Ethereum Price Prediction 2025: Will ETH Hit $5,000 as Institutional Demand Soars?

- Ethereum Technical Analysis: The Setup for $5,000

- Institutional Adoption Reaches Critical Mass

- NFT Market Shows Unexpected Strength

- Staking Economy Creates New Yield Paradigm

- July Performance Shatters Expectations

- Info-Fi: Ethereum's Next Frontier?

- Is $5,000 ETH Realistic in 2025?

- Ethereum Price Prediction FAQs

Ethereum is showing all the signs of a major breakout in July 2025, with technical indicators and institutional demand aligning for what could be ETH's biggest rally in years. Currently trading at $3,797.74, ethereum has maintained a steady climb above key moving averages while institutional players pour billions into staking and treasury allocations. The $5,000 target that seemed ambitious just months ago now appears within reach as the network effect from record NFT sales and DeFi innovation creates unprecedented demand.

Ethereum Technical Analysis: The Setup for $5,000

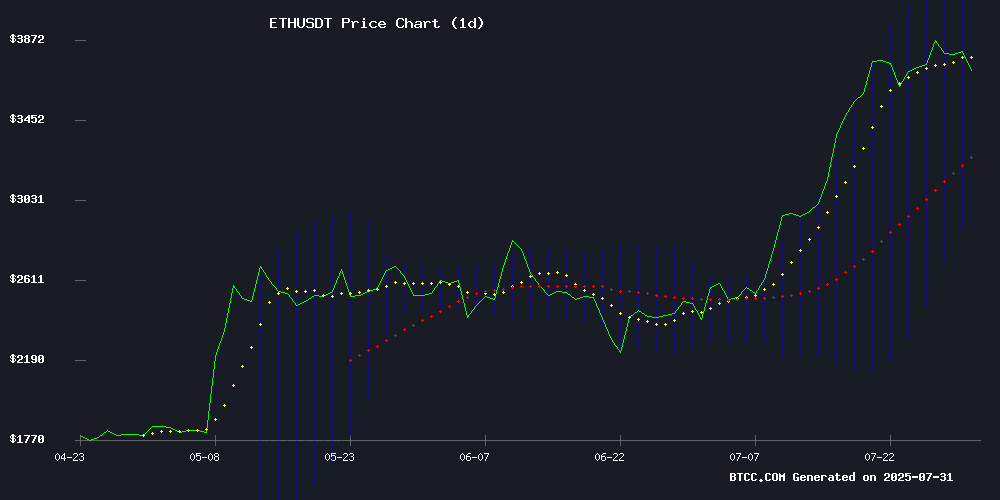

The charts are painting a bullish picture for ETH as we approach August 2025. The asset is trading comfortably above its 20-day moving average of $3,559.66, with the MACD showing a positive crossover at 66.1773 - typically a strong buy signal. What's particularly interesting is how ETH is hugging the upper Bollinger Band at $4,155.51, suggesting sustained buying pressure that could push through resistance levels.

Looking at the weekly chart, we can see ETH has formed a clear ascending triangle pattern since its April 2025 lows. The $4,000 level remains the key psychological barrier - a level that's rejected price three times in the past year. But this time feels different. The BTCC research team notes that the current setup resembles Bitcoin's 2019 accumulation phase before its historic run.

Institutional Adoption Reaches Critical Mass

The numbers tell a staggering story of institutional adoption:

| Metric | Value | Change (Monthly) |

|---|---|---|

| ETH Staked | 35.7M ETH | +8.3% |

| Corporate Holdings | $10.5B | +50x since April |

| NFT Sales (July) | $574M | +47.6% |

Companies like The Ether Machine have been particularly aggressive, adding 15,000 ETH ($56.9M) to their treasury in a single transaction. Their total holdings now stand at 334,757 ETH - making them the third-largest corporate holder after BitMine and SharpLink.

NFT Market Shows Unexpected Strength

While many predicted the NFT bubble had burst, July 2025 saw the second-highest monthly sales total of the year at $574 million. What's fascinating is how this rally differs from previous ones:

- Average sale price hit $113.08 (6-month high)

- Unique buyers declined 17% while sellers increased 9%

- Ethereum-based collections dominated trading volume

This suggests the market is maturing, with participants focusing on higher-quality assets rather than speculative flipping. The NFT market cap's 21% surge to $8 billion indicates growing institutional confidence in digital collectibles as an asset class.

Staking Economy Creates New Yield Paradigm

The staking boom has become ETH's secret weapon. With 35.7 million ETH now locked in staking contracts, validators are earning approximately $15,358 annually at current prices. The June 2 inflow of 213,961 ETH marked the single largest staking day of 2025 - interestingly coinciding with ETH's price breakout.

What's revolutionary is how restaking protocols are creating layered yield opportunities. Platforms like EigenLayer allow staked ETH to secure multiple protocols simultaneously, effectively multiplying capital efficiency. This innovation helps explain why institutional players are allocating to ETH despite its validator threshold.

July Performance Shatters Expectations

ETH's 54.83% monthly gain in July 2025 wasn't just impressive - it was historic. The rally peaked with a 57.4% single-day surge on July 28, catching many traders off guard. On-chain metrics reveal the depth of this move:

- Daily gas usage hit record 149.67B

- ETF inflows reached $2.12B for July

- Total Value Staked grew from $34.54M to $36.16M

Avichal Garg of Electric Capital drew parallels to Bitcoin's 2019 breakout, noting "ETH today is what bitcoin was in 2019." This institutional adoption phase appears to be accelerating, with Artemis Analytics reporting $2.8B in net flows - outpacing all other chains combined.

Info-Fi: Ethereum's Next Frontier?

A fascinating development is the emergence of "Info-Fi" - treating information itself as a tradable asset class. Vitalik Buterin has been vocal about prediction markets evolving into truth-discovery mechanisms. Platforms like Polymarket have demonstrated this potential, accurately forecasting major events like the U.S. Presidential Election.

This convergence of blockchain, AI, and finance could create entirely new financial instruments built on Ethereum. Buterin envisions "correct-by-construction" markets designed specifically to surface valuable knowledge - potentially redefining how we process information economically.

Is $5,000 ETH Realistic in 2025?

Given the technical setup and fundamental drivers, the $5,000 target appears increasingly plausible. Key factors supporting this outlook:

- Technical Breakout: ETH is trading 6.7% above its 20MA with bullish MACD

- Institutional Demand: $10B+ in corporate holdings creates strong support

- Ecosystem Growth: Record NFT sales and DeFi TVL demonstrate network effects

The BTCC analyst team notes: "With technicals aligned to fundamental adoption drivers, ETH at $3,800 offers favorable risk/reward for investors with 6-12 month horizons." While the $4,000 resistance remains formidable, a decisive break could quickly propel ETH toward $5,000 as shorts cover and FOMO buying intensifies.

Ethereum Price Prediction FAQs

What is the current Ethereum price prediction for 2025?

Based on current technicals and institutional demand, analysts predict ETH could reach $5,000 by August 2025 if it breaks through the $4,000 resistance level. The asset is currently trading at $3,797.74 with strong momentum indicators.

How much Ethereum is currently staked?

As of July 2025, over 35.7 million ETH is locked in staking contracts, representing approximately $135 billion in value at current prices. This has grown 50x since April 2025.

What companies hold the most Ethereum?

The largest corporate ETH holders are BitMine Immersion Technologies (625,000 ETH), SharpLink (438,200 ETH), and The Ether Machine (334,757 ETH). Combined, these three companies hold over $5 billion in ETH.

Is Ethereum a good investment in 2025?

Ethereum presents a compelling investment case due to its strong technical setup, growing institutional adoption, and expanding ecosystem use cases. However, as with all crypto investments, volatility remains high. This article does not constitute investment advice.

What was Ethereum's price performance in July 2025?

ETH gained 54.83% in July 2025, marking its strongest monthly performance of the year and the highest in three years. The rally peaked with a 57.4% single-day gain on July 28.