Hot US PCE Inflation Data Drops – Will Crypto Markets Melt Down or Moon?

Another inflation surprise hits Wall Street. Traders scramble as the Fed's favorite gauge runs hotter than expected.

Crypto's inflation paradox: Digital gold or risk-off casualty?

Bitcoin's staring down its toughest test since the last Fed meeting. Will institutional money flood in as a hedge, or retreat to boring old Treasuries? The market's about to place its bets.

Meanwhile, degenerate traders are already levering up on shitcoin futures – because nothing says 'rational market' like 100x altcoin positions during macro turbulence.

Key Insights:

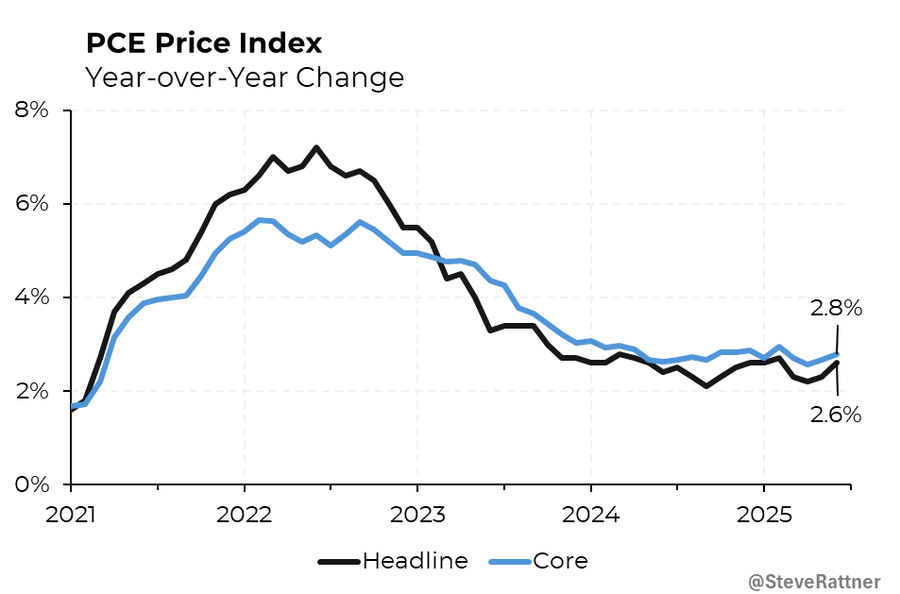

- US Federal Reserve could keep interest rate unchanged as core PCE inflation increased by 0.3% month-over-month and headline PCE surged to 2.6%.

- The US Core PCE Inflation comes in hotter at 2.8%, sparking market concerns as U.S. Dollar index (DXY) and 10-Year Treasury yield climbed higher.

- Ethereum saw more liquidations than Bitcoin, with altcoins including XRP, Solana, Dogecoin, BNB, and Cardano fell between 1-2%.

The Core PCE inflation surged by 0.3% month-over-month, and headline PCE increased to 2.6%, as per the latest report on Friday. This indicated that the Federal Reserve may hold the interest rate unchanged in September.

Following the release, Bitcoin and ethereum prices fell slightly after the higher PCE release, triggering a pullback in the broader crypto market. While analysts remained bullish on the long-term outlook, traders turned cautious and may liquidate their holdings.

US Headline PCE Inflation Comes in Hot 2.6%

The U.S. Bureau of Economic Analysis released the Federal Reserve’s preferred inflation gauge, US PCE data, on July 31. This was one of the most crucial PCE inflation data points as the Fed paused rate cuts.

On a year-over-year basis, headline PCE inflation came at 2.6% against 2.5% expected, higher than 2.4% previously. Similarly, CORE PCE inflation came in higher at 2.8% against 2.7% expected, but the same as in the last month.

The PCE inflation increased to 0.3% month-over-month, in line with expectations but higher than the previous print. Whereas, the core PCE index, which excludes volatile food and energy prices, rises to 0.3% in line with estimates but higher than 0.2% last month.

US Fed to Keep Interest Rate Unchanged for Longer?

US Federal Reserve Chair Jerome Powell and other FOMC members decided to keep interest rates unchanged on Wednesday. The financial services firms also pointed to US tariffs as the reason behind the rise in inflation.

At the time of writing, the CME FedWatch tool showed only a 39% probability of the Fed rate cut in September. The data suggested only one rate cut of 25 bps by December this year, as inflation data and uncertainty in the markets remained higher in recent months.

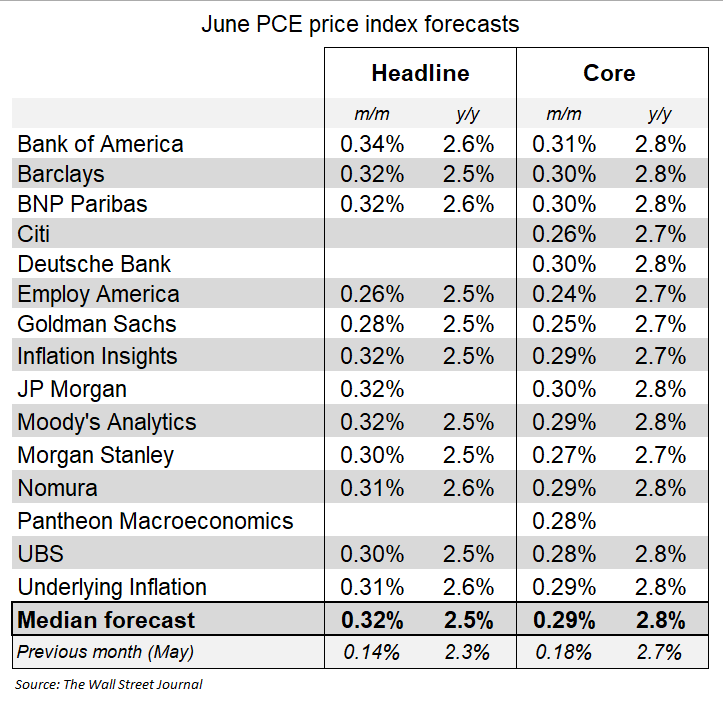

Nick Timiraos, chief economics correspondent at the Wall Street Journal, said economists who translated the CPI and PPI into the PCE expected monthly core inflation to come in firm in June.

Wall Street giants predicted a 2.5% headline US PCE inflation reading. They also estimated core PCE inflation to increase to 2.8%.

Crypto Market Could Lose Upside Momentum

Bitcoin showed volatility after the PCE inflation data, holding the $118,500 level. However, altcoins started losing momentum, with ethereum price dropping slightly to $3,823 at the time of writing.

Altcoins including XRP, Solana, Dogecoin, BNB, and Cardano fell between 1-2%. This raised speculation about weak altcoin market amid volatility and uncertainty.

CoinGlass data indicated nearly $400 million in crypto liquidations, with almost 107K traders liquidated in the last 24 hours. The largest single liquidation order of ETHUSDT, valued at $6.82 million, happened on crypto exchange Binance.

Nearly $280 million long and over $120 million short positions were liquidated. Most liquidated cryptocurrencies included ETH, SOL, XRP, DOGE, WIF, and SUI.

Bitcoin historical patterns and on-chain data signaled BTC price could fall into a correction, with altcoin season sentiment rising.

After the PCE data, the US dollar index (DXY) hits 100 for the first time since May. Also, the 10-year US Treasury yield showed volatility and ROSE to around 4.36%.