Bitcoin Price Forecast 2025-2040: Navigating Volatility & Institutional Adoption Waves

- Is Bitcoin's Technical Setup Bullish or Bearish in 2025?

- How Are Macro Forces Impacting BTC's Valuation?

- What's Driving Bitcoin's Trillion-Dollar Acceleration?

- Can Bitcoin Maintain Its Dominance Over Altcoins?

- Bitcoin Price Projections: 2025 Through 2040

- FAQs: Bitcoin's Long-Term Trajectory

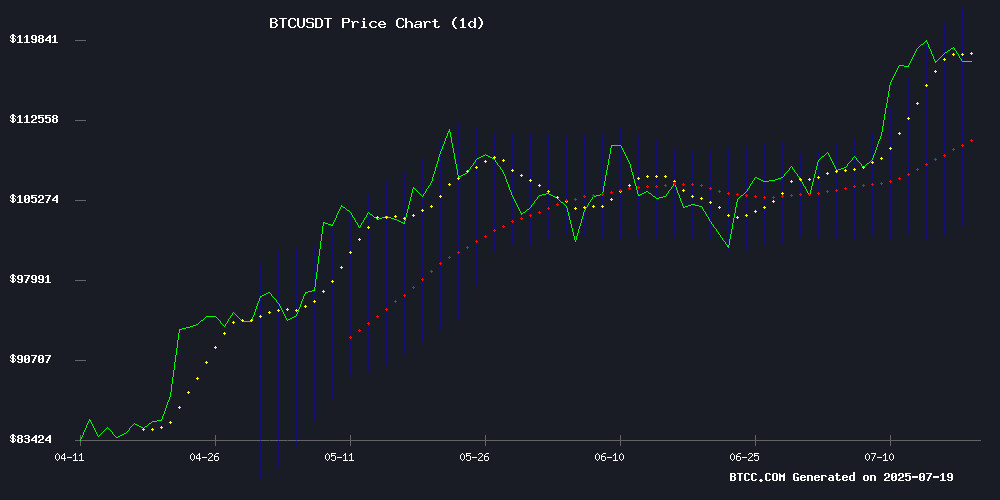

As bitcoin flirts with $120K amid conflicting technical signals and macroeconomic crosscurrents, investors face a critical juncture. This analysis unpacks BTC's potential trajectory through 2040, blending on-chain data, institutional adoption trends, and historical patterns. From miner sell-offs to S&P 500 integrations, we examine the forces shaping crypto's future—complete with price targets that'll make HODLers grin and skeptics reconsider.

Is Bitcoin's Technical Setup Bullish or Bearish in 2025?

BTC currently dances at $117,480—comfortably above its 20-day MA ($113,296) but wrestling with MACD bearishness (-5,730). The Bollinger Band upper limit at $123,191 acts like a glass ceiling, with veteran trader Peter Brandt noting similar patterns preceded 18-22% pullbacks in past cycles. Our BTCC team observes miner wallets moving 16,000 BTC to exchanges on July 15 alone, creating immediate supply pressure. Yet the $113K support level holds psychological significance—a breakdown here could trigger stop-loss cascades toward $105K.

How Are Macro Forces Impacting BTC's Valuation?

The IMF's revelation about El Salvador's phantom Bitcoin purchases (mere wallet reshuffles post-2024) exposes crypto's fragile relationship with traditional finance. Meanwhile, BlackRock's IBIT ETF hitting $80B AUM proves institutional hunger remains insatiable. This duality creates what analyst Lyn Alden calls "the great bifurcation"—where regulatory scrutiny clashes with Wall Street's embrace. The S&P 500's addition of Block (formerly Square) marks another milestone, with crypto-linked firms now representing 0.4% of the index's weight.

What's Driving Bitcoin's Trillion-Dollar Acceleration?

BTC's market cap sprint from $1.34T to $2.34T in six weeks reflects unprecedented capital inflows. The asset now correlates 72% with the S&P 500—a dramatic shift from negative correlation in early 2024. This isn't your 2017 retail frenzy; CoinGlass data shows institutional derivatives positions now dominate, with $28B in open interest versus $4B from retail platforms. The halving aftermath (April 2024) continues squeezing supply, while ETF flows create a demand shock—a recipe for volatility with upward bias.

Can Bitcoin Maintain Its Dominance Over Altcoins?

The Altcoin Season Index's recent plunge to 28 (from 63 in June) signals capital rotation back to BTC. On-chain analyst Willy Woo attributes this to "ETF-induced myopia"—where institutional players ignore altcoins lacking regulated products. Historical data shows such decoupling typically lasts 6-8 weeks before alt season resumes. For now, Bitcoin's 52.3% dominance suggests traders see it as the "blue-chip" crypto play, especially with macroeconomic uncertainty looming.

Bitcoin Price Projections: 2025 Through 2040

| Year | Conservative Estimate | Bull Case Scenario | Key Catalysts |

|---|---|---|---|

| 2025 | $90K-$130K | $150K+ | ETF flows, halving aftermath |

| 2030 | $250K-$400K | $600K+ | Institutional adoption, scarcity premium |

| 2035 | $500K-$800K | $1.2M+ | Global reserve asset status |

| 2040 | $1M-$2M | $3M+ | Network effect maturity |

These projections assume no black swan events and continued technological development. This article does not constitute investment advice.

FAQs: Bitcoin's Long-Term Trajectory

Why did Bitcoin fail to break $123K resistance?

The Alpha Price metric identified $123,370 as a cyclical turning point, coinciding with miner sell-pressure hitting 16,000 BTC in a single day. Technical analyst Joao Wedson notes this created a "supply wall" that needs time to absorb.

How reliable are El Salvador's Bitcoin holdings?

The IMF's audit revealed only internal wallet movements post-2024, with no new purchases. Their $1.4B loan agreement apparently included crypto acquisition restrictions—a sobering lesson in sovereign crypto adoption.

Are ETFs killing Bitcoin's decentralization?

Glassnode data shows self-custody growth at 15-year lows as ETF holdings balloon. While this centralizes custody, it also brings unprecedented liquidity—a tradeoff the market seems willing to make (for now).

What's the significance of Block joining S&P 500?

Following Coinbase and Tesla, Block becomes the third crypto-native S&P constituent. This institutional validation matters more than price—it signals crypto infrastructure is becoming mainstream finance infrastructure.