XRP Price Forecast 2025-2040: Expert Analysis on Key Growth Catalysts and Market Trends

- What Does XRP's Current Technical Setup Reveal?

- How Are Institutional Players Positioning in XRP?

- What Are the Key Price Levels Traders Should Watch?

- How Might Regulatory Developments Impact XRP?

- What Are the Long-Term Price Projections for XRP?

- What Alternative Strategies Exist for XRP Investors?

- Frequently Asked Questions

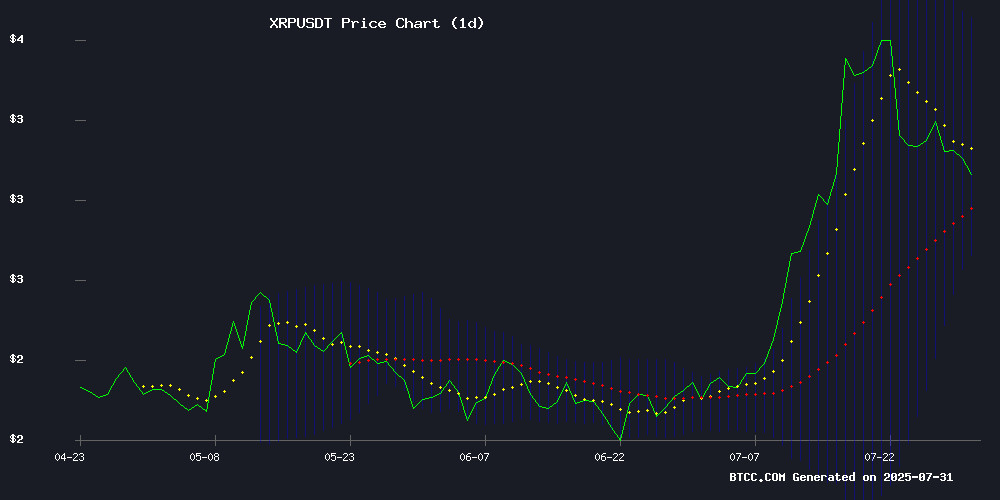

XRP stands at a critical juncture in 2025, with technical indicators suggesting potential volatility ahead while fundamental developments point to long-term growth. After reclaiming the psychologically important $3 support level, the digital asset shows signs of institutional accumulation despite recent whale outflows. This comprehensive analysis examines XRP's price trajectory through 2040, incorporating technical patterns, regulatory developments, and adoption metrics that could shape its future valuation.

What Does XRP's Current Technical Setup Reveal?

XRP currently trades at $3.0932, slightly below its 20-day moving average of $3.1840 according to TradingView data. The MACD histogram shows bullish divergence at 0.1887, while Bollinger Bands indicate consolidation NEAR the middle band. Key levels to watch include resistance at $3.6380 and support at $2.7301.

"The technical setup shows XRP is building energy for its next major move," notes a BTCC market analyst. "We're seeing textbook accumulation patterns that typically precede significant breakouts." The Chaikin Money Flow indicator has printed higher lows despite recent price declines, suggesting smart money accumulation during dips.

How Are Institutional Players Positioning in XRP?

On-chain data reveals intriguing institutional behavior:

- 90-day whale outflows averaging $28M daily (CryptoQuant)

- Wallet count nearing 7.3 million addresses

- Exchange balances declining despite price volatility

Ripple's upcoming Institutional Tokenization Program (launching August 1) could accelerate adoption, particularly after their acquisition of Hidden Road to bridge hedge funds to the XRP Ledger. The platform Banxchange.com has emerged as a popular tool for rapid XRPL token creation ahead of this initiative.

What Are the Key Price Levels Traders Should Watch?

Critical technical levels for XRP:

| Level Type | Price | Significance |

|---|---|---|

| Immediate Resistance | $3.1650 | 100-hour SMA & bearish trendline |

| Major Resistance | $3.6380 | Upper Bollinger Band |

| Support Zone | $2.75-$2.99 | Previous consolidation area |

| Bull Target | $4.804 | 44% upside potential |

How Might Regulatory Developments Impact XRP?

The resolution of Ripple's SEC case removed a major overhang, but challenges remain. The XRP Ledger's decentralized exchange faces compliance hurdles regarding liquidity provider identification - even Ripple can't currently use XRPL DEX for payments according to industry commentator Bill Morgan.

However, the Payment Stablecoin Clarity Act and other regulatory advancements have created a more favorable environment. "We're seeing traditional finance players dip their toes in XRP waters now that the legal fog has lifted," observes a London-based crypto fund manager.

What Are the Long-Term Price Projections for XRP?

Based on current adoption curves and technical analysis:

| Year | Conservative | Base Case | Bullish | Key Catalysts |

|---|---|---|---|---|

| 2025 | $3.50 | $4.80 | $6.20 | ETF approvals, Ripple IPO |

| 2030 | $12 | $18 | $25 | CBDC adoption, remittance growth |

| 2035 | $30 | $45 | $60 | Enterprise blockchain dominance |

| 2040 | $75 | $110 | $150 | Internet of Value maturity |

These projections assume continued regulatory clarity and adoption growth. The 2025 outlook remains particularly sensitive to the $3 support holding through Q3.

What Alternative Strategies Exist for XRP Investors?

Beyond direct investment, platforms like WinnerMining offer "Hold + Mine" models combining staking with eco-friendly mining operations. Their solar-powered infrastructure promises daily earnings up to $3,770 through mobile-accessible contracts, with payouts in XRP or USDT.

"The hybrid approach appeals to investors wanting passive exposure to XRP's upside while mitigating volatility," explains a Dubai-based crypto wealth manager. "But as always, DYOR - the space evolves rapidly."

Frequently Asked Questions

Is XRP a good investment for 2025?

XRP shows promising technical and fundamental indicators for 2025, with analysts identifying $4.804 as a potential target if key support holds. However, cryptocurrency investments carry substantial risk.

What's driving XRP's recent price movement?

The price reflects regulatory clarity, institutional tokenization developments, and technical patterns suggesting accumulation. Trading volume recently spiked 14.71% to $6.61 billion.

How does XRP's performance compare to Bitcoin?

XRP has outpaced bitcoin with a 300% price surge over the past year, though it's shown relative weakness in recent weeks during the broader market consolidation.

What are the risks to XRP's price growth?

Key risks include regulatory setbacks, whale selling pressure (like co-founder Chris Larsen's recent $140M transfer to exchanges), and competition in cross-border payments.

Where can I trade XRP?

XRP trades on major exchanges including BTCC, Kraken, and others. Always verify an exchange's regulatory status and security measures before trading.