Bitcoin Defies Gravity at $117,500 as Retail Investors Step Up While Whales Watch Silently – Should You Worry?

Retail traders just flipped the script on crypto's usual power dynamics.

Bitcoin's holding firm above the $117,500 mark—not because institutional whales are buying, but thanks to steady support from everyday investors. The big players? They're sitting this one out, watching from the sidelines with uncharacteristic quiet.

What’s Driving Retail Confidence?

Mainstreet’s stepping up where Wall Street hesitates. Smaller wallets keep accumulating, showing conviction even as large holders take a breather. It’s a vote of confidence—or maybe just FOMO dressed as strategy.

Is Whale Silence a Red Flag?

When whales go quiet, markets listen. Their absence often signals caution, or worse—indecision. But this time, retail volume’s picking up the slack, pushing back against typical sell-pressure patterns. Still, no one likes a party where the hosts don’t show up.

Where Does Bitcoin Go From Here?

If retail keeps buying, this could get interesting. Momentum’s building, but one sharp whale move could still wreck the vibe. Classic crypto—where “financial innovation” means hoping the next person pays more than you did.

Bitcoin Holds $117,500 Amid High Retail Inflows

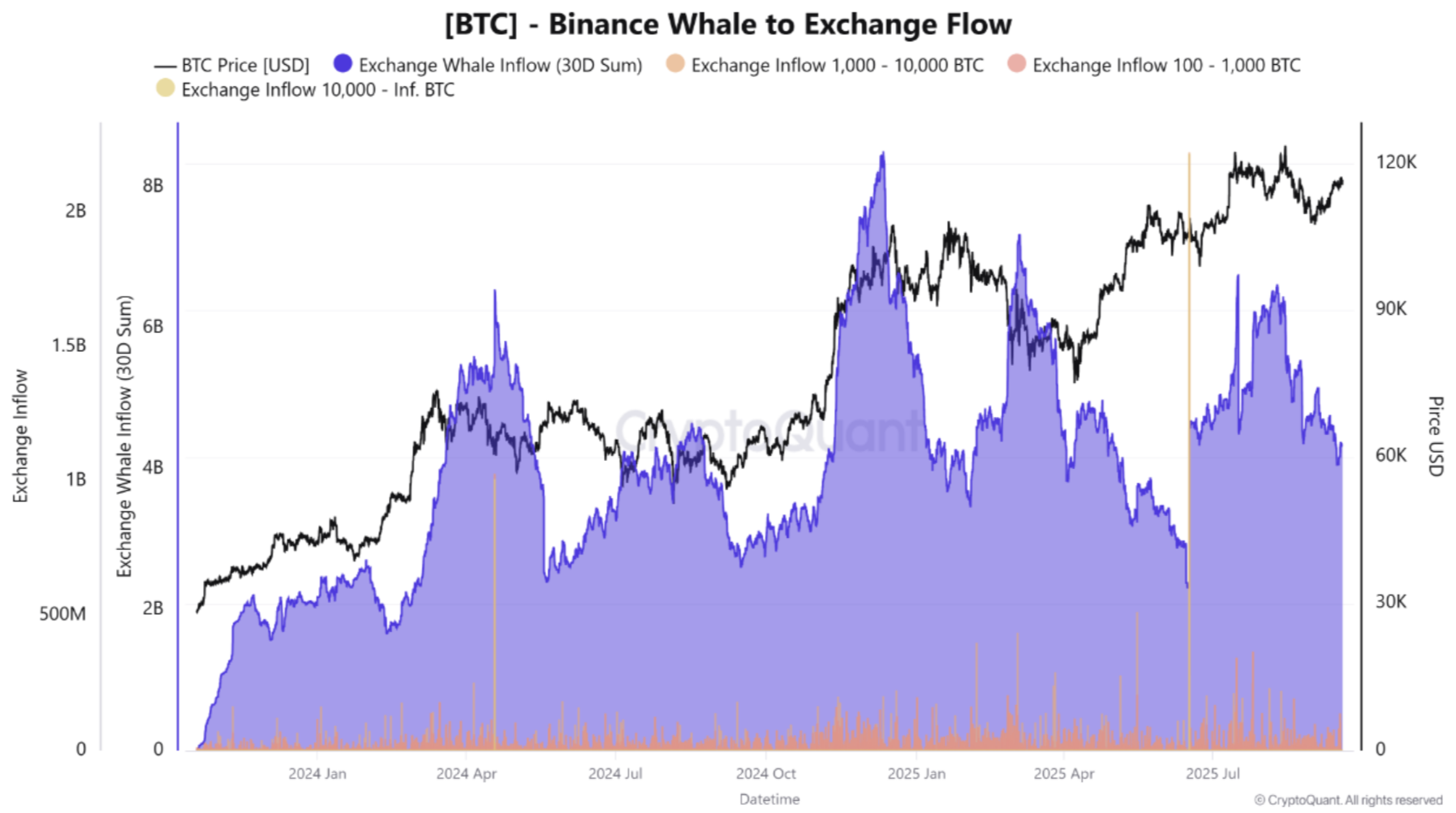

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin is hovering around the $117,500 price level, supported by active inflows from retail investors. Notably, large whale inflows have been completely absent, indicating that the current market is being driven by individuals more than by large wallets.

Inflows ranging from 0 to 0.001 BTC recorded approximately 97,000 BTC. Similarly, inflows from the 0.001 to 0.01 BTC segment totaled nearly 719,000 BTC.

The distribution above suggests that Bitcoin’s current rally is largely driven by retail investors. These investors conduct numerous but small-volume transactions, confirming that individual investors are shaping the market dynamics. Arab Chain added:

The figures reveal that the bulk of inflows are concentrated in small and medium-sized transactions, reflecting the dominance of retail activity in bitcoin trading. This liquidity, despite its limited scale, has helped keep the market balanced at current levels.

It is worth emphasizing that there has been almost no whale pressure during the current market rally. Specifically, no significant surges in inflows of more than 100 BTC were observed, mitigating the likelihood of a sharp short-term price correction.

To conclude, the current market situation shows that Bitcoin is experiencing a state of equilibrium, largely due to heightened retail investor participation. Such a scenario gives the market an opportunity to steadily surge toward the important $120,000 resistance level.

That said, it WOULD be wise to keep an eye on any whale activity, as it could quickly alter the market’s direction. Any sudden entry of whale inflows could trigger a rapid price correction, similar to previous market tops.

Experts Divided On BTC Price Action

As Bitcoin trades about 5.4% below its all-time high (ATH), there are signs that the top cryptocurrency by market cap may be on the cusp of a fresh rally. For instance, BTC recently broke above the mid-term holder breakeven, reducing the likelihood of an immediate sell-off.

Recent positive developments – such as the US Federal Reserve (Fed) reducing interest rates by 25 basis points – could reinvigorate the crypto market. Against that backdrop, crypto entrepreneur Arthur Hayes recently reiterated his ambitious $1 million BTC prediction.

That said, Gold bug Peter Schiff opines that BTC has likely already peaked for this market cycle. At press time, BTC trades at $117,523, up 1.8% in the past 24 hours.