Ethereum Dominates $3.75 Billion Crypto Surge as XRP and Solana Ride the Wave

Crypto markets just witnessed their biggest capital injection in months—and Ethereum isn't just leading the charge, it's dragging the entire sector forward.

The $3.75 Billion Flood

Money's pouring back into digital assets, and it isn't subtle. Ethereum scooped up the lion's share—no surprise given its institutional cred and DeFi dominance. But the real story? XRP and Solana aren't just along for the ride; they're grabbing meaningful slices of the inflow pie.

Altcoins Wake Up

While Bitcoin often hogs the spotlight, this round belongs to the alternatives. Solana's speed narrative and XRP's regulatory clarity play are pulling weight. Traders are clearly diversifying—not just stacking the usual suspects.

Institutional Money Talks Louder

This isn't retail FOMO. These numbers scream institutional moves—hedge funds, family offices, maybe even a few brave ETFs. They aren't betting on memes; they're positioning for the next cycle.

Finance's 'I-told-you-so' Moment

Wall Street still thinks crypto's a casino—right up until it isn't. Another few weeks of inflows like this, and even the suits might have to admit digital assets aren't just a side show. Or they'll miss the boat—again.

Ethereum’s Record-Breaking Numbers

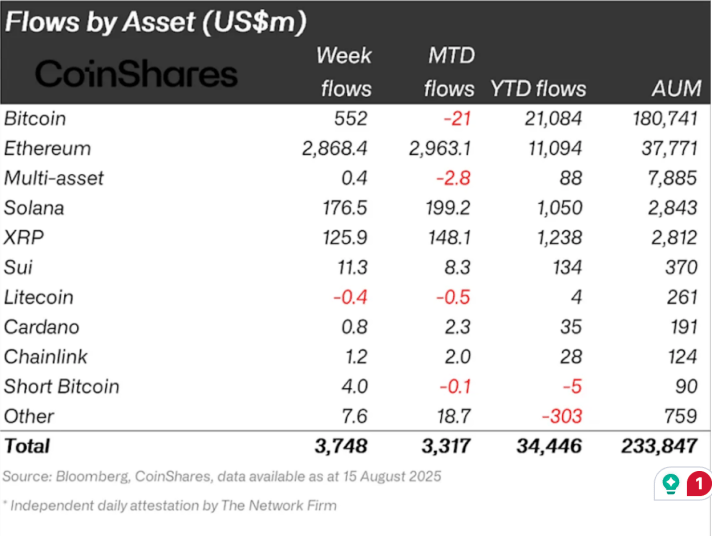

Ethereum witnessed the most activity last week since the 2021 bull run that took many crypto investors by surprise. In terms of crypto-based products, Ethereum managed to displace Bitcoin’s supremacy last week by leading with $2.87 billion in inflows, representing 77% of the total $3.75 billion. This performance brought its year-to-date inflows to $11.094 billion, which is about 29% of total Ethereum assets under management.

The intensity of institutional demand had an immediate impact on Ethereum’s market price action. Notably, the ethereum price surged to $4,776 last week, its highest level since the 2021 bull market.

In terms of geographical location, most of the inflows came from the United States, with $3.725 billion in inflows, more than 99% of the total. This concentration was mostly by iShares ETFs. Smaller but meaningful contributions came from Canada with $33.7 million, Hong Kong with $20.9 million, and Australia with $12.1 million. On the other hand, Brazil and Sweden posted outflows of $10.6 million and $49.9 million, respectively.

Although Bitcoin also managed to push to a new all-time price high of $124,128 last week, the leading cryptocurrency took a step back in institutional inflows. Bitcoin brought in $552 million last week. Although its year-to-date inflows are larger in absolute terms at $21.08 billion, they represent only 11.6% of its total assets under management (AuM), compared to Ethereum’s 29%.

XRP And Solana Join The Party

Although Ethereum captured most of the inflows, both solana and XRP also attracted notable inflows that show the altcoins are gaining strength among institutional investors, despite the absence of spot crypto ETFs for these assets in the US market.

Solana-based products recorded $176.5 million, bringing its monthly flows to $199.2 million and its year-to-date figure to $1.05 billion. Effectively, this means that Solana-based products witnessed 89% of their total monthly inflow and 16.8% of their year-to-date inflow last week.

XRP witnessed about $125.9 million worth of inflows last week, boosting its monthly total to $148.1 million and its 2025 total to $1.238 billion. As such, XRP-based products also witnessed 85% of their total monthly inflow and 10% of their year-to-date inflow last week.

Sui, Cardano, Chainlink, and Short Bitcoin products also witnessed $11.3, $0.8 million, $1.2 million, and $4 million in inflows, respectively, last week. The only major exception was Litecoin, which diverged from the broader trend and recorded net outflows of $400,000.