Chainlink Shatters 3-Month High as 2025 Bull Run Ignites Market Frenzy

Chainlink's oracle network just punched through its highest price level since May 2025—and the crypto crowd's losing their minds.

Why the sudden surge?

Turns out even Wall Street's starting to wake up to what crypto natives knew years ago: you can't build DeFi 2.0 without bulletproof price feeds. Chainlink's racking up partnerships faster than a VC fund during an ICO boom.

The institutional angle

BlackRock's tokenized fund announcement last week mentioned Chainlink integrations three times—which, in banker-speak, counts as screaming from the rooftops. Meanwhile, Goldman's quietly testing the waters with their own node.

Funny how the same suits who called this "niche tech" in 2022 are now scrambling to get in before the real fireworks start. Typical herd mentality—just with more blockchain jargon.

Community Momentum And Market Moves

Reports have highlighted a spike in bullish talk from Chainlink’s community, often called “marines,” and on-chain activity that traders are watching closely.

Based on Etherscan data, one token contract reportedly bought back roughly 40,000 LINK units in an hour via Uniswap V3, which traders said added fuel to the rally.

Sentiment trackers show a notable upswing, and trading charts reflect a string of green days that pushed prices into the mid-twenties.

Chainlink’s Role In RWA And Policy Debates

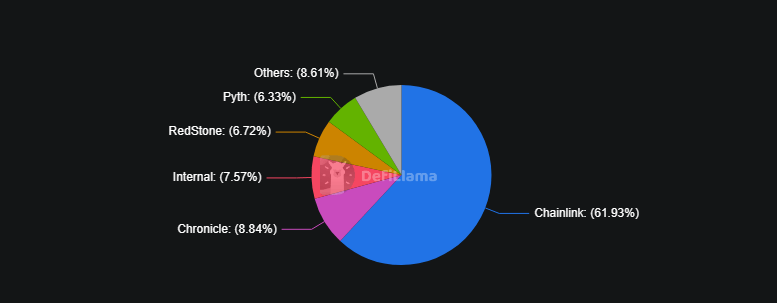

Based on reports, Chainlink now secures over $62 billion in total value that relies on its oracle feeds, a figure that was put at about 60% of the oracle market.

The project is reported to provide data for 450 projects across 21 chains. LINK’s exposure to real-world assets also gets attention: reports place Chainlink-linked RWAs at nearly $16 billion out of a $57 billion RWA space.

The project was mentioned in recent White House digital asset frameworks as an example of oracle usage, which added another LAYER to the story driving interest.

According to short-term forecasts cited by some providers, LINK could rise by 7% to reach $25 by September 13, 2025.

Market indicators shown in those reports mark current sentiment as Bullish, with the Fear & Greed Index at 75 (Greed).

LINK recorded 19/30 green days over the past month, with price volatility at about 10% for the same period.

Active daily transactions on Chainlink’s token have climbed during this rally, even though the baseline number of holders remains relatively low.

Featured image from Unsplash, chart from TradingView