Bitcoin’s High-Stakes Standoff: Liquidation Traps Lurk on Both Sides of the Market

Bitcoin's playing a dangerous game of chicken—and everyone's leveraged to the teeth.

The squeeze is coming

Whales are stacking orders at key levels, setting traps for overeager bulls and desperate shorts alike. One false move triggers cascading liquidations in this zero-sum cage match.

Who blinks first?

Market makers love this volatility buffet—racking up fees while retail traders get chewed up. Same old Wall Street game, just with fancier tech and worse memes.

When the dust settles, the house always wins. Always.

Bitcoin: Clustering At $103K–$106K And $108K–$111K – What Could This Mean?

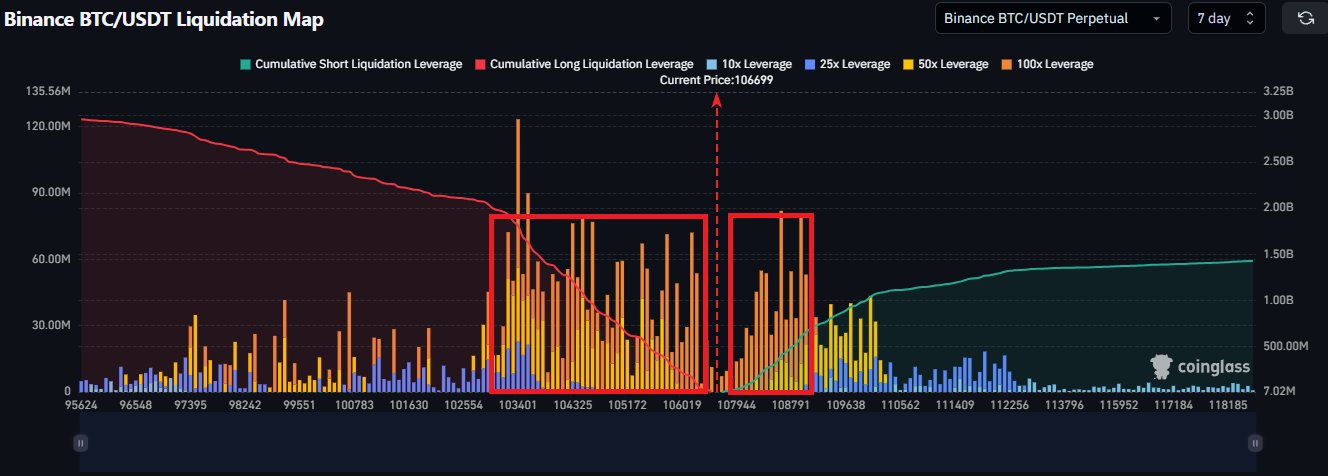

In a recent X post , KillaXBT shares that Bitcoin is currently at a pivotal decision zone as liquidation heatmap data from Coinglass reveals notable liquidity clusters forming on both ends of the current price range. The market expert explains that BTC is trapped between long and short liquidation zones in both low and high time frames (L/HTF) signaling a moment of market indecision

On the 7-day chart (LTF), KillaXBT states there are accumulations of long positions between $103,400 and $106,000. This data suggests that a move below this price range could trigger cascading stop-losses and force liquidations, sending bitcoin prices lower in a short-term decline.

On the other hand, there are also liquidity clusters in the $108,000–$109,000 region, indicating the presence of potentially significant short positions. A breakout above $109,000 could initiate a sharp short squeeze, perhaps driving prices higher toward the current all-time high in the $111,000 price range.

Using the 30-day chart (HTF), KillaXBT provides more information on the Bitcoin market stalemate. The analyst notes that more short-side liquidations are clustered between $108,300 and $109,000 than long-side liquidations between $103,000 and $106,000. However, the presence of short positions at $111,000 presents a scenario where bulls could reclaim control if they successfully push past this upper resistance.

Ultimately, KillaXBT concludes the current BTC market structure suggests a delicate balance with high-leverage positions stacked both above and below current prices. The market expert warns that traders refrain from engaging the market until the highlighted liquidation zones are tested.

Bitcoin Market Overview

At press time, Bitcoin trades at $107,451, after a slight 0.41% gain in the past day. Meanwhile, the asset’s daily trading volume is down by a staggering 36.12% suggesting a fall in market participation.

Meanwhile, blockchain analytics firm Sentora reports that Bitcoin’s weekly network fees totaled $3.39 million, marking a 38.9% decline from the previous week. Despite this drop in on-chain activity, exchange outflows of $310 million suggest a strong market confidence, as investors increasingly MOVE their assets into private wallets, typically a sign of long-term holding intent.