🚨 Ethereum Exodus: Exchange Reserves Drain 1M ETH in Bold Market Move

Ethereum's exchange reserves just took a nosedive—over a million ETH vanished from trading platforms. Is this the smart money betting big on the Merge 2.0 hype?

Whales on the move: While retail traders were busy chasing memecoins, institutional players quietly pulled enough ETH to move markets. The timing? Impeccable—right as gas fees hit yearly lows.

The great reshuffle: This isn't your average sell-off. That much ETH doesn't disappear without leaving tracks—staking contracts, OTC desks, and maybe even a few cold wallets just got fatter.

Wall Street analysts are scrambling to update their 'crypto is dead' PowerPoints. Meanwhile, the ETH/BTC ratio quietly gained 8% this month. Coincidence? In crypto, there are no coincidences—just patterns waiting to be front-run by hedge funds.

Ethereum Exchange Reserve Has Seen A Sharp Decline

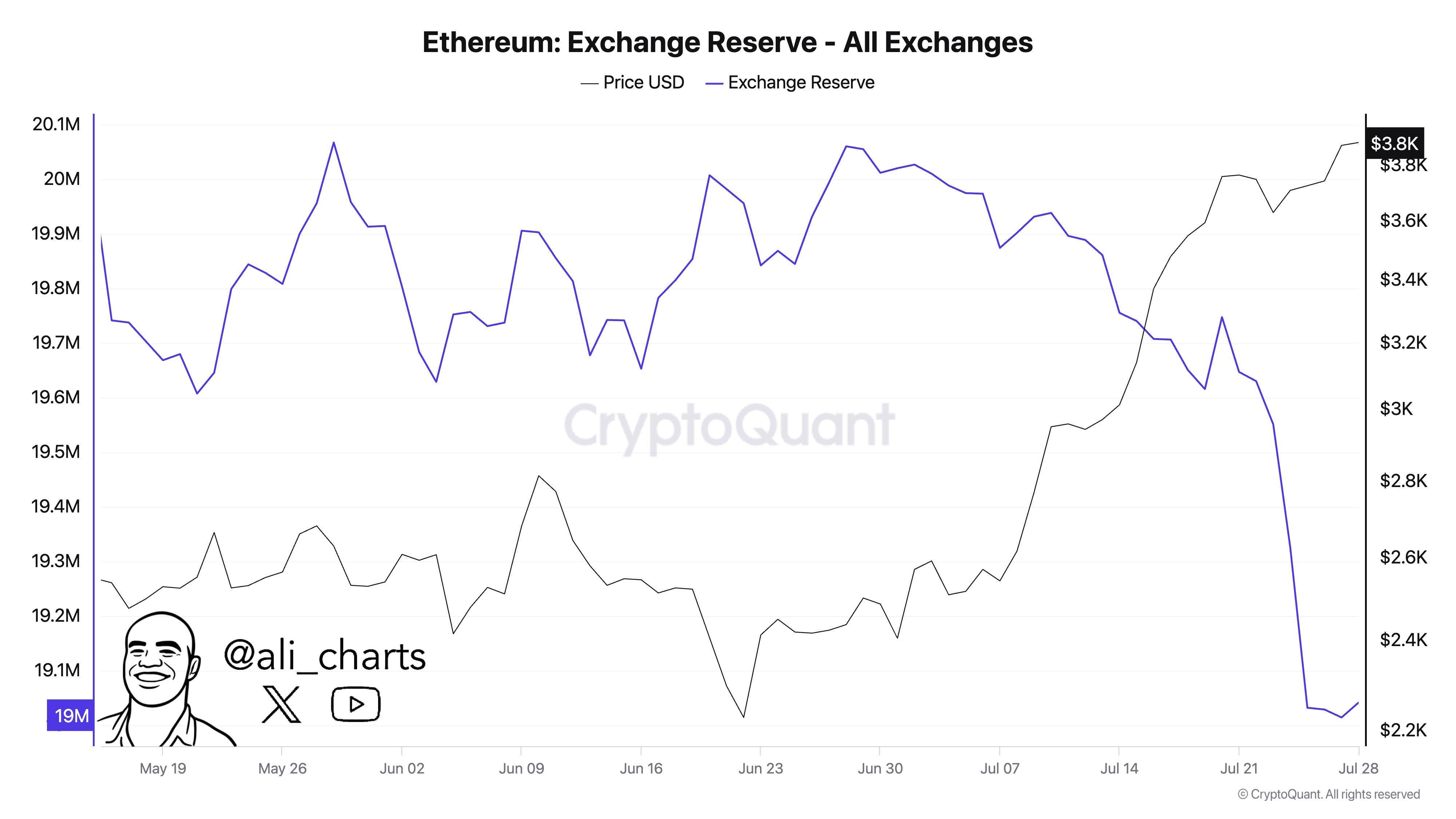

In a new post on X, analyst Ali Martinez has talked about the latest trend in the Exchange Reserve of Ethereum. The “Exchange Reserve” here refers to an on-chain indicator that keeps track of the total amount of ETH that’s sitting in the wallets associated with centralized exchanges.

When the value of this metric goes down, it means the investors are withdrawing a net number of coins from these platforms. Generally, holders take their coins to self-custodial wallets when they plan to hold into the long term, so such a trend can be a bullish sign for the cryptocurrency.

On the other hand, the indicator’s value observing a decline suggests the inflows into exchanges outweigh the outflows. As one of the main reasons why investors use exchanges is for selling-related purposes, this kind of trend could be bearish for the asset’s price.

Now, here is the chart shared by the analyst that shows how the Exchange Reserve for Ethereum has changed during the last few months:

As displayed in the above graph, the Ethereum Exchange Reserve has seen a sharp drop recently, implying the investors have withdrawn a large amount of the asset.

More specifically, the holder have taken out more than 1 million tokens of the cryptocurrency (worth about $3.8 billion at the current price) from the exchanges over the past month.

Alongside this withdrawal spree, the ETH price has enjoyed a bull rally beyond the $3,800 level, indicating that the accumulation wave could be a driving factor behind it. The Exchange Reserve may be to keep an eye on now, as where it heads next could also end up having an effect on the asset.

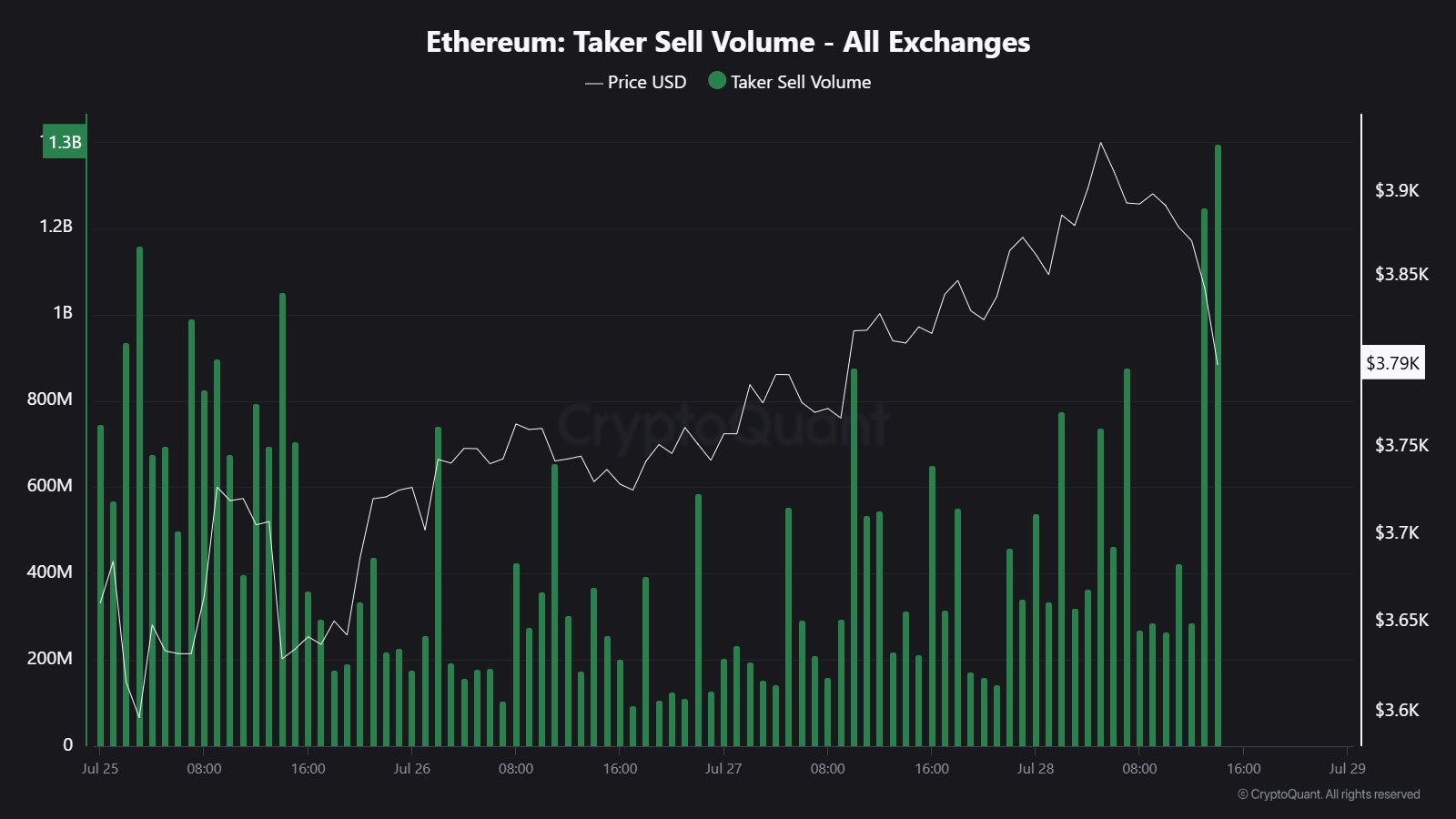

In some other news, the Ethereum Taker Sell Volume has just seen a sharp spike, as CryptoQuant community analyst Maartunn has pointed out in an X post.

The Taker Sell Volume here refers to a metric that keeps track of the volume of sell orders (in USD) that are being filed by traders in Ethereum perpetual swaps. From the chart, it’s apparent that this metric has just observed two huge spikes. Across these, Taker Sell Volume has totaled at a whopping $2.68 billion.

Whether this reflects a shift in market sentiment or just short-term positioning remains to be seen.

ETH Price

While altcoins like XRP and Dogecoin have seen pullbacks during the past week, Ethereum has managed to do relatively well as its price is trading around $3,800.