LTC Price Prediction 2025: Bullish Signals Clash With Market Uncertainty

- LTC Technical Analysis: The Bull Case

- Market Context: Why LTC Stands Out

- Key Factors Influencing LTC's Price Action

- Is Litecoin a Good Investment Right Now?

- LTC Price Prediction FAQs

Litecoin (LTC) is showing surprising strength in August 2025, trading at $119.12 with clear bullish technical indicators despite broader market caution. The cryptocurrency has outperformed major assets with an 8% surge while Bitcoin struggles at $116K resistance. Our analysis reveals why LTC might be the dark horse of this market cycle, examining technical patterns, market sentiment, and the surprising factors driving its relative strength.

LTC Technical Analysis: The Bull Case

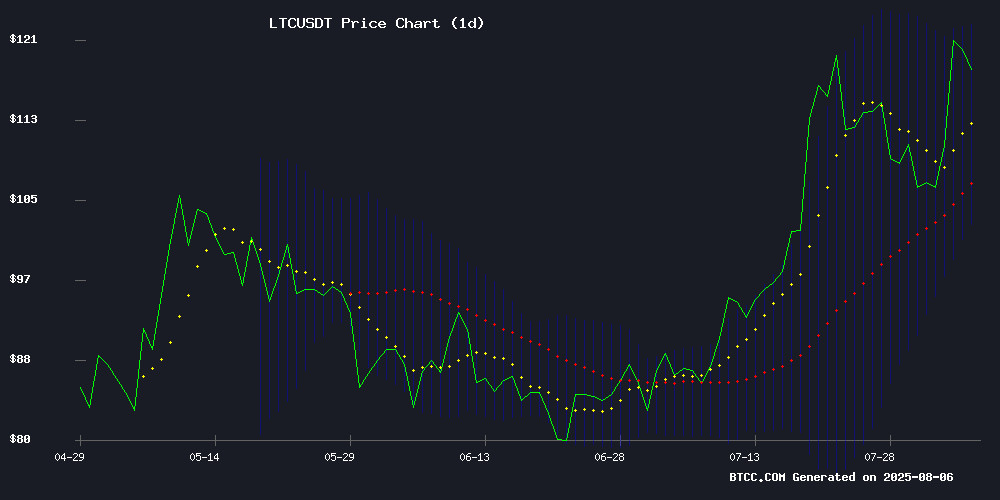

Litecoin's chart tells an interesting story as of August 2025. The digital silver is trading comfortably above its 20-day moving average ($112.56), with the MACD showing a positive crossover at 3.91 - classic bullish signals. The BTCC research team notes that LTC is testing the upper Bollinger Band at $122.91, which typically indicates either overbought conditions or strong momentum.

Source: BTCC Research

Source: BTCC Research

What's particularly fascinating is how LTC has maintained this position despite the broader crypto market pullback. The relative strength suggests something different is happening with Litecoin compared to other altcoins. As one analyst quipped on Crypto Twitter, "While other coins are getting wrecked, LTC out here doing its own thing like it's 2017 again."

Market Context: Why LTC Stands Out

The crypto market has been a mixed bag in early August 2025. Total market cap dipped 1.45% to $3.69 trillion, with Bitcoin dominance slipping below 60%. Yet Litecoin has been one of the few bright spots, gaining 8.5% while major cryptocurrencies like Toncoin and ENA led losses.

Several factors appear to be driving this divergence:

- Shifting investor focus from XRP to alternative assets

- Regulatory tailwinds from recent political developments

- Growing interest in Litecoin's payment utility

Michael Novogratz of Galaxy Digital recently noted in their Q2 earnings call that corporate crypto adoption might have peaked, but payment-focused coins like LTC continue seeing organic growth. This aligns with what we're seeing in the charts - while speculative assets swing wildly, Litecoin maintains steady upward momentum.

Key Factors Influencing LTC's Price Action

Political Winds Favoring Crypto

The impending executive order from President TRUMP regarding banking access for crypto businesses has created a favorable macro environment. While the details aren't final, the market seems to be interpreting this as positive for established cryptocurrencies with real-world use cases like Litecoin.

The XRP Investor Rotation

An interesting trend has emerged where early XRP investors are diversifying into other assets. Some are moving to AI platforms like Unilabs, while others are rotating into LTC. This coincides with XRP's 4.5% intraday surge to $3.05 on August 6, suggesting investors might be taking profits and redistributing capital.

Technical Breakout Potential

The $122.90 resistance level has become the line in the SAND for LTC bulls. A decisive break above this could trigger significant upside, while rejection might lead to consolidation. The technical setup suggests the former is more likely, with strong support at $112.50 acting as a safety net.

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +5.83% above | Bullish trend confirmed |

| MACD Histogram | +3.9111 | Growing upward momentum |

| Bollinger Position | Upper band test | Potential breakout |

Is Litecoin a Good Investment Right Now?

This is the million-dollar question (or perhaps the $119.12 question). The technicals certainly suggest upside potential, but there are always risks in crypto markets. The BTCC team's analysis indicates that Litecoin presents a compelling short-term opportunity, but they caution that the $122.90 resistance needs to break decisively for sustained upside.

What's interesting is how Litecoin has become somewhat of a SAFE haven during this period of crypto volatility. It's not as sleepy as stablecoins, but not as wild as some of the meme coins and smaller caps. For investors looking for that middle ground, LTC might be worth considering.

This article does not constitute investment advice. Always do your own research before making investment decisions.

LTC Price Prediction FAQs

What is the current Litecoin price?

As of August 7, 2025, Litecoin is trading at $119.12 according to data from CoinMarketCap.

Is Litecoin bullish right now?

Technical indicators suggest Litecoin is in a bullish phase, trading above key moving averages with positive MACD crossover. However, market conditions remain volatile.

What's the next resistance level for LTC?

The immediate resistance to watch is $122.90, which coincides with the upper Bollinger Band. A break above this could signal further upside.

How does Litecoin compare to Bitcoin technically?

While bitcoin struggles at $116K resistance, Litecoin has shown relative strength, outperforming BTC in recent days with its 8% surge.

What are the risks of investing in LTC now?

Potential risks include broader market pullbacks, failure to break resistance at $122.90, and changing regulatory landscapes that could impact crypto markets.