Ethereum Price at a Crossroads: $300M OTC Whale Buys Clash With Massive ETH Dumps

Whales are playing tug-of-war with Ethereum—and retail traders are caught in the middle.

The Dump vs. The Buy: While panic sellers flood exchanges with ETH, a shadowy $300M over-the-counter purchase just snapped up a mountain of coins off the books. Classic crypto: the left hand never knows what the right hand is doing.

Market Mechanics at Work: OTC deals typically signal institutional accumulation, but exchange dumps create instant sell pressure. Who blinks first? The algo traders watching order books or the diamond hands stacking ETH at 'discount' prices?

The Cynic's Corner: Nothing boosts confidence like watching billionaires play hot potato with an asset they claim to believe in long-term. Place your bets—just don't expect Wall Street's rules to apply.

Key Insights:

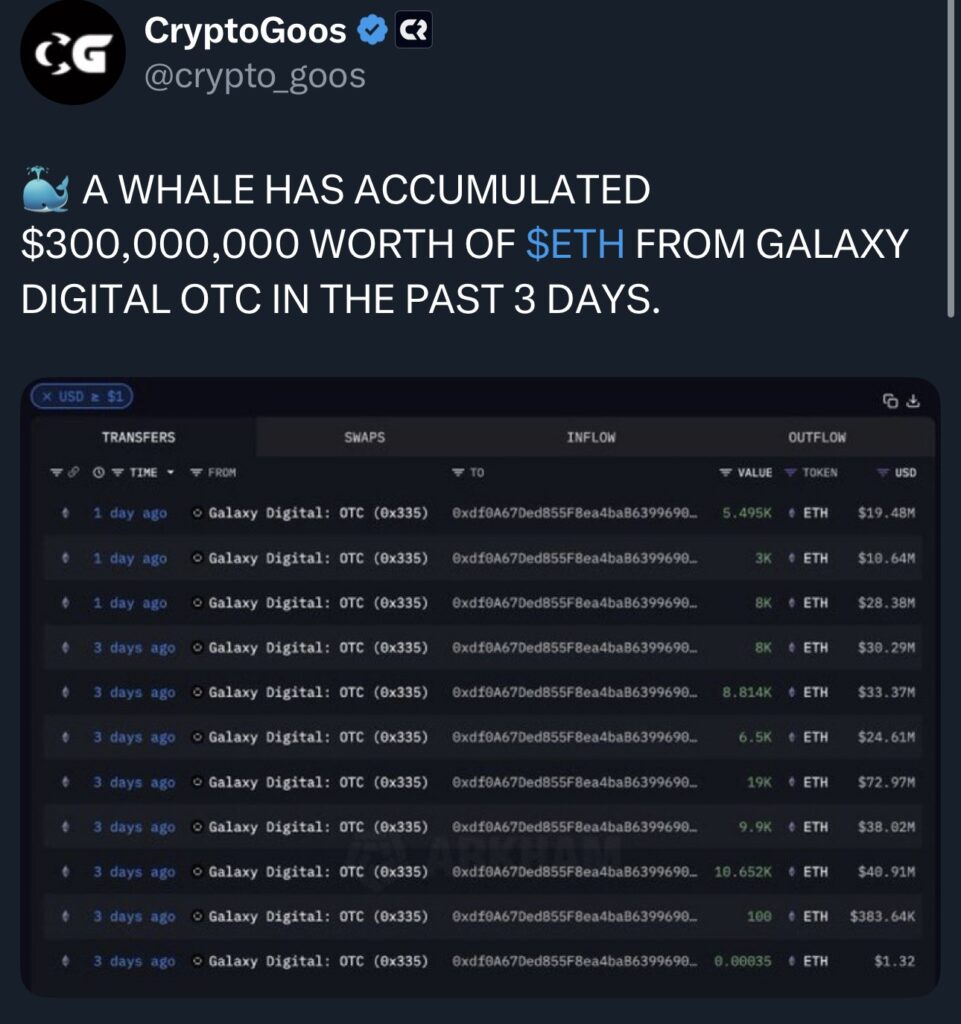

- A whale dumped 33,682 ETH ($119M) while another bought $300 million via Galaxy Digital’s OTC desk. This signals a battle between sellers and deep-pocket buyers pulling Ethereum price.

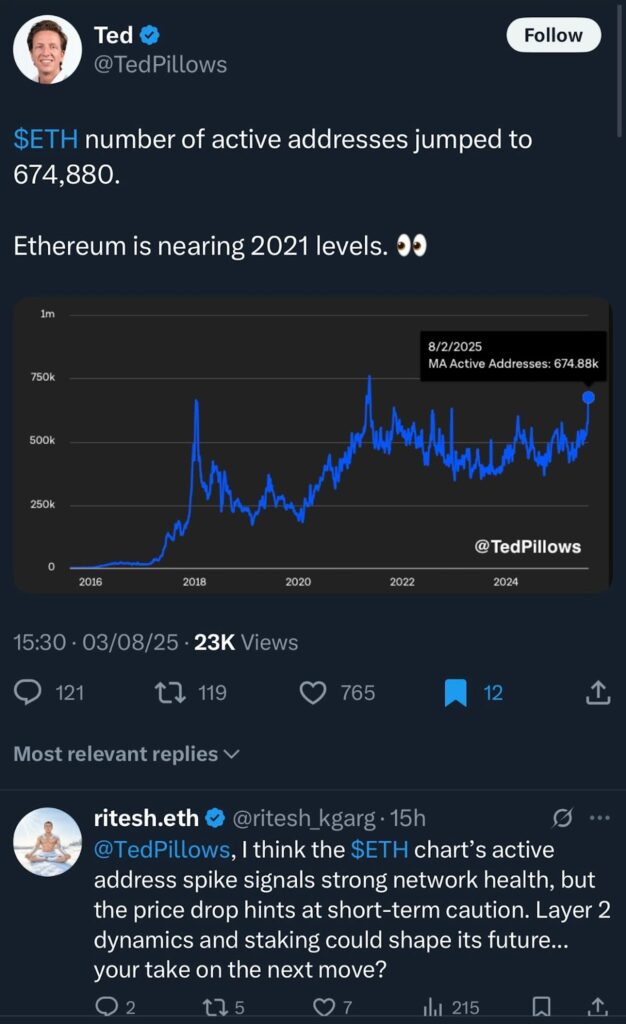

- Mega whale wallet count is rising, and daily active Ethereum addresses have hit 675,000, close to 2021 bull run levels.

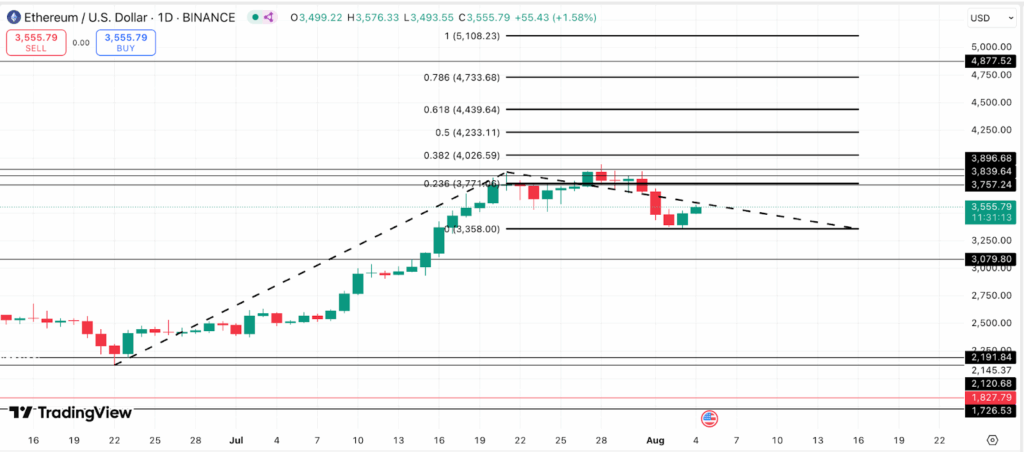

- The Ethereum price must hold above $3,500 to remain bullish, with $3,800 acting as the next potential breakout zone.

The ethereum price is down almost 9% over the past week. But despite this fall, the story isn’t as bearish as it looks. In the past 3 months, Ethereum has more than doubled, showing that momentum is still alive.

Right now, whales are doing very different things; some are selling hard, while others are buying big. This tug of war could shape Ethereum’s next big move.

Whale Dumping vs. Whale Buying: Both Impacting Ethereum Price

In the last three days, a large Ethereum holder (also called a whale) sent over 33,000 ETH, worth nearly $119 million, to exchanges. This usually signals selling pressure. When whales send coins to exchanges, they often plan to sell, and that can pull the Ethereum price down.

At the same time, another whale bought $300 million worth of ETH from Galaxy Digital’s OTC (over-the-counter) desk. OTC buys are usually done by smart money or institutions. They prefer OTC because it lets them buy in large amounts without crashing the price on public exchanges.

So, in short, one big whale is dumping on the market, while another is quietly scooping it all up.

Ethereum Whale Addresses Are Growing

Even though one whale is selling, the bigger picture says something else.

According to Glassnode data, the number of mega whale ethereum addresses (those holding more than 10,000 ETH) is rising. That means the biggest holders are adding to their bags, not cutting down. This kind of accumulation is often a sign that they believe in Ethereum’s long-term value.

If this trend continues, it shows confidence behind the scenes, even if the short-term price looks weak.

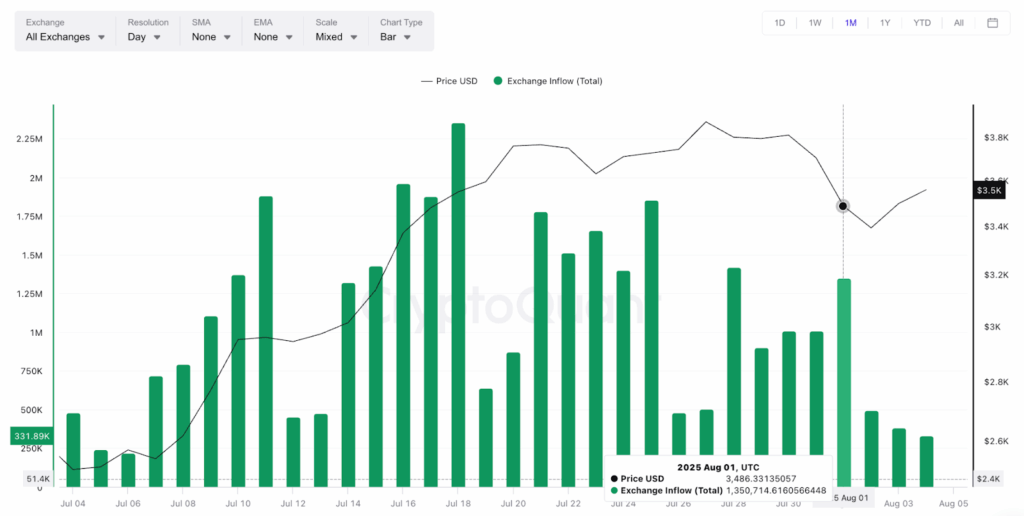

And complementing the whale-buying scenario are the sluggish exchange inflow numbers. Not a lot of ETH is being pushed into the exchanges. And that hints at rising conviction.

Ethereum’s Network Activity Is Heating Up Again

There’s also good news from on-chain activity. The number of active Ethereum addresses just jumped to over 674,000, which is close to the levels seen during the 2021 bull run. More active addresses often mean more users, more transactions, and more interest in the network.

In other words, Ethereum isn’t going quiet. It’s still buzzing with activity, and that’s often a strong backbone for price strength in the long run.

Do note that despite the address counter showing high numbers, there are people who keep relating all of it to layer-2 ecosystems. As a trader, it is crucial to keep an eye on that angle as well.

Ethereum Price Holds Strong at Key Levels

The Ethereum price recently found support at $3,358, and buyers have pushed it back above $3,550. This bounce shows that bulls are still in the game.

The area between $3,500 and $3,771 is now acting as a key zone to watch. If this range holds, the next target for bulls is $3,896. That’s a resistance zone from past price action. A breakout above that could send ETH toward $4,000 and beyond.

But if sellers manage to break below $3,358, the rally could lose steam. So far, though, the price is holding strong.

Right now, the Ethereum price is stuck in a strange place. On the surface, it looks weak. There’s whale selling, and the price has dropped almost 9% in a week. But deeper down, the signs are bullish. Smart money is buying OTC. Mega whale wallets are growing. And Ethereum’s network activity is rising fast.

The next few days could decide who wins: dumpers or buyers. But with strong support holding and fundamentals improving, bulls still have the upper hand when it comes to the Ethereum price.