.

Overall, the growth in holdings across various firms confirms institutional FOMO in Bitcoin, as the premier asset trades in the six-figure range with widespread long-term conviction to crack the seven-figure mark.

As of press time, Bitcoin is trading at $118,500, slightly below its peak of $123,200. Bitcoin bulls like Michael Saylor, Robert Kiyosaki, and Jack Dorsey have predicted that the price could exceed $1 million in the next decade.