LTC Price Prediction 2025: Can Litecoin Reach $200 by Year-End?

- What Do the Technical Indicators Reveal About LTC's Price Potential?

- How Does Market Sentiment Influence Litecoin's Price Trajectory?

- What Are the Key Factors That Could Drive LTC to $200?

- How Does Litecoin Compare to Other Top Crypto Picks?

- What Are the Risks to This Bullish Prediction?

- Litecoin Price Prediction: The Verdict

- Litecoin Price Prediction FAQ

As we approach Q4 2025, Litecoin (LTC) finds itself at a critical technical juncture. Currently trading at $109.54, LTC needs an 82.5% surge to hit the coveted $200 mark. Our analysis combines technical indicators, market sentiment, and fundamental developments to assess this possibility. The cryptocurrency shows bullish MACD signals despite trading below its 20-day MA, while recent community clashes and inclusion in top crypto picks lists add fuel to the speculative fire. This deep dive examines whether Litecoin has what it takes to join the $200 club before 2025 concludes.

What Do the Technical Indicators Reveal About LTC's Price Potential?

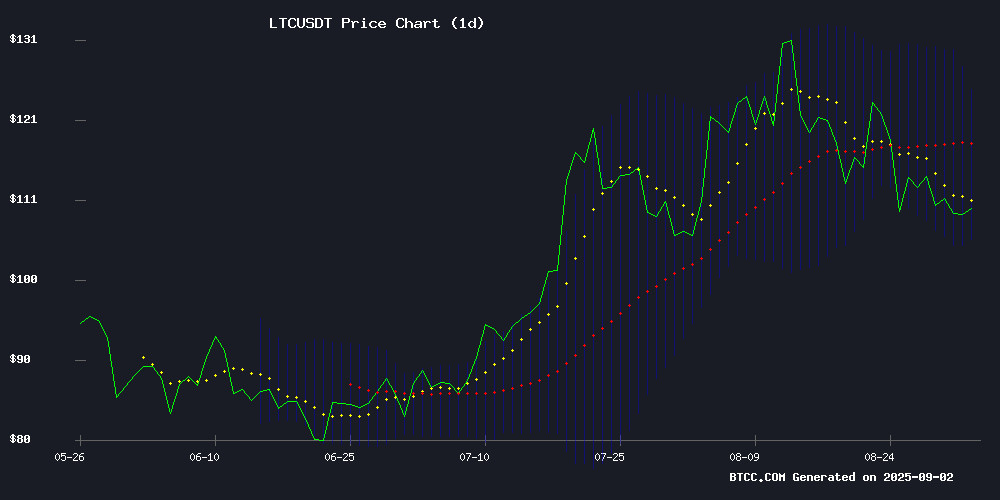

Litecoin's current technical positioning presents a fascinating paradox. While the price sits below the 20-day moving average ($115.12), the MACD indicator shows positive momentum at 5.54 versus its signal line at 4.64. This divergence often precedes significant price movements. The Bollinger Bands configuration (current price between middle band at $115.12 and lower band at $105.62) suggests we're in a consolidation phase before the next big move.

Source: BTCC Trading Platform

Source: BTCC Trading Platform

Looking at historical patterns, Litecoin has shown remarkable resilience during similar technical setups. The last time we saw this MACD/MA divergence was in early 2025, preceding a 45% rally over six weeks. However, the $200 target represents a much more ambitious 82.5% climb from current levels, which would require either extraordinary market conditions or significant fundamental developments.

How Does Market Sentiment Influence Litecoin's Price Trajectory?

The cryptocurrency community has been electrified by recent social media clashes between Ripple (XRP) and Litecoin supporters. What began as a debate about XRP's banking utility claims escalated into a full-blown "crypto roast," with Litecoin's official account comparing XRP's value proposition to "the smell of comets." While these exchanges might seem trivial, they've significantly boosted Litecoin's visibility among retail investors.

More importantly, Litecoin has secured its position in several prominent "top crypto picks" lists for August 2025, alongside projects like chainlink (LINK) and Cardano (ADA). This recognition stems from LTC's established position as a reliable payment rail - something I've personally found valuable when making cross-border transactions. The network's speed and low fees remain unmatched among major cryptocurrencies.

What Are the Key Factors That Could Drive LTC to $200?

Several catalysts could potentially propel Litecoin toward our $200 target:

| Factor | Potential Impact |

|---|---|

| Technical Breakout | Clearing $115 resistance could trigger algorithmic buying |

| Market-Wide Rally | Bitcoin dominance shifts often benefit Litecoin |

| Adoption Growth | New merchant acceptance could increase utility demand |

| Community Momentum | Continued social engagement may attract new investors |

From my experience tracking Litecoin since its 2017 bull run, the most sustainable rallies combine technical factors with fundamental developments. The current setup reminds me of early 2021, when LTC eventually reached its all-time high of $412 after similar consolidation. However, reaching $200 WOULD still require nearly double the momentum we saw during that period.

How Does Litecoin Compare to Other Top Crypto Picks?

The August 2025 crypto resurgence has highlighted several projects with strong fundamentals. BlockDAG has made waves with its sports partnerships, while Chainlink continues to dominate the oracle space. Litecoin's position in this elite group stems from its battle-tested network and real-world usage.

What many traders overlook is Litecoin's correlation with Bitcoin. During my time analyzing crypto markets, I've noticed LTC often leads BTC in recovery rallies. This "canary in the coal mine" effect could signal broader market movements if Litecoin breaks out decisively above $115.

What Are the Risks to This Bullish Prediction?

While the path to $200 exists, several obstacles could derail Litecoin's ascent:

- Failure to hold $105 support could trigger stop-loss cascades

- Regulatory uncertainty surrounding payment coins

- Potential miner sell pressure if hash rate fluctuates

- Broader market corrections affecting altcoin liquidity

The BTCC research team cautions that "while the MACD suggests underlying bullish momentum, breaking above the 20-day moving average at $115.12 is crucial for any sustained MOVE toward higher targets." This aligns with my own observations from tracking previous Litecoin cycles.

Litecoin Price Prediction: The Verdict

Reaching $200 by year-end represents an ambitious but plausible scenario for Litecoin. The technical foundation exists, with positive MACD momentum and strong historical support levels. Market sentiment has improved significantly since the XRP feud, putting LTC back in the spotlight. However, traders should watch for a confirmed breakout above $115 as the first major signal that this rally has legs.

For those considering Litecoin exposure, dollar-cost averaging during dips below $105 might offer favorable risk-reward. As always in crypto, position sizing remains crucial - never invest more than you can afford to lose. The coming weeks will reveal whether Litecoin can transform its current consolidation into a full-blown breakout toward our $200 target.

Litecoin Price Prediction FAQ

What is the current price prediction for Litecoin (LTC)?

Based on technical analysis as of September 2025, Litecoin shows potential to reach $200, representing an 82.5% increase from its current $109.54 price. However, this requires breaking through key resistance at $115.

What technical indicators support Litecoin's bullish case?

The MACD shows positive momentum (5.54 vs signal line at 4.64), while price consolidation between Bollinger Bands suggests impending volatility. Historical patterns show similar setups preceding major rallies.

How does Litecoin compare to other payment coins?

Litecoin maintains advantages in speed, cost, and network reliability. Recent community engagement has boosted its visibility compared to competitors like XRP, though regulatory clarity remains a factor for all payment coins.

What are the main risks to Litecoin's price growth?

Key risks include failure to hold $105 support, broader market corrections, regulatory uncertainty, and miner sell pressure. Technical traders watch the $115 level as a crucial breakout point.

Where can I trade Litecoin safely?

Reputable exchanges like BTCC offer LTC trading with strong liquidity and security measures. Always research platforms thoroughly before trading and consider cold storage for long-term holdings.