USELESS Coin Defies Expectations—Skyrockets 52% Post-Binance Listing

From punchline to profit engine—USELESS Coin just pulled off the ultimate crypto irony.

Binance's stamp of approval sends 'meme' token into orbit

Who's laughing now? The token that dared call itself USELESS just delivered a 52% gut punch to skeptics after securing a Binance listing. Traders piled in like it was a free airdrop, proving once again that in crypto, branding matters more than utility.

Market mechanics at work: When the world's largest exchange whispers, speculators shout. The 52% surge came on textbook exchange listing psychology—liquidity meets hype meets FOMO. Never mind that the project's whitepaper reads like an inside joke.

The cynical take: Another day, another token proving that in 2025's market, you don't need fundamentals—just an exchange willing to play along. At least this one's honest about its priorities with that name.

Exchange Listings Fuel Hype

Reports have disclosed that other platforms moved quickly. Kraken listed the token amid the buzz, and Coinbase added USELESS to its listing roadmap, making the token visible to US markets.

That wider exposure appears to have attracted new buyers and attention. Some traders said that easing crypto rules and exchange access were helping memecoins get more eyes and more capital.

Deposits for $USELESS are now open on https://t.co/AZwoBOh0gq!

Trading on the USELESS/USDT pair will begin on Aug 14 at 7 a.m. EDT.@theuselesscoin is Solana’s unapologetically pointless memecoin, a parody of “serious” crypto that thrives on meme power and a growing community.

— Binance.US![]() (@BinanceUS) August 13, 2025

(@BinanceUS) August 13, 2025

Buyers Pushed Early And Some Took Profits

Orderbook snapshots showed heavy bids before the Binance announcement, and some market watchers flagged those buys as suspicious.

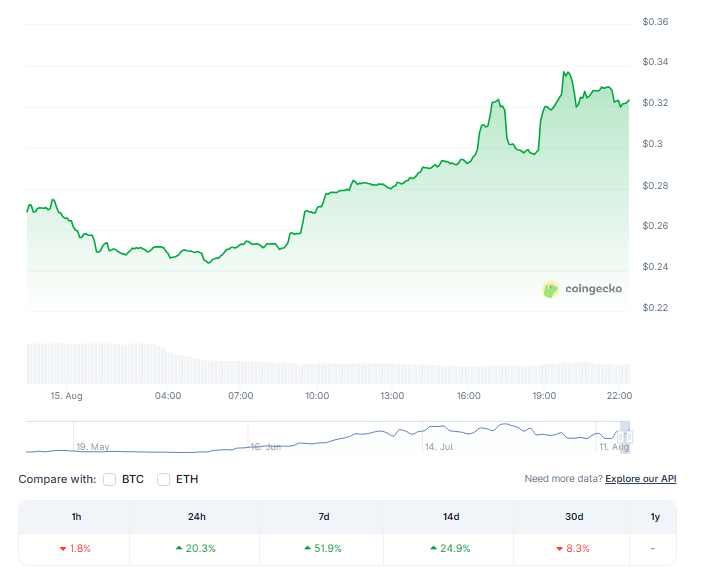

Insider buying is a common concern around listings, and the timing here raised eyebrows. After the launch, price shot to $0.31 from $0.22, then cooled as profit-taking set in. By the second day, buy-side depth had thickened while taker buy/sell volume began to ease.

Trading activity spiked. Daily volume reached $420 million, which was more than 1.5x the token’s market cap according to trade tallies. In the run-up and immediate aftermath, overall activity rose by almost 300%.

Recovery phase for Bonk’s pairs, led by hard-working communities that never stopped during the bear days.#USELESS target is $5B.$KORI, $MOMO, and #旺柴: each aiming for at least $300M.

The Bonk community stands apart from other launchpad platforms, with projects here often… pic.twitter.com/dKwIMmbtJW

—![]() GEM DETECTER

GEM DETECTER![]() (@gem_detecter) August 14, 2025

(@gem_detecter) August 14, 2025

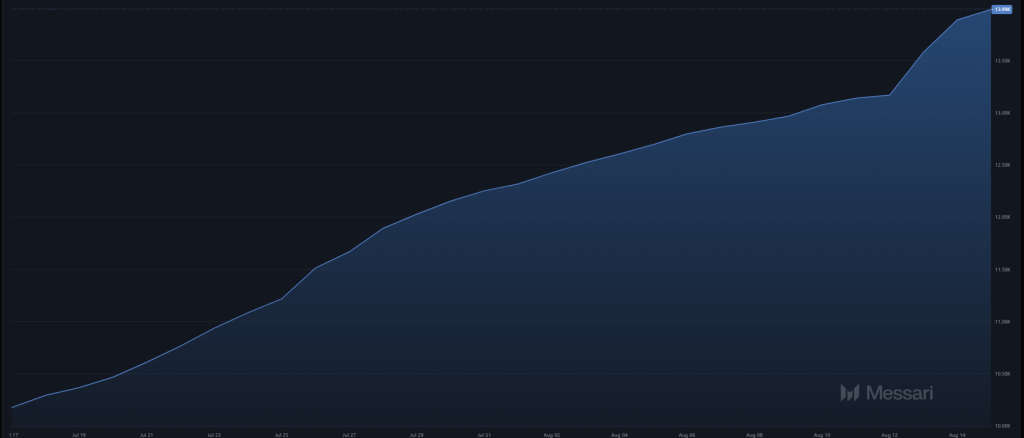

On decentralized exchanges, netflows put USELESS at the top of the list among the top 10 coins by netflow, even ahead of Bonk [BONK]. Gem Detector data on X showed USELESS as the most held token among the platform’s top four memecoins, a sign that community interest was strong.

Technical indicators signaled higher volatility as Bollinger Bands widened. The midpoint of the bands sits NEAR an earlier resistance at $0.27, which could act as the next support.

Resistance around $0.33 looks to be a key pivot; a clear break above that might open a path toward $0.40. If $0.27 fails, the token could slip back to $0.22, the level where the surge began. Aggregated spot and bid delta hit its highest level since launch, even as taker buy volume tapered off.

Featured image from X/@theuselesscoin, chart from TradingView