SOL Price Prediction 2025: Can SOL Surge to $200 Amid Bullish Signals and Market Hype?

- SOL Technical Analysis: Is the Bullish Trend Sustainable?

- Market Sentiment: Why Are Traders Bullish on SOL?

- Key Factors Driving SOL’s Price Action

- Will SOL Hit $200? The Verdict

- Q&A: Your Burning SOL Questions Answered

Solana (SOL) is showing strong bullish momentum, trading at $186.14 with key technical indicators suggesting a potential rally to $200. Analysts highlight institutional interest, ETF speculation, and a breakout above $190 as critical factors. This article dives into SOL’s technicals, market sentiment, and expert predictions to answer whether SOL can hit $200 in the NEAR term.

SOL Technical Analysis: Is the Bullish Trend Sustainable?

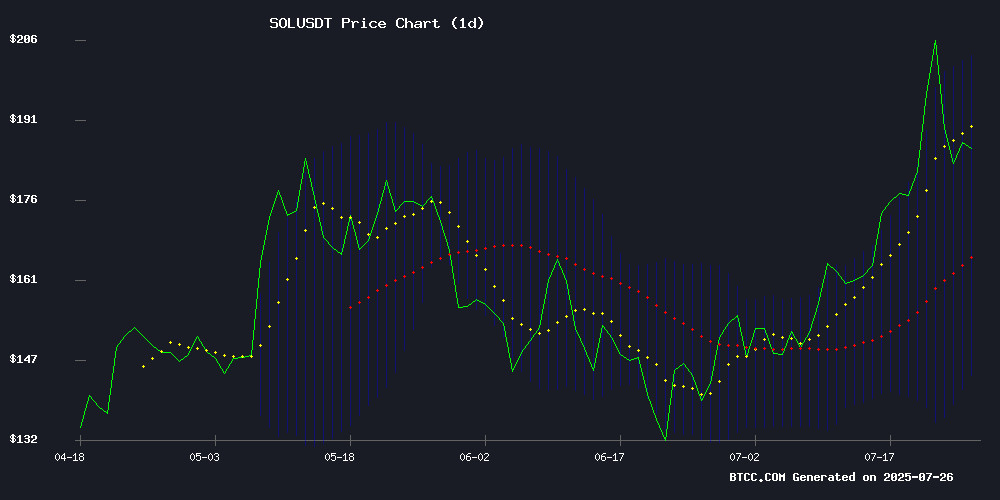

SOL is currently trading at $186.14, comfortably above its 20-day moving average of $173.23—a classic bullish signal. The MACD histogram, though still in negative territory, shows slight improvement, hinting at growing buying pressure. Bollinger Bands indicate potential volatility, with the upper band sitting at $202.84, a key resistance level. "A sustained MOVE above $190 could open the door to $200," notes Robert from the BTCC team. Source: TradingView

Source: TradingView

Market Sentiment: Why Are Traders Bullish on SOL?

Optimism around SOL is fueled by institutional interest and ETF speculation. Recent headlines highlight Unilabs' $6.1M funding round and price targets as high as $205. "The combination of technical breakouts and ETF chatter creates perfect conditions for a rally," says Robert. Polymarket data prices SOL ETF approval odds at 80%, though SEC delays until Fall 2025 add uncertainty.

Key Factors Driving SOL’s Price Action

1. Viral AI Project Unilabs Raises $6.1M Amid SOL Volatility

Solana’s price rebounded to $185 after a brief dip from $200, while Unilabs—dubbed the "Solana Slayer"—gained traction with its AI-driven platform. The project’s $6.1M raise contrasts with SOL’s reliance on market momentum. Notably, whale withdrawals of 164,000 SOL from Kraken signal accumulation.

2. SOL Eyes $205 Despite ETF Delays and Market Swings

SOL dipped 3.2% last week but holds strong support near $180. Analysts like Jonathan Carter see an ascending triangle breakout, with targets at $205, $225, or even $268. Liquidity absorption at current levels will dictate whether SOL consolidates or climbs back to $200.

3. Technical Breakout Signals 38% Upside Potential

SOL’s breakout above $175-$185 resistance and its hold above $160 suggest a measured move to $260—its 2021 peak. With bitcoin dominance waning, altcoins like SOL could outperform. Institutional accumulation appears likely, but traders await confirmation above $190.

Will SOL Hit $200? The Verdict

Here’s a snapshot of critical indicators:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $186.14 | 7.5% below $200 target |

| 20-day MA | $173.23 | Price above = bullish |

| Upper Bollinger | $202.84 | Potential resistance |

The $200 psychological barrier is within reach if buying pressure persists, but ETF delays and Bitcoin’s movements could sway SOL’s trajectory. Trade wisely—this isn’t financial advice!

Q&A: Your Burning SOL Questions Answered

What’s driving SOL’s bullish momentum?

Technical breakouts, ETF speculation, and institutional interest are key drivers. SOL’s resilience above $180 and whale activity suggest strong demand.

Can SOL realistically hit $200 soon?

If SOL holds above $190 and Bitcoin remains stable, $200 is achievable. The upper Bollinger Band at $202.84 is the next hurdle.

How do ETF delays impact SOL?

Short-term uncertainty, but Polymarket’s 80% approval odds keep hopes alive. Delays until Fall 2025 may slow momentum but won’t kill the rally.