Ethereum Price Prediction 2025: Will ETH Hit $4,000 This Week as Bulls Take Control?

- Is Ethereum Primed for a Breakout to $4,000?

- Institutional Demand vs. Whale Activity: Who's Winning?

- What's Driving Ethereum's Current Rally?

- Analyst Predictions: Where Does ETH Go From Here?

- Ethereum Price Prediction FAQ

Ethereum is showing strong bullish momentum as technical indicators and market sentiment align for a potential push toward $4,000. With ETH currently trading at $3,458.31, analysts point to institutional accumulation, reduced bearish momentum, and breaking through key resistance levels as signs of continued upside. However, whale activity and large short positions create near-term volatility. This analysis examines the competing forces shaping ETH's price trajectory and provides two potential scenarios for the coming week.

Is Ethereum Primed for a Breakout to $4,000?

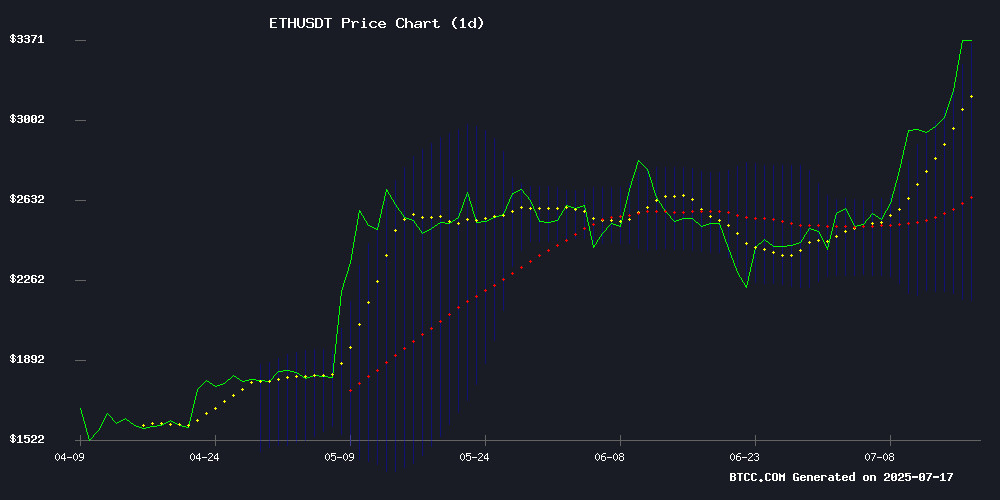

Ethereum's price action has crypto traders buzzing as ETH shows all the signs of a major breakout. Currently trading at $3,458.31, the second-largest cryptocurrency has surged past its 20-day moving average ($2,765.76) and breached the upper Bollinger Band ($3,380.34). While this typically indicates overbought conditions, in strong uptrends it can precede extended rallies.

The MACD histogram, while still negative at -114.79, shows narrowing bearish divergence - suggesting weakening downward pressure. "We're seeing textbook bullish signals," notes a BTCC market analyst. "The $3,400 breakout was significant, and if ETH can hold above $3,300, the path to $4,000 looks increasingly plausible."

Institutional Demand vs. Whale Activity: Who's Winning?

The market presents a fascinating tug-of-war between institutional accumulation and whale profit-taking. On the bullish side, SharpLink Gaming has emerged as Ethereum's largest corporate holder, surpassing even the ethereum Foundation. Their recent buying spree - adding 20,279 ETH ($68.38 million) on Thursday alone - brings their total holdings to 321,000 ETH with an average purchase price of $2,745.

However, whale activity tells a more cautious story. Over $374 million in ETH moved across exchanges in just four hours, including a $127 million transfer to Kraken. Even more telling, a prominent trader took a $62.42 million short position against ETH at $3,060, already sitting on $1.14 million in unrealized profits as of July 17.

What's Driving Ethereum's Current Rally?

Several factors are fueling ETH's upward momentum:

- Institutional Adoption: Public companies like SharpLink Gaming and Bit Digital have collectively acquired 570,000 ETH over two months

- Derivatives Activity: Open interest swelled by 1.84 million ETH in July while maintaining healthy funding rates

- Staking Growth: Staking pools absorbed an additional 1.51 million ETH since June

- Technical Breakout: ETH broke through key resistance at $3,150 and $3,250 before testing $3,423

Interestingly, Ethereum has now become the 30th largest global asset by market cap, overtaking Johnson & Johnson. This milestone seems to be attracting more institutional attention.

Analyst Predictions: Where Does ETH Go From Here?

Crypto analyst Kaleo (@CryptoKaleo) has gained attention for predicting a potential "God candle" that could send ETH soaring past $4,000 this week. The ETH/USDT pair has been trading within an ascending wedge pattern for over three months, and the recent breakout above $3,030 has reignited bullish sentiment.

The BTCC research team outlines two primary scenarios:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish | $4,200-$4,500 | Sustained close above $3,500 with declining MACD histogram |

| Consolidation | $3,200-$3,600 | Whale selling pressure counters institutional demand |

Key levels to watch include resistance at $3,680 (1.618 Fibonacci extension) and support at $3,150 (20-day MA convergence). The $3,500 zone appears critical - a decisive break above could trigger the MOVE to $4,000 that many are anticipating.

Ethereum Price Prediction FAQ

What is the Ethereum price prediction for July 2025?

Analysts predict Ethereum could reach $4,000-$4,500 in July 2025 if bullish momentum continues, with $3,200-$3,600 as a consolidation range if selling pressure increases.

Why is Ethereum price rising?

ETH's rise is driven by institutional accumulation (like SharpLink Gaming's purchases), growing derivatives activity, increased staking, and technical breakout above key resistance levels.

What are the key levels to watch for ETH?

Critical levels include support at $3,150 and resistance at $3,680, with the $3,500 zone being particularly important for determining the next major move.

Is now a good time to buy Ethereum?

While technical indicators suggest bullish potential, the significant whale activity and short positions indicate volatility. This article does not constitute investment advice.

How does institutional activity affect ETH price?

Institutional buying (like SharpLink's $68 million purchase) creates strong support levels, while large transfers to exchanges can signal impending sell pressure.