TRON Q2 Report Reveals Stellar Performance: Revenue & USDT Dominance Hit Multi-Quarter Highs

TRON's Q2 numbers just dropped—and Wall Street's spreadsheet jockeys might want to pay attention.

Revenue rockets while USDT tightens its grip

The network's latest report shows revenue surging to levels not seen in multiple quarters. Meanwhile, Tether's USDT continues its quiet takeover of TRON's ecosystem—because nothing says 'decentralized finance' like a stablecoin monopoly.

Active addresses spike as developers flock

Behind the numbers? A growing developer base betting on TRON's high-throughput blockchain. Because when Ethereum gas fees hit triple digits again, alternatives start looking real attractive.

Closing thought: In a quarter where 'crypto winter' memes circulated, TRON's heating up—proving once again that in blockchain, the most interesting action often happens off Bitcoin's spotlight.

TRON Reports Deflationary TRX Supply, Record Stablecoin Growth In Q2

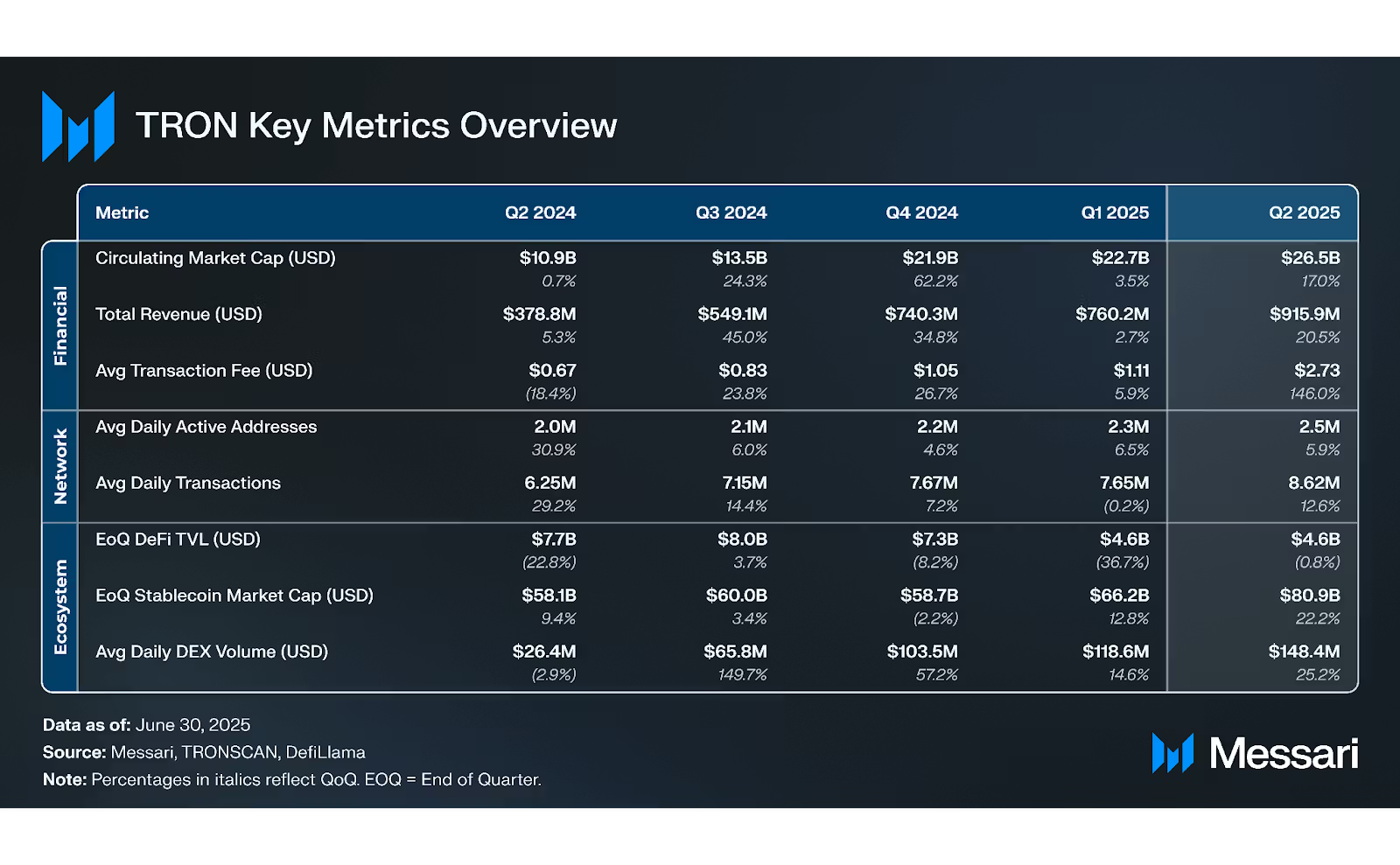

TRON’s Q2 report highlights a deflationary shift in TRX supply alongside strong network growth and stablecoin dominance. The circulating supply of TRX declined from 95.0 billion to 94.8 billion tokens, reflecting an annualized inflation rate of approximately -1.8%. While this marks a slightly higher inflation rate than Q1’s -1.6%, it still points to deflationary pressure on TRX, reinforcing its value proposition amid broader market uncertainty.

Network activity also showed solid growth during the quarter. Daily average transactions ROSE 12.6% quarter-over-quarter (QoQ), increasing from 7.7 million to 8.6 million, while daily active addresses climbed 5.9% QoQ from 2.4 million to 2.5 million. These metrics suggest rising user engagement and expanding utility across the TRON ecosystem.

Stablecoin activity remains a cornerstone of the network’s success. TRON’s stablecoin market cap surged 22.2% QoQ, rising from $66.2 billion to an all-time high of $80.9 billion. Tether (USDT) continues to dominate, accounting for 99.2% of the stablecoin supply on TRON. By the end of Q2, the USDT market cap on TRON reached $80.3 billion, a 22.2% increase from the previous quarter. Notably, TRON now hosts 50.6% of all USDT in circulation, underscoring its role as the leading blockchain for stablecoin activity.

TRX Price Holds Above Key Support

TRON (TRX) is showing resilience following its strong Q2 performance, holding steady above key support levels despite recent market volatility. As of the latest 8-hour chart, TRX is trading at $0.3163, up 0.48% on the day. After reaching a local high NEAR $0.34 earlier this month, TRX experienced a mild pullback but has since stabilized and is now consolidating in a tight range.

Price action remains bullish, with TRX trading above the 50-day ($0.3084), 100-day ($0.2935), and 200-day ($0.2840) moving averages—an indication of strong medium- and long-term momentum. The recent bounce from the 50-day MA suggests buyers are actively defending short-term support zones, reinforcing the overall uptrend.

A breakout above the $0.32–$0.325 zone could signal a push toward retesting the $0.34 high. A failure to hold above the 50-day MA could open the door to a retest of the $0.30 psychological level. For now, the bias remains cautiously bullish.

Featured image from Dall-E, chart from TradingView