Bitcoin Stumbles—But Don’t Count Out the $135K Dream Yet

Market nerves are fraying as Bitcoin takes a breather—just another Tuesday in crypto land. The king of digital assets dipped its toes in red, triggering the usual chorus of 'bull market over' hot takes. But here’s the twist: that $135K price target isn’t dead yet.

Corrections Happen—Even in Neverland

Pullbacks sting, but they’re the market’s way of whispering 'calm down.' Bitcoin’s 20% retreat from its 2025 peak isn’t a collapse—it’s a reality check for traders who thought gravity got canceled. Remember: every ATH needs a cooldown.

The $135K Gambit Still Stands

Yes, the charts look messy. No, the macro hasn’t magically fixed itself (looking at you, Fed). But the institutional FOMO pipeline—ETFs, halving tailwinds, and that one hedge fund manager who finally 'gets it'—hasn’t evaporated. Price targets aren’t prophecies, but the math still works.

Bottom Line: Panic Is a Luxury

Wall Street’s still overpaying for 'crypto consultants' while retail traders hyperventilate over 4-hour candles. Bitcoin’s playing the long game—whether you’ve got the stomach for it is another question.

Traders Watch Price Levels Closely

Popular market watcher Daan crypto Trades pointed out that Bitcoin’s struggle to pick a direction isn’t unusual. He noted the coin has been locked between support and resistance zones, with neither bulls nor bears taking control. It’s the kind of setup that often leads to big moves once one side gives in.

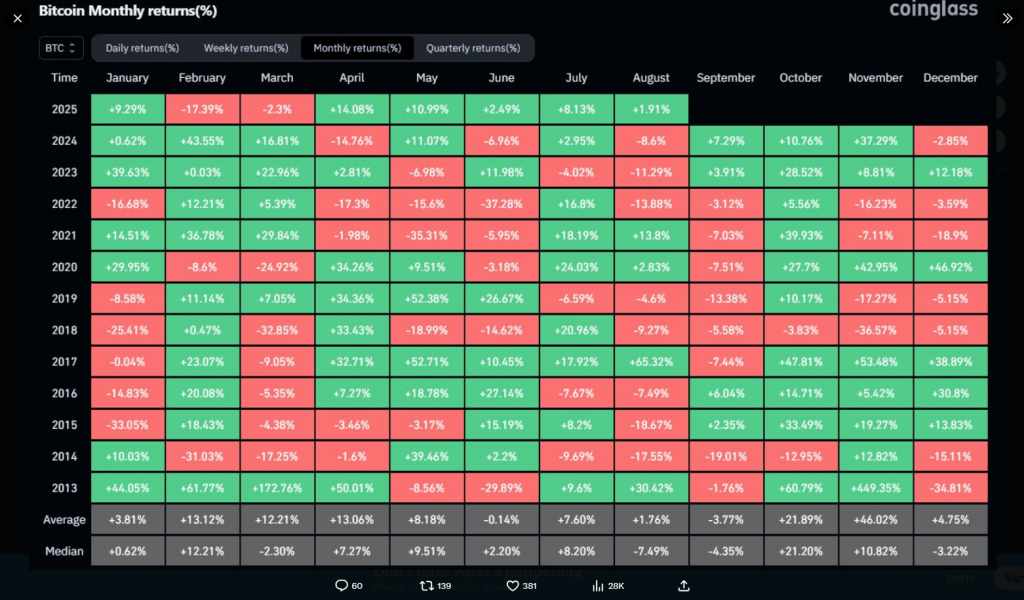

$BTC August has been pretty uneventful for Bitcoin so far. We’ve seen some movement but no clear direction as price consolidates in this current range.

Never in history, has BTC seen both a green August and September. We tend to see a quick flush followed by an explosive Q4 in… pic.twitter.com/cClxJUG6Vh

— Daan Crypto Trades (@DaanCrypto) August 17, 2025

Meanwhile, technical evidence sends mixed signals. By September 16, 2025, bitcoin will reportedly hit at least $130,266, which is a 13.07% increase compared to the previous prediction.

The Fear & Greed Index is currently at 60, indicating that greed is on the menu, while sentiment indicators are neutral.

In the last 30 days, Bitcoin had 14 green sessions out of 30, and the average performance remained on the positive at 1.63%. That isn’t extreme, but it does indicate that traders are being cautious.

Analysts Split On What’s Next

There are a few investors who believe the current lull is nothing but a breather before another rally. They say that buying interest remains high, particularly with long-term demand coming from institutions.

Skeptics, however, believe the latest rejection at higher levels is a sign of weakness and that another pullback opportunity has opened up.

Jitters in the marketplace always invite disorientation, and this moment is no exception. A 13% gain sounds exciting, but sentiment may change in a heartbeat if the Bitcoin price loses the entire support level.

Traders are keen to see if momentum will pick up or if the sideways chop will continue.

Is It A Good Time To Buy?

Based on technical indicators, reports suggest it may still be a decent entry point. But timing is tricky. With price forecasts pointing toward $130K and resistance overhead, the next few weeks could decide the short-term trend.

Some see this as a chance to accumulate, while others WOULD rather wait for a clearer breakout.

For now, Bitcoin sits in limbo. Traders are scanning the charts, looking for clues on whether the path to $135K is still alive — or if the market is setting up for another surprise.

Featured image from Adobe Stock, chart from TradingView