Chainlink Whales Go on a Buying Spree — Is a LINK Price Surge Imminent?

Whale activity for Chainlink just hit levels not seen since January 2025 — and the market's buzzing. When big players move, retail traders scramble to decode the signals. But is this a genuine bull rally or just another pump-and-dump waiting to happen?

LINK's price action has been sluggish lately, but whale wallets don’t lie. Or do they? The last time accumulation spiked like this, LINK rallied 40% in three weeks. History doesn’t repeat, but it often rhymes — especially when Wall Street’s crypto tourists start ‘discovering’ DeFi oracles.

Here’s the kicker: Chainlink’s fundamentals are stronger than ever. Mainstream adoption of its price feeds keeps growing, and the staking v2 upgrade gave tokenomics real teeth. Yet somehow, LINK still trades like it’s 2021 — volatile, misunderstood, and perpetually undervalued by TradFi analysts who think ‘blockchain’ is a type of Excel formula.

Watch the $15 resistance level. Break that, and we could see FOMO fuel a run toward $20. Fail, and well… at least the whales got a nice tax write-off.

LINK Whales Make Big Moves

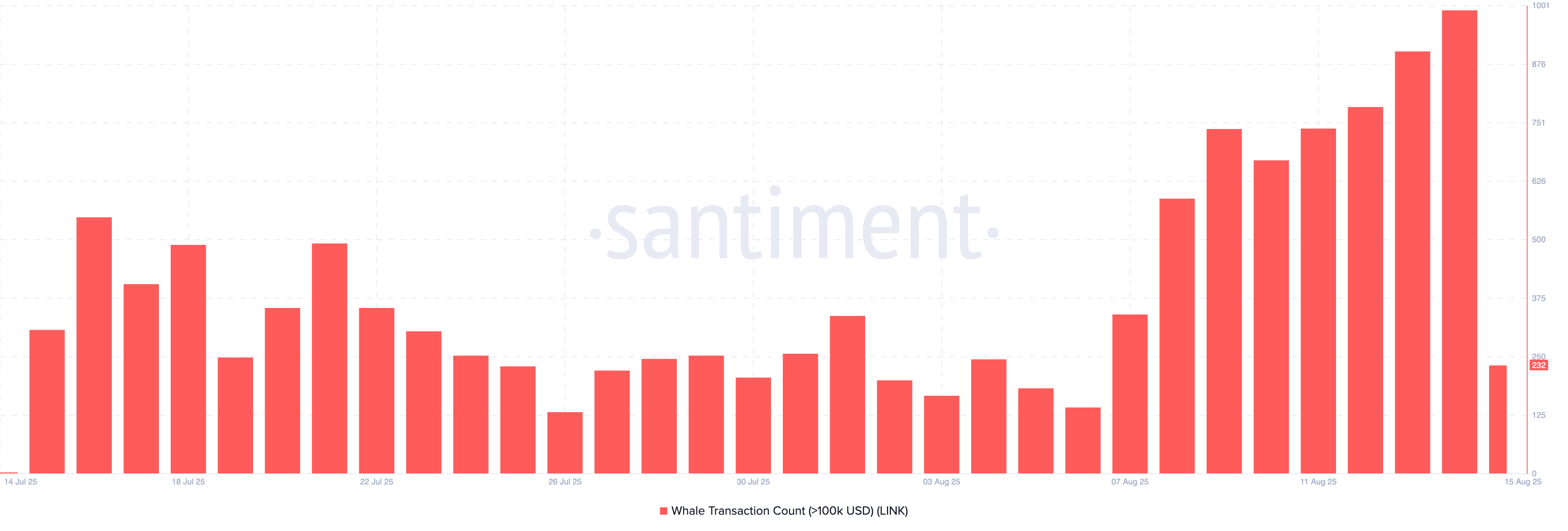

On-chain data has shown that the count of LINK whale transactions exceeding $100,000 soared to a seven-month high of 992 on Thursday.

![]() LATEST: $LINK Rallies Nearly 40% in a Week as Whale Activity Surges

LATEST: $LINK Rallies Nearly 40% in a Week as Whale Activity Surges![]()

![]() Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.

Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.

On the on-chain side, we're seeing the most active $LINK addresses in 8 months, and most whale… pic.twitter.com/fRio7S0PZ8

This uptick in high-value transfers helped drive LINK’s price to a high of $24.31, just 2% shy of the previous day’s close, before easing lower.

As of today, 232 whale transactions worth more than $100,000 have already been recorded. This suggests continued interest from deep-pocketed investors despite today’s broader market consolidation.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

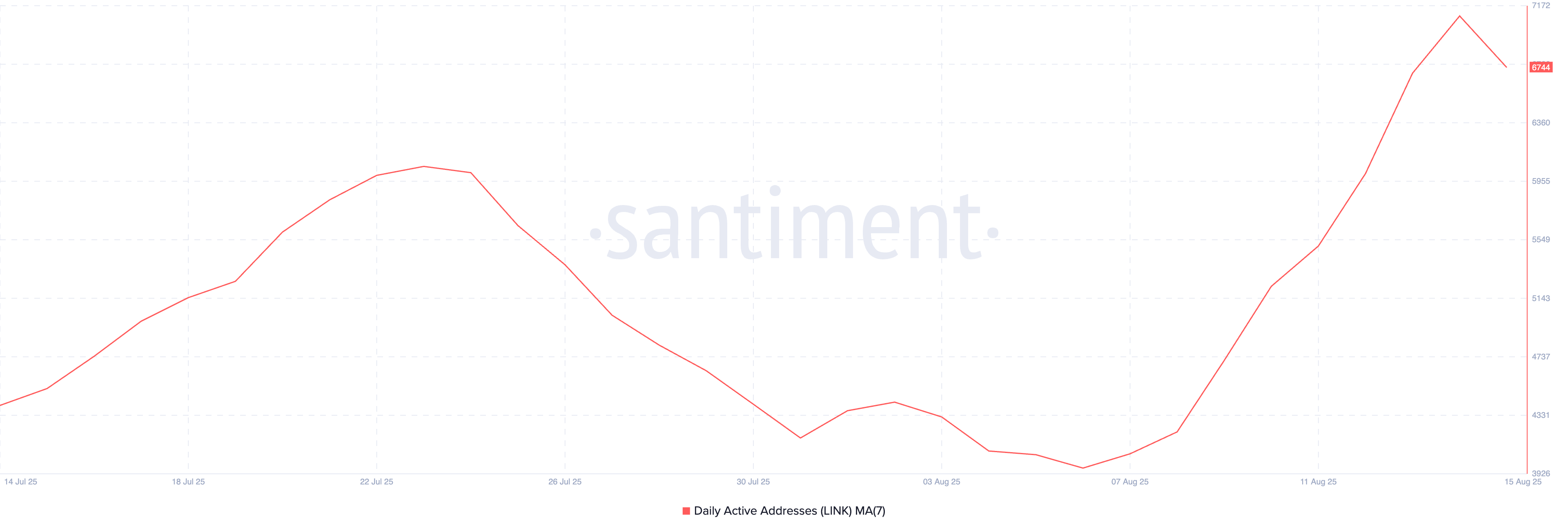

In addition, the number of daily active addresses trading LINK has also trended higher, signaling increased on-chain engagement. Per Santiment, this, observed using a seven-day moving average, has risen by 55% since the beginning of August.

This steady uptick suggests that while whales are active, broader participation from the LINK traders is also growing, confirming climbing interest in the asset despite recent market volatility.

LINK Price Poised for Breakout if $22.21 Support Holds

Higher active address counts reflect stronger network usage on Chainlink. If this trend continues alongside increased whale demand for LINK, it could strengthen the support at $22.21. In this scenario, LINK could rally toward $25.55.

Conversely, if the support floor weakens and gives way, LINK’s price could drop to $19.51.