Bitcoin’s $100K Dream Stalls: Bulls Lose Nerve as Price Tests Arthur Hayes’ Bold Prediction

Bitcoin's rally hits a wall—just as the crypto faithful were polishing their Lambo shopping lists. Arthur Hayes' $100K moonshot call now looks shaky, with bulls suddenly remembering that markets don't care about hopium.

The hesitation game

Traders are tapping the brakes harder than a DeFi yield farmer spotting an audit report. Liquidity's drying up faster than a shitcoin's Twitter engagement after the pump ends.

Institutional déjà vu

Wall Street's 'when, not if' chorus sounds suspiciously like their 2018 playbook. Meanwhile, Bitcoin's price action moves with all the decisiveness of a hedge fund manager waiting for SEC approval.

The king of crypto's stuck playing psychological warfare—with traders, with Hayes' prediction, and with every 'number go up' true believer who forgot that even digital gold gets weighed sometimes.

Key Insights:

- Bitcoin price is hovering around $114,000, showing resilience even after Hayes’ bearish $100,000 prediction.

- Exchange reserves are low, meaning sellers aren’t rushing to offload BTC, which is a quiet sign of strength.

- Despite his bold call, Arthur Hayes hasn’t sold any BTC, raising doubts about how deep the bearish conviction runs.

Bitcoin price has confused a lot of traders in the past few days. It has dropped a bit, but not too much. Keeping a steady stance and tempting investors for new highs, BTC price is keeping the market on the edge.

Over the past 7 days, BTC price is down by about 3.5%, but in the last 24 hours, it hasn’t really moved. But while the price stays still, the market is far from boring.

Arthur Hayes, a well-known cryptocurrency figure, recently predicted that Bitcoin could reach $100,000, and Ethereum could return to $3,000. But strangely, right after tweeting that, he sold over 2,373 ETH (worth more than $8.3 million), along with other tokens like ENA and PEPE, but not a single satoshi of BTC.

So, the question is: If Arthur really believes Bitcoin will go to $100,000, why didn’t he sell any?

Bitcoin Price Holds Key Support, but Is It Strong Enough?

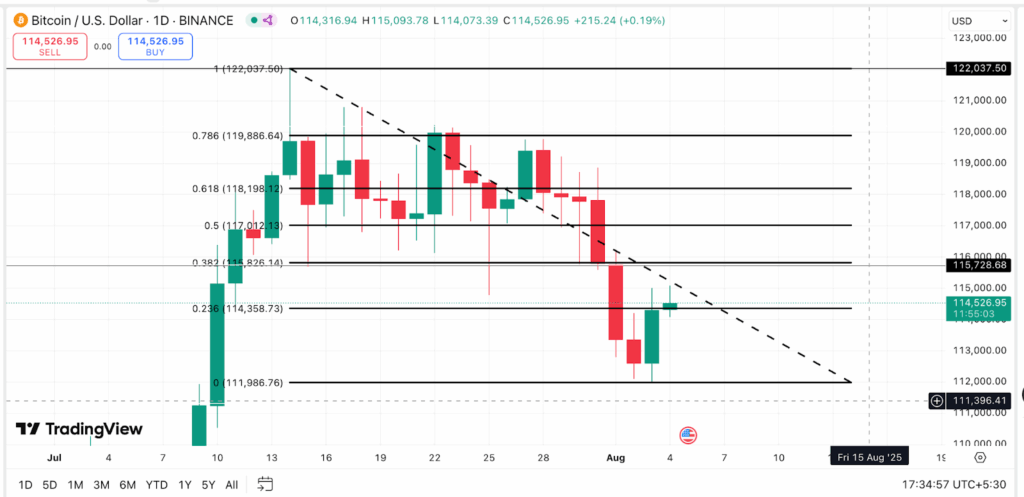

Right now, the Bitcoin price is hovering around the $114,000 level. This line is acting like a wall; buyers are showing up here and trying to keep the price from falling further.

f BTC price drops below $113,000, the next big test is at $107,000. If it holds there, bulls are still in the game. But if it breaks, things could turn bearish quickly.

The chart also shows that despite sideways price movement, bulls are still showing signs of strength. The candles aren’t breaking down heavily. A small upward slope is forming, and unless we see a strong breakdown below $113,000, the bitcoin price is still holding up relatively well.

Dominance Hints at a Shift for Bitcoin Price; but It’s Not That Simple

Let’s talk about bitcoin dominance: this shows how big Bitcoin is compared to the rest of the crypto market.

Recently, BTC dominance has formed what looks like an inverted bearish flag on the chart. Normally, this kind of pattern means a big drop is coming. The dominance did fall earlier but has started to slowly rise again inside a narrow upward channel.

The current dominance is sitting around 62%, and if it continues climbing, this could kill the bearish flag setup entirely. That means altcoins might slow down again, and Bitcoin could take the lead. If it starts falling again and goes below 61.04%, then we might expect a bigger altcoin rally and weaker Bitcoin movement.

But here’s the kicker: Bitcoin price itself hasn’t dropped like you’d expect from a dominance breakdown. That suggests the bears don’t have full control, even if the dominance pattern looks weak.

Exchange Reserves Stay Low; Sellers Are Not Rushing In

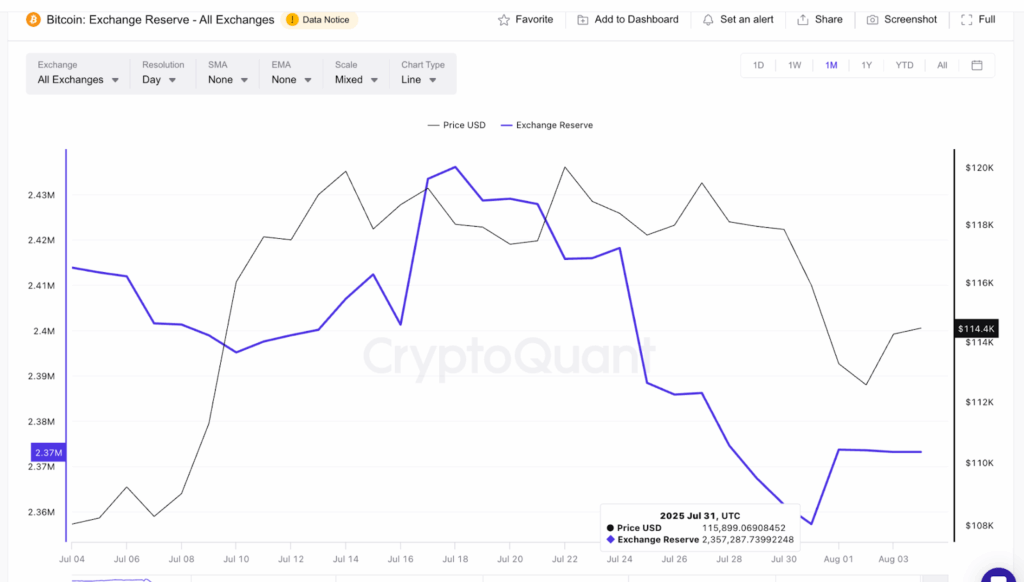

Now, let’s take a look at CryptoQuant’s exchange reserve data. These reserves show how much BTC is sitting on exchanges and ready to be sold.

As of July 31, there are about 2.357 million BTC on exchanges, which is still low. In fact, the number has dropped steadily from mid-July to the end of the month.

What does this mean?

It shows that big sellers aren’t lining up to dump their coins. Even with sideways price movement, the fact that reserves are low tells us that the market isn’t in panic mode. In other words, there’s no heavy pressure to sell right now, which helps Bitcoin price stay stable.

Arthur Hayes’ $100K Call: But No Bitcoin in His Wallet?

Let’s get back to Arthur Hayes. He made a bold claim that Bitcoin could test $100K, but according to on-chain data, he didn’t back that call with any BTC selling. Instead, he sold ETH, PEPE, and ENA, worth millions, and sent them to exchanges and Uniswap pools.

This raises questions.

Was his tweet just a market move? Did he want to trigger BTC selling? Or does he still believe in Bitcoin but needs cash?

Either way, it’s important to note that none of his trades included Bitcoin, which feels off considering his public call.

Hayes has made bold calls before; some accurate, some not. He’s known for using big macro narratives like inflation, debt cycles, and liquidity crunches. But even if he says “Bitcoin to $100,000,” the charts say not yet.

Right now, the Bitcoin price is in a quiet but important spot. It’s not breaking down, but it’s not rallying either. There’s no flood of sellers, reserves are low, and the price is still above key support levels. But it also hasn’t shown real weakness, confirming Arthur Hayes’ $100,000 dream.

Until we get a clean breakout above $115,000, bulls are still waiting. If it happens, we may just see Arthur’s words turn into reality. But for now, the chart is the real judge, not the tweet.